Fresh provisional attachment under GST

Case Covered:

M/s. Amazonite Steel Pvt. Ltd. & Anr.,

M/s. Corandum Impex Pvt. Ltd. & Anr.,

M/s. Cuprite Marketing Pvt. Ltd. & Anr.

Versus

Union of India & Ors.

Facts of the Case:

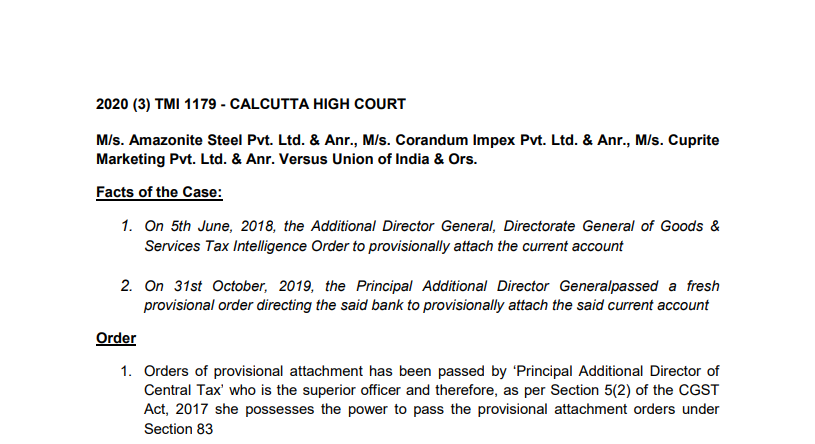

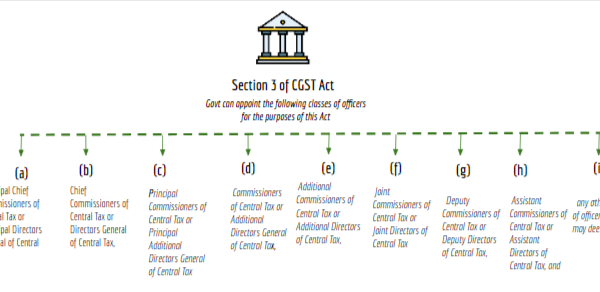

1. On 5th June 2018, the Additional Director General, Directorate General of Goods & Services Tax Intelligence Order to provisionally attach the current account

2. On 31st October 2019, the Principal Additional Director Generalpassed a fresh provisional order directing the said bank to provisionally attach the said current account

Order

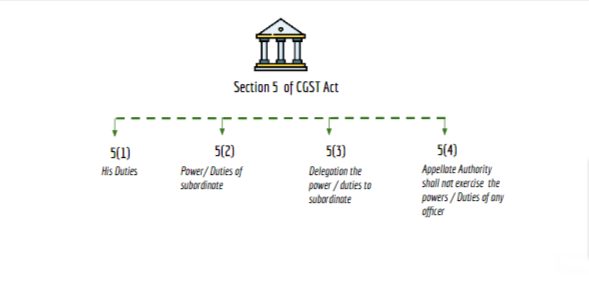

1. Orders of provisional attachment have been passed by ‘Principal Additional Director of Central Tax’ who is the superior officer and therefore, as per Section 5(2) of the CGST Act, 2017 she possesses the power to pass the provisional attachment orders under Section 83

2. Section 83(2) is crystal clear that the provisional attachment shall cease upon expiry of one year. The failure to do the above is nothing short of being an act of highhandedness. In my view, the above action is clearly in violation of the petitioners’ rights for carrying on business under Article 19(1) of the Constitution of India and under Article 300A of the Constitution of India wherein the petitioners have been deprived of their property without authority of law. In light of the same, I direct the concerned respondent authorities to pay costs of ₹ 5 Lakhs to each of the three petitioner companies.

3. There is nothing in the section which indicates that upon completion of the prescribed period, a fresh order cannot be issued. In the viewpoint of the Court, after the expiry of the time period, the appropriate authority may be of the opinion that such an attachment is further required to protect the interest of government revenue, and may, therefore, issue a fresh order upon compliance of the formalities in Section 83(1).

EPILOGUE:

“A tax collector should collect taxes from a taxpayer just like a bee collects honey from a flower in an expert manner without disturbing its petals” – Kautilya in Arthashastra

Download the copy:

CA Rachit Agarwal

CA Rachit Agarwal