Import/export of services in GST Act

Why we need to determine if a transaction is import/export of services:

(PDF for this post is also attached in the end of this article)

In GST the treatment of domestic and cross border supply is different. Supply of services as import or export will be treated as interstate supply for the purpose of GST. In case of export of services refund of IGST or input tax credit will be available. For Goods it is easy to determine its nature as the definition of export of goods is pretty simple. It says export of goods means taking goods out of India to a place outside India.On the same note import of goods is also simple. Import of goods is defined as bringing goods from a place outside India to a place in India.

But in case of services it is not as simple. Services are intangible and visible movement is not there. To determine the import/export of services specific provisions are given. We will discuss rules to determine when a transaction will be an import or export of services in GST

When to refer section 10 of IGST Act:

Section 10 of IGST Act provide for the provisions applicable in case of supply.The section will apply when the location of either supplier or receiver of services is outside India. Reason behind use of this language is meaning of import/export of services.

What Section 10 of IGST Act provide for the place of supply for services for import/export of services:

Section 10 contains a detail list of provisions covering various transactions for supply of services for import/export. We have divided all those scenarios in 4-5 parts for ease of understanding.

General rule for place of supply for import/export of services:

The basic rule is that the place of supply for services shall be the place of recipient of services.If the place of recipient is not available the place of supplier will be the place of supply. But this rule will not apply on cases which are specifically covered. Clause 3 to 13 of section 10 covers those specific cases.

Place of supply where the services are actually performed:

These provisions are compiled in following table.

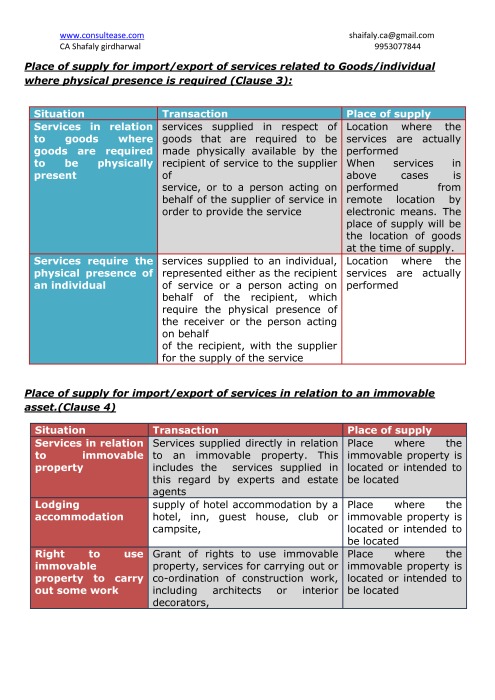

Place of supply for import/export of services related to Goods/individual where physical presence is required (Clause 3):

|

Situation |

Transaction |

Place of supply |

|

Services in relation to goods where goods are required to be physically present |

services supplied in respect of goods that are required to be made physically available by the recipient of service to the supplier of service, or to a person acting on behalf of the supplier of service in order to provide the service |

Location where the services are actually performed When services in above cases is performed from remote location by electronic means. The place of supply will be the location of goods at the time of supply. |

|

Services require the physical presence of an individual |

services supplied to an individual, represented either as the recipient of service or a person acting on behalf of the recipient, which require the physical presence of the receiver or the person acting on behalf of the recipient, with the supplier for the supply of the service |

Location where the services are actually performed |

Place supply for import export of services in relation to an immovable property:

Place of supply for import/export of services in relation to an immovable asset.(Clause 4)

|

Situation |

Transaction |

Place of supply |

|

Services in relation to immovable property |

Services supplied directly in relation to an immovable property. This includes the services supplied in this regard by experts and estate agents |

Place where the immovable property is located or intended to be located |

|

Lodging accommodation |

supply of hotel accommodation by a hotel, inn, guest house, club or campsite, |

Place where the immovable property is located or intended to be located |

|

Right to use immovable property to carry out some work |

Grant of rights to use immovable property, services for carrying out or co-ordination of construction work, including architects or interior decorators, |

Place where the immovable property is located or intended to be located |

Place of supply for organisation or entry into an event:

Place of supply for import/export of services in case of organising or entry into an event:)(Clause5)

|

Situation |

Transaction |

Place of supply |

|

Services of entry into an event |

services supplied by way of admission to a cultural, artistic, sporting, scientific, educational, or entertainment event, or a celebration, conference, fair, exhibition, or similar events, and of services ancillary to such admission |

Place where the event is actually held |

|

Services of organising an event |

services supplied by way of organisation of a cultural, artistic, sporting, scientific, educational, or entertainment event, or a celebration, conference, fair, exhibition, or similar events, and of services ancillary to such admission |

Place where the event is actually held |

Place of supply in case of services to more then one location:

Place of supply in case of services to more than one location (Clause 6 and 7)

|

Situation |

Transaction |

Place of supply |

|

More than one location including a location in taxable territory |

Where any service referred to in sub-sections (3), (4), or (5) is supplied at more than one location, including a location in the taxable territory |

place of supply shall be the location in the taxable territory where the greatest proportion of the service is provided |

|

Services supplied in more than one state in taxable territory |

Where the services referred to in sub-sections (3), (4), (5) or (6) are supplied in more than one State, |

The place of supply of such services shall be taken as being in each of the States in proportion to the value of services so provided in each State as ascertained from the terms of the contract or agreement entered into in this regard or, in absence of such contract or agreement, on such other reasonable basis as may be prescribed in this behalf |

Instances when the location of supplier will be the place of supply:

Instances where the location of supplier will be the place of supply: (Clause 8)

|

Situation |

Transaction |

Place of supply |

|

Services to account holders |

Services by · A banking company · Financial institution · Non-banking financial company To their account holder |

Location of supplier of services |

|

Intermediary services

|

intermediary services |

Location of supplier of services |

|

Hiring of means of transport for less than a month |

Hiring of means of transport other than aircrafts and vessels except yachts, upto a period of one month |

Location of supplier of services |

Place of supply for services of transportation of Goods:

In case of transportation of Goods other then by post or courier shall be the destination of Goods. (Clause 9)

Place of supply for passenger transportation services:

In this case PoS shall be the place where the passenger embarks on the conveyance for a continuous journey.(Clause 10)

Services provided on board a conveyance:

In this case the place of supply shall be the first scheduled point of departure of that conveyance. (Clause 11)

The place of supply of the “online information and database access or retrieval services” services (Clause 12)

For online information and database access or retrieval services the place of supply shall be the location of recipient.

Location of recipient will be taken as in taxable territory is any two of following conditions are satisfied.

(i) the location of address presented by the recipient of service via internet is in taxable territory;

(ii) the credit card or debit card or store value card or charge card or smart card or any other card by which the recipient of service settles payment has been issued in the taxable territory;

(iii) the billing address of recipient of service is in the taxable territory;

(iv) the internet protocol address of the device used by the recipient of service is in the taxable territory;

(v) the bank of recipient of service in which the account used forpayment is maintained is in the taxable territory;

(vi) the country code of the subscriber identity module (SIM) card used by the recipient of service is of taxable territory;

(vii) the location of the fixed land line through which the service is received by the recipient is in taxable territory.

Power of CG/SG:

This clause give power to CG/SG to notify any description of service or circumstances. In these services or circumstances the place of supply shall be the place of effective use and enjoyment of a service.

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.