G7 minimum tax proposal

On 5.6.2021, OECD Secretary-General Mathias Cormann said the consensus among the G7 Finance Ministers, including on a minimum level of global taxation, is a landmark step toward the global consensus necessary to reform the international tax system and it will be a game-changer.

It is just a proposal – Another meeting of G20 finance ministers meeting in Italy on 8-9 July 2021.

Organization for Economic Cooperation and Development(OECD) and Group of Twenty (G20) have been spearheading the Base Erosion and Profit Shifting (BEPS) initiative—a multilateral negotiation with over 135 countries, including the United States.

Where did it all start?

The U.S. Treasury Secretary Janet Yellen’ in the newly formed Biden Government, in a press statement, proposed a Global Minimum Corporate Tax Rate of 21% as an attempt to reverse a 30-year race to the bottom.

Base Erosion Profit Shifting

BEPS refers to tax planning strategies used by multinational enterprises to exploit tax arbitrage opportunities arising out of ‘Shifting Base or Profits from Higher Tax Jurisdictions to Lower Tax Jurisdictions or Tax Havens’ to minimize their tax exposure.

How is the G7 proposal linked to BEPS?

◦ Minimum Global Corporate Tax Rate of 15% – Mandatory

◦ Taxing the overseas profits of the multinational corporates in their respective countries, to curb BEPS. What if some entity pays less than 15%?

◦ Their parent nations will have to ‘top-up’ their taxes to the minimum rate and thereby eliminating the advantage of shifting profits to lower tax jurisdictions.

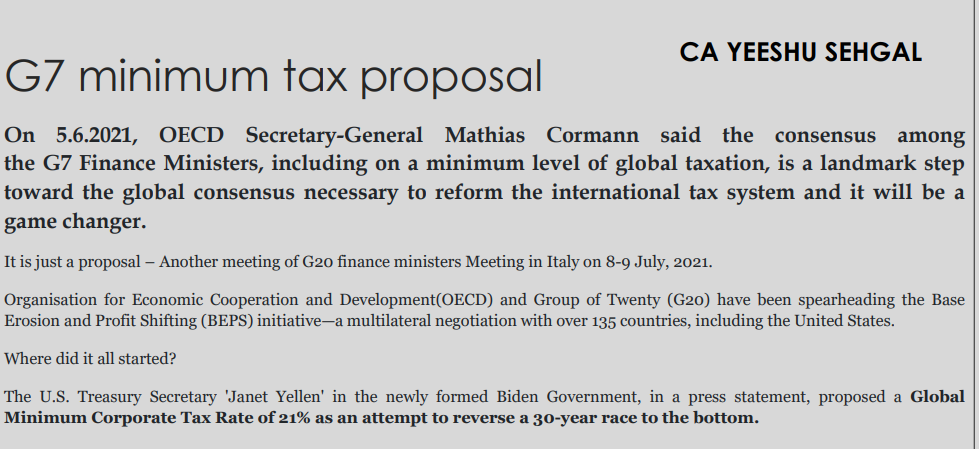

What was google, Apple, Facebook doing? Double Irish and Dutch Sandwich Rule

India and the G7 proposal – India can not be the deal-breaker

Powerful economies – USA, UK, Italy, France, Germany, Japan, Canada.

OECD Involvement

BEPS

India received huge FDI in FY 20-21 despite pandemic

The concessional tax regime for corporates

Tax incentives for SEZ/Gift city

Changes to the Indian Income-tax Act

CFC regulations

Income Inclusion rule – Pillar 2 report

OECD pillar 1 and pillar 2 reports

Unilateral measures like Equalisation levy, significant economic presence could be done away with – Pillar 1 report Climate control

Pillar 1 and Pillar 2

Pillar 1 (Unified approach)

◦ Removal of unilateral tax actions e.g Digital Service Tax

◦ Reallocation of taxing right for market countries

◦ Physical presence is not required

◦ No application of Arm’s length

◦ 20% over 10% approach

◦ Non-routine income (Residual Income)

Pillar 2 (Minimum tax)

• BEPS AP 13 limit of CBCR – Multinational enterprises (“MNE”) with gross revenue over EUR 750 million

• Applying minimum tax of 15%

• Minimum tax to be paid wherever an MNE operates and not just where they are headquartered

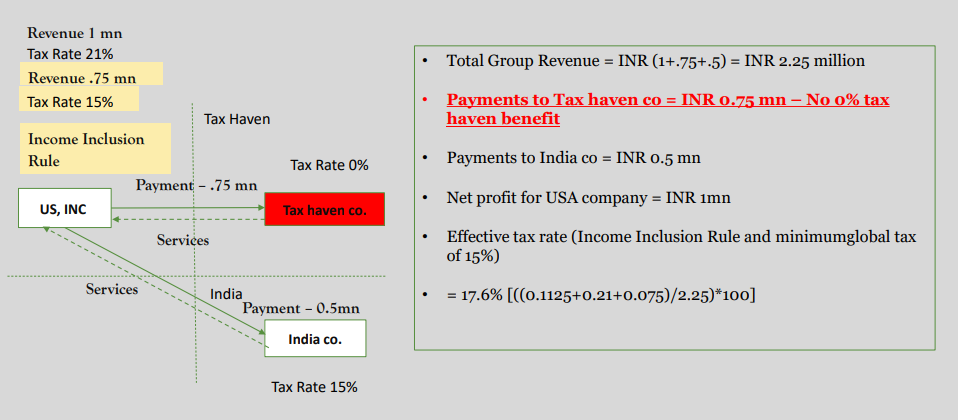

• Income Inclusion rule

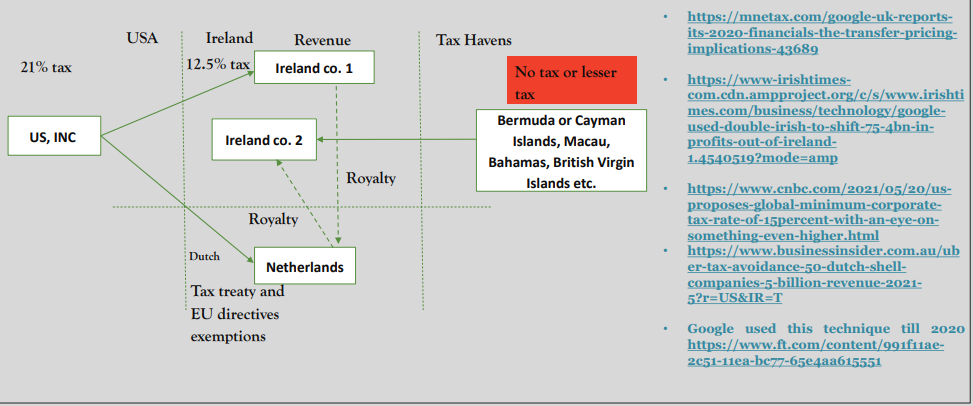

How will G7 affect tax structures?

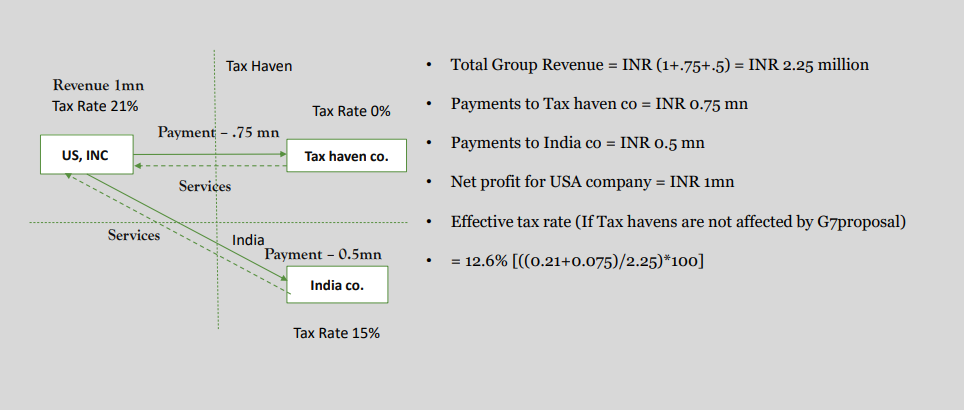

How will G7 affect tax structures – OECD Pillar 2

Yeeshu Sehgal

Yeeshu Sehgal

Yeeshu Sehgal is a Chartered Accountant and an associate member of The Institute of Chartered Accountant of India (ICAI). He has authored various articles on International tax related topics which have been published on widely accessed professional websites like taxsutra, India tax forum, taxguru, linkedin etc. He has been actively contributing through writing about latest developments in International tax space in ICAI NIRC regional branches newsletters such as Faridabad branch, Jaipur Branch etc. He has been a regular speaker on several international and national seminars with audiences from US, UK, Nigeria, Bangladesh, Russia etc. He has spoken at Faridabad Branch of NIRC of ICAI as well on International tax practice for beginners. He has a strong passion and respect for International tax as a work area and at the same time aim to empower his CA, Lawyer, MBA or friends from other walk of life to stay confident and make International tax a part of their life from him. He has received a creator mode on linkedin as well. He has done his graduation in B.com (Hons.) From Shaheed Bhagat Singh College (M) and also worked with big4 firms to top tier firms in India during his articleship and even post qualification. At present, he is working in transaction advisory services (part of International tax advisory) at one of the top consulting firms in India.