CESTAT in the case of Shiv Om Paper Mills Pvt. Ltd. Versus Commissioner of C. EX.

Introduction

In The Era of GST, there is a clause mentioned in the Act that “WRONG AVAIMENT Or UTILIZATION “of ITC will attract penal provision(Section 73 r/w Section 122).

The same provisions were there in Central Excise Act.

However, I have argued the case before the Hon’ble CESTAT in which court has categorically denied the invoking of the penal provision in case of wrongly availed, but not utilized Cenvat credit. Availment of the wrong Cenvat is only a book entry, no revenue loss to Govt. Therefore no penal provision attracts. Citation attached.

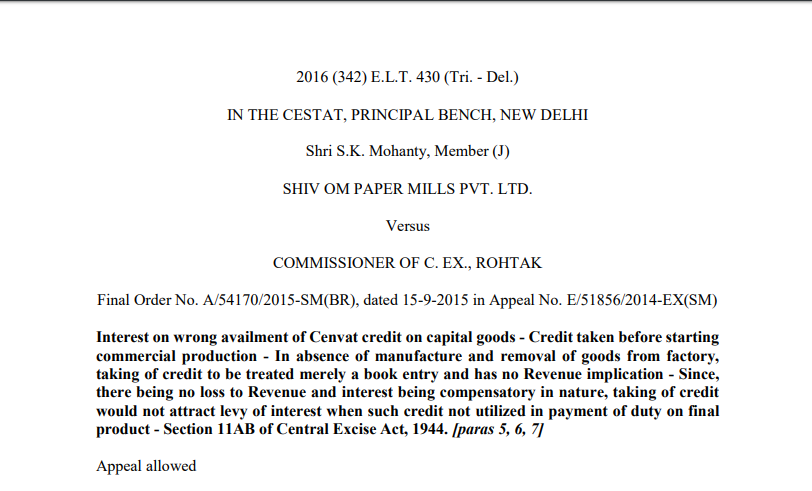

2016 (342) E.L.T. 430 (Tri. – Del.)

IN THE CESTAT, PRINCIPAL BENCH, NEW DELHI

Shri S.K. Mohanty, Member (J)

SHIV OM PAPER MILLS PVT. LTD.

Versus

COMMISSIONER OF C. EX., ROHTAK

Final Order No. A/54170/2015-SM(BR), dated 15-9-2015 in Appeal No. E/51856/2014-EX(SM)

Interest on the wrong availment of Cenvat credit on capital goods – Credit has taken before starting commercial production – In absence of manufacture and removal of goods from factory, taking of credit to be treated merely a book entry and has no Revenue implication – Since, there being no loss to Revenue and interest being compensatory in nature, taking of credit would not attract levy of interest when such credit not utilized in payment of duty on the final product – Section 11AB of Central Excise Act, 1944. [paras 5, 6, 7]

Appeal allowed

CASES CITED

Commissioner v. Bill Forge (P) Ltd. — 2012 (279) E.L.T. 209 (Kar.) = 2012 (26) S.T.R. 204 (Kar.) — Relied on [Paras 2, 5, 7]

Commissioner v. Strategic Engineering (P) Ltd. — 2014 (310) E.L.T. 509 (Mad.) — Referred [Para 2]

Indian Oil Corporation Ltd. Panipat Refinery v. Commissioner — Final Order No. A/58435/2013- SM(BR), dated 26-11-2013 by CESTAT, New Delhi — Referred [Para 2]

Union of India v. Ind-Swift Laboratories Ltd. — 2011 (265) E.L.T. 3 (S.C.) = 2012 (25) S.T.R. 184 (S.C.) — Distinguished [Paras 3, 6]

DEPARTMENTAL CLARIFICATION CITED C.B.E. & C. Circular No. 942/03/2011-CX, dated 14-3-2011 [Para 1]

REPRESENTED BY: Shri Dinesh Verma, Advocate, for the Appellant.

Shri G.R. Singh, DR, for the Respondent.

Order

The brief facts of the case are that during the course of audit of records of the appellant, for the years 2006-07 to 2009-10, the Central Excise Department observed that the appellant had taken full Cenvat credit of duty paid on capital goods, instead of 50% in the year of receipt and remaining in the next financial year. In terms of Rule 4(2a) and 4(2b) of Cenvat Credit Rules, 2004 read with C.B.E. & C. Circular No. 942/03/2011-CX, dated 14-3-2011, the Department proceeded against the appellant for recovery of interest amounting to Rs. 3,37,251/- under Rule 14 of the said Rules read with Section 11AB of the Central Excise Act, 1944, and the imposition of penalty under Rule 14 of the said Rules read with Section 11AC of the said Act. The Show Cause Notice dated 16-11-2011 issued in this regard culminated in the adjudication order dated 29-4-2013, confirming the interest amount of Rs. 3,37,251/- and imposing an equal amount of penalty. In appeal, ld. Commissioner (Appeals) vide the impugned order dated 26-12-2013 has confirmed the adjudged interest amount and set aside the penalty imposed in the adjudication order. Confirmation of interest liability by the authorities below is the subject matter of the present dispute.

2. Shri Dinesh Verma, ld. advocate for the appellant submits that the full amount of Cenvat credit taken by the appellant inadvertently during the disputed period has not been utilized for payment of Central Excise duty on the finished products since the commercial production in the appellant’s unit commenced on 1-7-2009. He further submits that taking Cenvat credit, without its utilization, is a mere book entry, for which there is no loss of revenue to the Govt. exchequer. As such, interest liability cannot be fastened on the appellant. To support his stand, he cited the judgment of Hon’ble High Court of Madras in the case of CCE, Madurai v. M/s. Strategic Engineer (P) Ltd. [2014- TIOL-466-HC-MAD-CX = 2014 (310) E.L.T. 509 (Mad.)] and the decision of Hon’ble High Court of Karnataka in the case of CCE ST, LTU, Bangalore v. M/s. Bill Forge Pvt. Ltd. [2011-TIOL799-HC-KAR-CX = 2012 (279) E.L.T. 209 (Kar.) = 2012 (26) S.T.R. 204 (Kar.)]. He further relied on the decision of this Tribunal in the case of Indian Oil Corporation Ltd. Panipat Refinery v. CCE, Gurgaon [Final Order No. A/58435/2013-SM(BR), dated 26-11-2013].

3. On the other hand, Shri GR Singh, ld. Departmental Representative appearing for the respondent-Revenue, reiterated the findings recorded in the impugned order and further relied on the judgment of the Hon’ble Supreme Court in the case of Union of India v. Ind-Swift Laboratories Ltd. [2011 (265) E.L.T. 3 (S.C.) = 2012 (25) S.T.R. 184 (S.C.)] to substantiate his stand that if the Cenvat credit is taken erroneously or refunded, irrespective of the fact that the same is utilized or not, interest liability is automatic, which is required to be paid by the assessee.

4. I have heard both parties and perused the records.

5. The fact is not in dispute that the appellant has commenced its commercial production on 1- 7-2009. Thus, in the absence of the manufacture of final products, there was no scope for the removal of the same from the factory on payment of Central Excise duty. Hence, in such an eventuality, the taking of Cenvat credit in the register maintained by the appellant will be considered as a mere book entry. Entering the credit particulars in the books has no revenue implication. Thus, in the absence of any loss of revenue to the Govt. exchequer, the demand of interest cannot be sustained against the appellant since the interest liability is compensatory in character. The issue, whether the interest is required to be paid when the Cenvat credit taken has not been utilized is no more res Integra, in view of the judgment of Hon’ble Karnataka High Court in the case of CCE ST, LTU, Bangalore v. M/s. Bill Forge Pvt. Ltd. The relevant paragraph in this regard is extracted hereinbelow:-

“20. From the aforesaid discussion what emerges is that the credit of excise duty in the register maintained for the said purpose is only a book entry. It might be utilized later for payment of excise duty on the excisable product. It is entitled to use the credit at any time thereafter when making payment of excise duty on the excisable product. It matures when the excisable product is received from the factory and the stage for payment of excise duty is reached. Actually, the credit is taken, at the time of the removal of the excisable product. It is in the nature of set-off or an adjustment. The assessee uses the credit to make payment of excise duty on excisable product. Instead of paying excise duty, the Cenvat credit is utilized, thereby it is adjusted or set-off against the duty payable and a debit entry is made in the register. Therefore, this is a procedure whereby the manufacturers can utilize the credit to make payment of duty to discharge his liability. Before the utilization of such credit, the entry has been reversed, it amounts to not taking credit. Reversal of Cenvat credit amounts to non-taking of credit on the inputs.”

6. The judgment of Hon’ble Supreme Court in the case of Union of India v. Ind-Swift Laboratories Ltd. (supra), relied upon by the Revenue is not applicable to the facts of the present case, inasmuch as, Cenvat credit in the said case was taken by the respondent wrongly on the basis of fake invoices, whereas; in the circumstances of the present case, the credit taken in the register of the appellant on the basis of genuine documents, has not been utilized for clearance of the final product.

7. In view of the fact that the credit taken has not been utilized by the appellant for clearance of the final product, I am of the opinion that the judgment of Hon’ble High Court of Karnataka in the case of CCE ST, LTU, Bangalore v. M/s. Bill Forge Pvt. Ltd. (supra) is squarely applicable, according to which no interest is required to be paid in the event where the credit taken inadvertently has not been utilized. Therefore, I do not find any merits in the impugned order, and the same is set aside. The appeal filed by the appellant is allowed.

Download the copy:

Advocate Dinesh Verma

Advocate Dinesh Verma