GST on Outsourcing of Export Services

In case an exporter of services outsources a portion of the services contract to another person located outside India, what would be the tax treatment of the said portion of the contract at the hands of the exporter? Let’s in this article discuss the GST on Outsourcing of Export Services:

To clarify the issue, Circular No. 78/52/2018-GST; Dated the 31st December, 2018 was issued.

Let’s in this article discuss the subject:

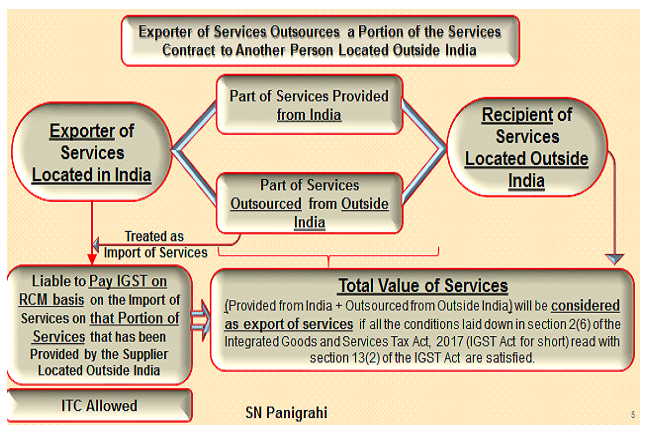

1. Where an exporter of services located in India is supplying certain services to a recipient located outside India, either wholly or partly through any other supplier of services located outside India, the following two supplies are taking place:-

- (i) Supply of services from the exporter of services located in India to the recipient of services located outside India for the full contract value;

(ii) Import of services by the exporter of services located in India from the supplier of services located outside India with respect to the outsourced portion of the contract.

Thus, the total value of services as agreed to in the contract between the exporter of services located in India and the recipient of services located outside India will be considered as export of services if all the conditions laid down in section 2(6) of the Integrated Goods and Services Tax Act, 2017 (IGST Act for short) read with section 13(2) of the IGST Act are satisfied.

2. It is clarified that the supplier of services located in India would be liable to pay integrated tax on reverse charge basis on the import of services on that portion of services which has been provided by the supplier located outside India to the recipient of services located outside India. Furthermore, the said supplier of services located in India would be eligible for taking an input tax credit of the integrated tax so paid.

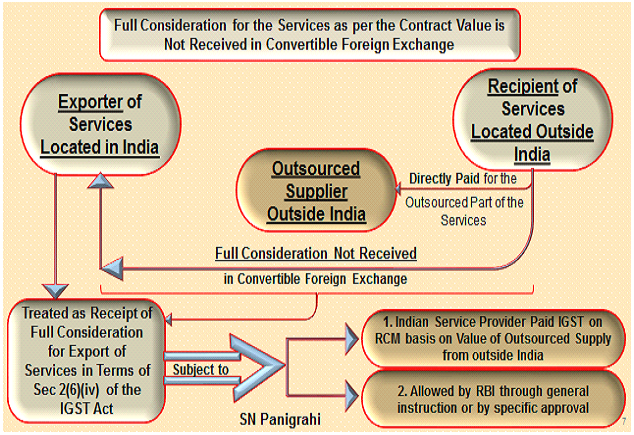

Full Consideration for the Services as per the Contract Value

Even if the full consideration for the services as per the contract value is not received in convertible foreign exchange in India due to the fact that the recipient of services located outside India has directly paid to the supplier of services located outside India (for the outsourced part of the services), that portion of the consideration shall also be treated as receipt of consideration for export of services in terms of section 2(6)(iv) of the IGST Act, provided the:

- (i) Integrated tax has been paid by the supplier located in India for import of services on that portion of the services which has been directly provided by the supplier located outside India to the recipient of services located outside India; and

(ii) RBI by general instruction or by specific approval has allowed that a part of the consideration for such exports can be retained outside India.

Conditions Laid Down in Section 2(6) of IGST Act

Sec 2(6) of IGST Act :

“export of services” means the supply of any service when,––

(i) the supplier of service is located in India;

(ii) the recipient of service is located outside India;

(iii) the place of supply of service is outside India;

(iv) the payment for such service has been received by the supplier of service in convertible foreign exchange; and

(v) the supplier of service and the recipient of service are not merely establishments of a distinct person in accordance with Explanation 1 in section 8;

Explanation 1.––For the purposes of this Act, where a person has,––

- (i) an establishment in India and any other establishment outside India;

- (ii) …….

- (iii) ………..

then such establishments shall be treated as establishments of distinct persons

Sec 13(2) of IGST Act

The place of supply of services except the services specified in sub-sections (3) to (13) shall be the location of the recipient of services

Illustration

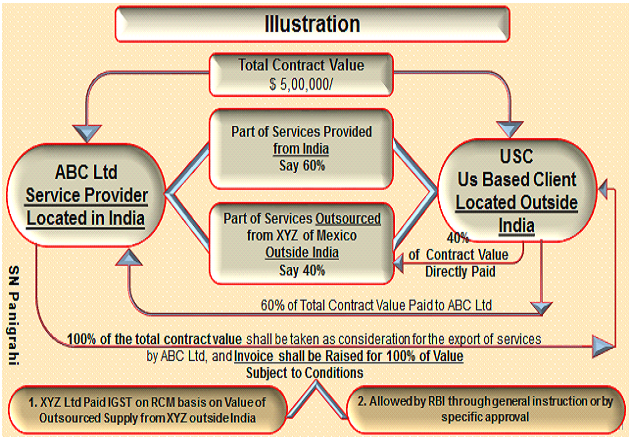

ABC Ltd. India has received an order for supply of services amounting to $ 5,00,000/- to a US-based client, USC. ABC Ltd. India is unable to supply the entire services from India and asks XYZ Ltd. Mexico (who is not merely an establishment of a distinct person viz. ABC Ltd. India, in accordance with the Explanation 1 in Section 8 of the IGST Act) to supply a part of the services (say 40% of the total contract value).

ABC Ltd. India shall be the exporter of services for the entire value if the invoice for the entire amount is raised by ABC Ltd. India. The services provided by XYZ Ltd. Mexico to the US-based client shall be import of services by ABC Ltd. India and it would be liable to pay integrated tax on the same under reverse charge and also be eligible to take input tax credit of the integrated tax so paid.

Further, if the provisions contained in section 2(6) of the IGST Act are not fulfilled with respect to the realization of convertible foreign exchange, say only 60% of the consideration is received in India and the remaining amount is directly paid by the US-based client to XYZ Ltd. Mexico, even in such a scenario, 100% of the total contract value shall be taken as consideration for the export of services by ABC Ltd. India provided an integrated tax on import of services has been paid on the part of the services provided by XYZ Ltd Mexico directly to the US-based client and RBI (by general instruction or by specific approval) has allowed that a part of the consideration for such exports can be retained outside India.

In other words, in such cases, the export benefit will be available for the total realization of convertible foreign exchange by ABC Ltd. India and XYZ Ltd. Mexico.

For more details please see the YouTube @ the following Link

https://www.youtube.com/watch?v=TZA2zJ5Jpvo

Also can be viewed @ Slideshare

Disclaimer : The views and opinions; thoughts and assumptions; analysis and conclusions expressed in this article are those of the authors and do not necessarily reflect any legal standing.

Author : SN Panigrahi, GST & Foreign Trade Consultant, Practitioner, Corporate Trainer & Author

Can be reached @ snpanigrahi1963@gmail.com