Ppt on Taxability Of Motor Vehicles Under GST

Ppt on Taxability Of Motor Vehicles Under GST

Part 1 – Inward Side

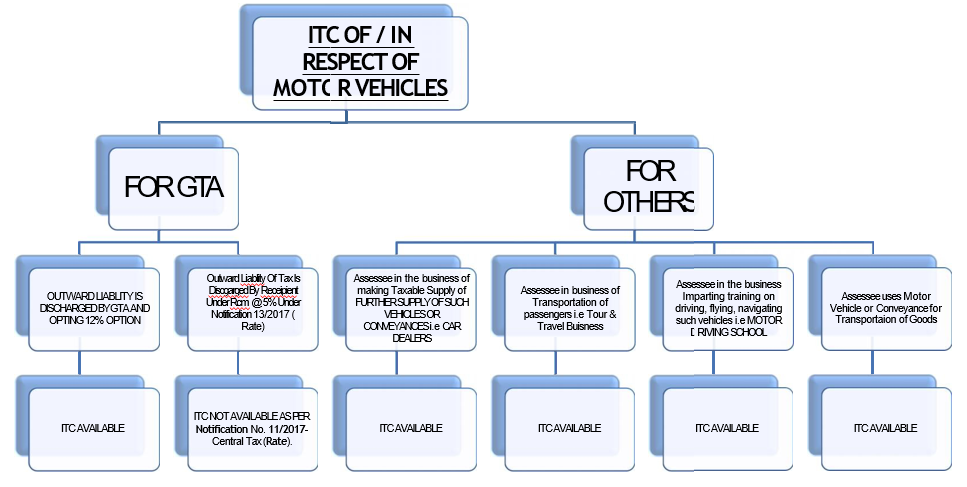

ITC Of/In Respect Of Motor Vehicles

SECTION 17(5) OF CGST ACT – Under section 17(5) of CGST Act, there are certain supplies on which input tax credit under GST is not available. supplies can also be said for blocked credit.

Section 17(5) of the Central Goods and Services Act, 2017 provides that input tax credit in respect of the following shall not be available-

(a)Motor vehicles and other conveyances except when they are used-

(i)For making the following taxable supplies, namely-

(A)The further supply of such vehicles or conveyances; or

(B)Transportation of passengers; or

(C)Imparting training on driving, flying, navigating such vehicles or conveyances;

(ii)For transportation of goods;

Examples where the credit of motor vehicles can be availed: Dealer of vehicles, cab providers, trucks/vehicles used by factories for transportation of goods.

Related Topic:

GST on Sale of Old Vehicles ( From 1.1.17 Till Date)

It is important to understand that there is nothing mentioned about whether the credit would be available for the purchase of the motor vehicle. Since the act provides that the credit is not available on motor vehicles it can be concluded that all input tax credit in relation to motor vehicle cannot be claimed except used in the supplies as mentioned above.

Download the full ppt by clicking on the image above.