The reply of taxpayer should be considered before passing the order (Pdf Attach)

The author can be reached at shaifaly.ca@gmail.com

Cases Covered:

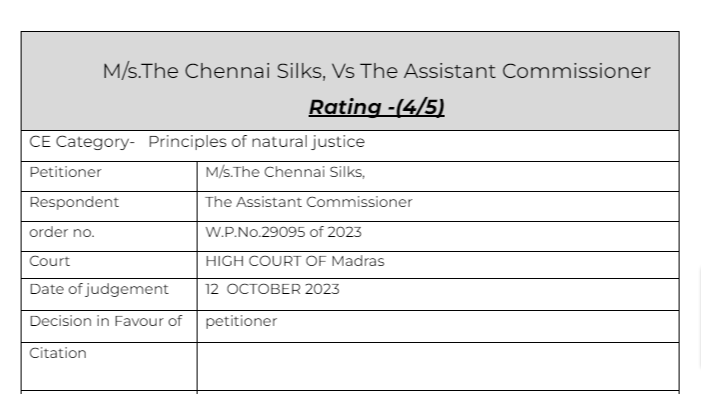

M/s.The Chennai Silks, Vs The Assistant Commissioner

Facts of the cases:

The respondent sent a reminder DRC-01A on 10.3.2022. Thereafter, DRC-01 show cause notice dated 17.4.2023 was issued and the personal hearing was fixed on 21.4.2023. In the said personal hearing, the respondent recordedthe statement of replies. According to the petitioner, though the petitioner filed a reply and their reply was also recorded by the respondent, the impugned order dated 04.7.2023 came to be issued without considering the replies and passed a non-speaking order. Though, they have provided the opportunity of personal hearing and permitted the petitioner to provide the reply, it is duty of the respondent to deal with the reply filed by the petitioner while passing the impugned order. But, the reply filed by the petitioner has not been taken into consideration and the respondent passed the non-speaking order. Hence, the above Writ Petition has been filed before this Court.

Observation & Judgement of the Court:

In the present case, the respondent/Assessing Officer, admittedly, has failed to consider the reply/objections made by the petitioner pursuant to the show cause notice and passed a non-speaking order. The learned counsel also brought to the notice of this Court certain paragraphs mentioned in the show cause notice were re-produced in the impugned order. Therefore, failure on the part of the respondent/Assessing Officer to address the reply/objections of the petitioner/assessee by a speaking order, would vitiate the impugned proceedings.

On this score, since the reply/objections made by the petitioner pursuant to the show cause notice remained undecided, this Court feels that the petitioner is entitled to have a considered opinion of the Assessing Officer after taking into consideration the reply filed by the petitioner. Thus, this Court is inclined to set-aside the impugned order and remit the matter back for re-consideration. Accordingly, the Assessing Officer is directed to pass a detailed order after taking into consideration the reply filed by the petitioner.

In the result, the Writ Petition is allowed and the impugned order is set-aside. The matter is remitted back to the respondent for reconsideration of its order, taking into consideration the reply filed by the petitioner dated 17.1.2022 and 02.2.2022. Needless to say that principles of natural justice shall be followed. No costs. Consequently, the connected WMP is closed.

Comment:

The principles of natural justice is not limited upto the level of giving personal hearing,but also to consider the reply given by the noticee.

Read & Download the Full M/s.The Chennai Silks, Vs The Assistant Commissioner

optional file name

optional file name

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.