GST bill passed in parliament

GST bill passed in Parliament:

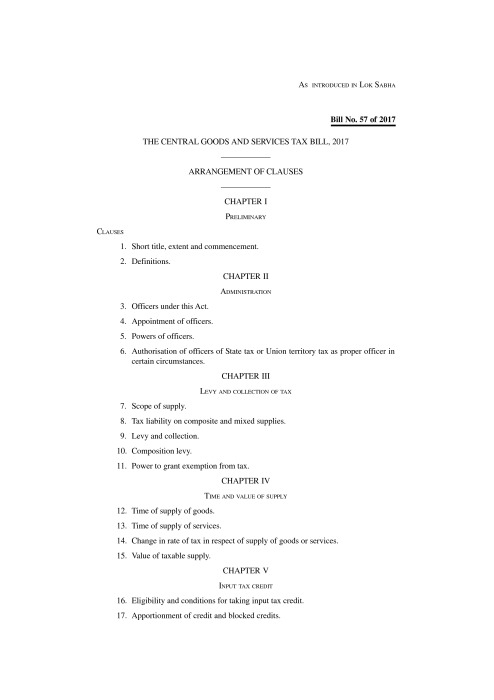

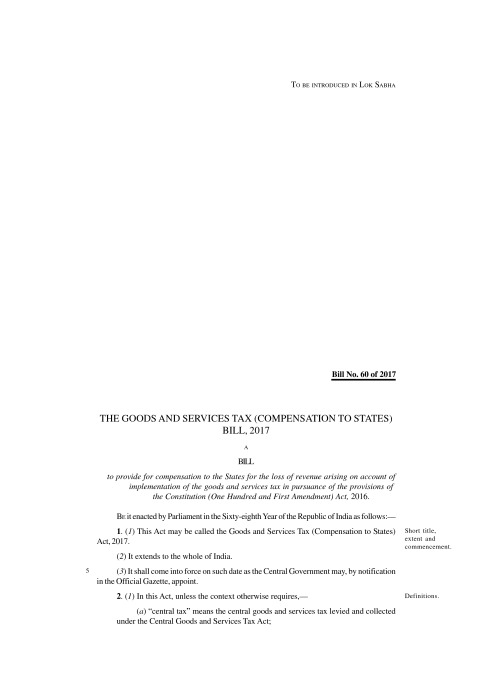

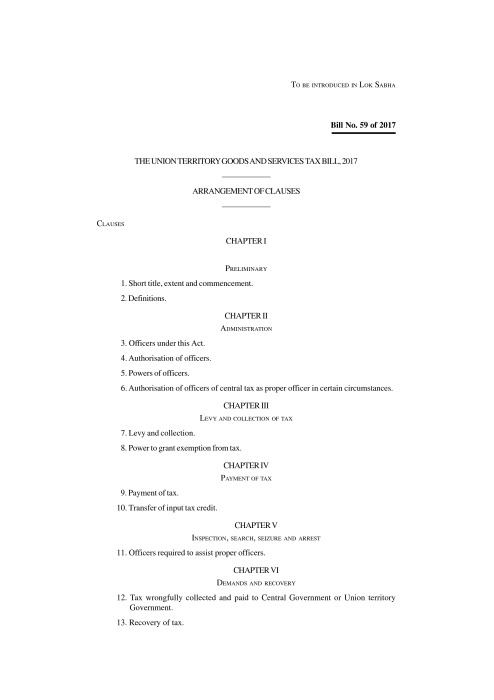

It is a big day for India as the GST bill passed in Parliament.The basic structure of GST is that center and state both charge tax on every supply. There are four type of bills:

All these legislation to control the GST in India. CGST and SGST is charged on all intra state supplies. On inter state supplies IGST is chargeable. Later on the share of consuming state will be transferred by the central government.

Important terms:

Under the GST model law the place of supply will be a major factor. It will determine the place where the supplies are consumed and tax will be paid to that state.The return format contains the field of place of supply. It means that when you need to mention the place of supply while filing return.

Location of supplier: It is also an important term. Your location as a supplier is determining factor for registration.

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.