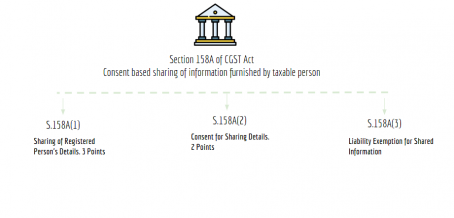

Section 158A of CGST Act : Consent based sharing of information furnished by taxable person (Updated till on July 2024)

Section 158A Summary Chart :

1[Section 158A of CGST Act : Consent based sharing of information furnished by taxable person

(1) Notwithstanding anything contained in sections 133, 152 and 158, the following details furnished by a registered person may, subject to the provisions of subsection (2), and on the recommendations of the Council, be shared by the common portal with such other systems as may be notified by the Government, in such manner and subject to such conditions as may be prescribed, namely:––

(a) particulars furnished in the application for registration under section 25 or in the return filed under section 39 or under section 44;

(b) the particulars uploaded on the common portal for preparation of invoice, the details of outward supplies furnished under section 37 and the particulars uploaded on the common portal for generation of documents under section 68;

(c) such other details as may be prescribed.

(2) For the purposes of sharing details under sub-section (1), the consent shall be obtained, of ––

(a) the supplier, in respect of details furnished under clauses (a), (b) and (c) of sub-section (1); and

(b) the recipient, in respect of details furnished under clause (b) of sub-section (1), and under clause (c) of sub-section (1) only where such details include identity information of the recipient,

in such form and manner as may be prescribed.

(3) Notwithstanding anything contained in any law for the time being in force, no action shall lie against the Government or the common portal with respect to any liability arising consequent to information shared under this section and there shall be no impact on the liability to pay tax on the relevant supply or as per the relevant return. ]

- Inserted vide sec 158 of The Finance Act, 2023 dated 31.03.2023 (No. 8 of 2023), notified through Notification No. 28/2023 – CT dated 31.07.2023 – Brought into force w.e.f. 01.10.2023.

Prem

Prem

designer

Adilabad, India

gst taxation