QRMP Features enabled in GSTN

QRMP Features enabled in GSTN

Background

―As a trade facilitation measure and in order to ease the process of doing business, the GST Council in its 42nd meeting held on 05.10.2020, had recommended that registered person having aggregate turnover up to five (5) crore rupees be allowed to furnish return on a quarterly basis along with monthly payment of tax, with effect from 01.01.2021.

― Towards fulfilling the recommendation, the Government has issued notifications and Circular to implement the Scheme of quarterly return filing along with monthly payment of taxes (hereinafter referred to as “QRMP Scheme”):

Notification for QRMP Scheme

―1. Notification No. 81/2020 – Central Tax, dated 10.11.2020.

▪ Notifies amendment carried out in sub-section (1), (2), and (7) of section 39 of the CGST Act vide Finance (No.2) Act, 2019.

―2. Notification No. 82/2020 – Central Tax, dated 10.11.2020.

▪ Makes the Thirteenth amendment (2020) to the CGST Rules 2017.

―3. Notification No. 84/2020 – Central Tax, dated 10.11.2020.

▪ Notifies class of persons under proviso to section 39(1) of the CGST Act.

―4. Notification No. 85/2020 –Central Tax dated 10.11.2020.

▪ Notifies special procedure for making payment of tax liability in the first two months of a quarter

―Circular No. 143/13/2020- GST dated 10.11.2020

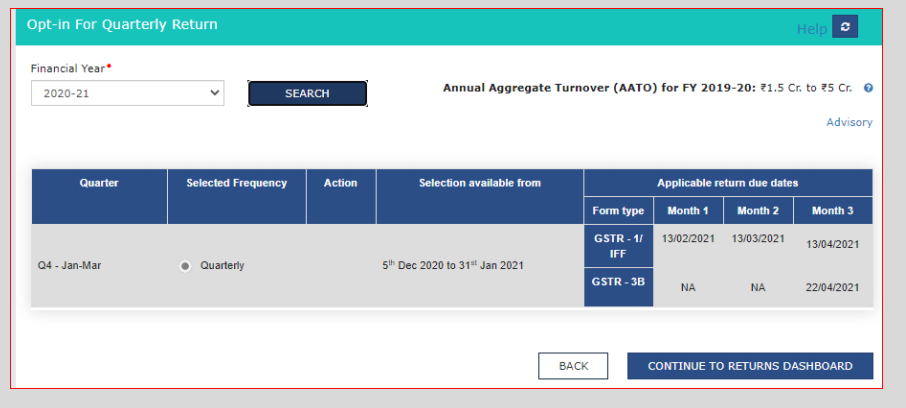

Default migration to QRMP Scheme

• For the first quarter of the Scheme i.e. for January 2021 to March 2021, all the registered persons, whose aggregate turnover for the FY 2019-20 is up to 5 crore rupees and who have furnished the return in FORM GSTR3B for the month of October 2020 by 30th November 2020 and who have not opted have been migrated to QRMP Scheme and their GSTR1/GSTR -3B filing has been modified in the portal.

• Now it has happened to many without awareness of options available. This option can not be modified till April 2021

Where to find the option and period

Dash board >Return >Option in for quarterly return

How to modify the option w.e.f. April-2021

Option modified for 2021-22

Filing Invoice Furnishing Facility in place of GSTR-1

―The registered persons opting for the Scheme would be required to furnish FORM GSTR-1 quarterly.

―A facilitation measure registered person will have the facility (Invoice Furnishing Facility- IFF) to furnish the details of outward supplies to a registered person, as he may consider necessary, between the 1st day of the succeeding month till the 13th day of the succeeding month, for each of the first and second months of a quarter,

―The details of outward supplies shall not exceed the value of fifty lakh rupees each month.

Read & Download the full Copy in pdf: