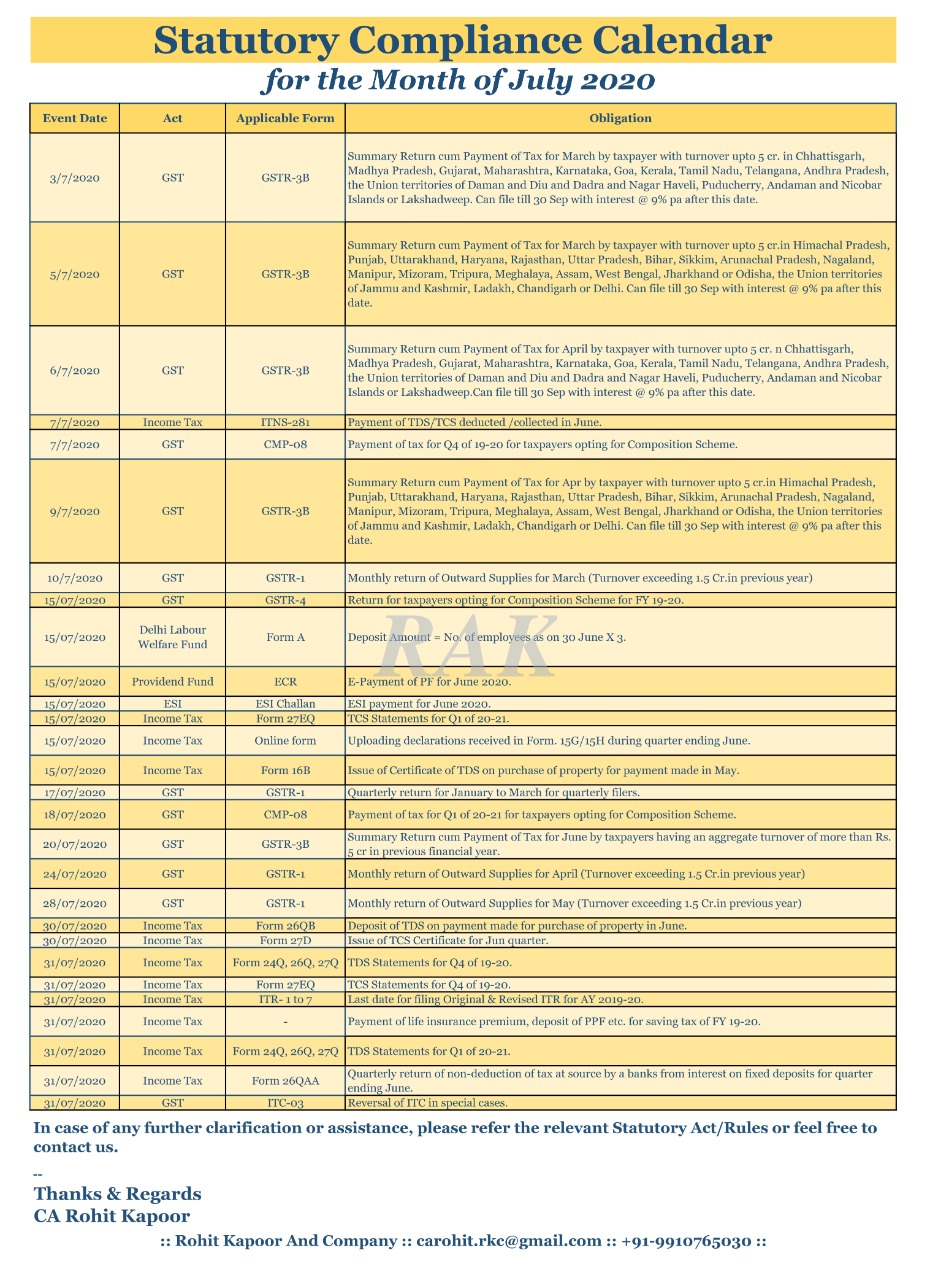

| Event Date |

Act |

Applicable Form |

Obligation |

| 3/7/2020 |

GST |

GSTR-3B |

Summary Return cum Payment of Tax for March by the taxpayer with turnover up to 5 cr. in Chhattisgarh, Madhya Pradesh, Gujarat, Maharashtra, Karnataka, Goa, Kerala, Tamil Nadu, Telangana, Andhra Pradesh, the Union territories of Daman and Diu and Dadra and Nagar Haveli, Puducherry, Andaman, and the Nicobar Islands or Lakshadweep. Can file till 30 Sep with interest @ 9% pa after this date. |

| 5/7/2020 |

GST |

GSTR-3B |

Summary Return cum Payment of Tax for March by the taxpayer with turnover up to 5 cr.in Himachal Pradesh, Punjab, Uttarakhand, Haryana, Rajasthan, Uttar Pradesh, Bihar, Sikkim, Arunachal Pradesh, Nagaland, Manipur, Mizoram, Tripura, Meghalaya, Assam, West Bengal, Jharkhand or Odisha, the Union territories of Jammu and Kashmir, Ladakh, Chandigarh or Delhi. Can file till 30 Sep with interest @ 9% pa after this date. |

| 6/7/2020 |

GST |

GSTR-3B |

Summary Return cum Payment of Tax for April by the taxpayer with turnover up to 5 cr. n Chhattisgarh, Madhya Pradesh, Gujarat, Maharashtra, Karnataka, Goa, Kerala, Tamil Nadu, Telangana, Andhra Pradesh, the Union territories of Daman and Diu and Dadra and Nagar Haveli, Puducherry, Andaman, and the Nicobar Islands or Lakshadweep.Can file till 30 Sep with interest @ 9% pa after this date. |

| 7/7/2020 |

Income Tax |

ITNS-281 |

Payment of TDS/TCS deducted /collected in June. |

| 7/7/2020 |

GST |

CMP-08 |

Payment of tax for Q4 of 19-20 for taxpayers opting for Composition Scheme. |

| 9/7/2020 |

GST |

GSTR-3B |

Summary Return cum Payment of Tax for Apr by the taxpayer with turnover up to 5 cr.in Himachal Pradesh, Punjab, Uttarakhand, Haryana, Rajasthan, Uttar Pradesh, Bihar, Sikkim, Arunachal Pradesh, Nagaland, Manipur, Mizoram, Tripura, Meghalaya, Assam, West Bengal, Jharkhand or Odisha, the Union territories of Jammu and Kashmir, Ladakh, Chandigarh or Delhi. Can file till 30 Sep with interest @ 9% pa after this date. |

| 10/7/2020 |

GST |

GSTR-1 |

Monthly Return of Outward Supplies for March (Turnover exceeding 1.5 Cr.in previous year) |

| 15/07/2020 |

GST |

GSTR-4 |

Return for taxpayers opting for Composition Scheme for FY 19-20. |

| 15/07/2020 |

Delhi Labour Welfare Fund |

Form A |

Deposit Amount = No. of employees as on 30 June X 3. |

| 15/07/2020 |

Provident Fund |

ECR |

E-Payment of PF for June 2020. |

| 15/07/2020 |

ESI |

ESI Challan |

ESI payment for June 2020. |

| 15/07/2020 |

Income Tax |

Form 27EQ |

TCS Statements for Q1 of 20-21. |

| 15/07/2020 |

Income Tax |

Online form |

Uploading declarations received in Form. 15G/15H during the quarter ending June. |

| 15/07/2020 |

Income Tax |

Form 16B |

Issue of Certificate of TDS on purchase of property for payment made in May. |

| 17/07/2020 |

GST |

GSTR-1 |

Quarterly return for January to March for quarterly filers. |

| 18/07/2020 |

GST |

CMP-08 |

Payment of tax for Q1 of 20-21 for taxpayers opting for Composition Scheme. |

| 20/07/2020 |

GST |

GSTR-3B |

Summary Return cum Payment of Tax for June by taxpayers having an aggregate turnover of more than Rs. 5 cr in the previous financial year. |

| 24/07/2020 |

GST |

GSTR-1 |

Monthly Return of Outward Supplies for April (Turnover exceeding 1.5 Cr.in previous year) |

| 28/07/2020 |

GST |

GSTR-1 |

Monthly Return of Outward Supplies for May (Turnover exceeding 1.5 Cr.in previous year) |

| 30/07/2020 |

Income Tax |

Form 26QB |

Deposit of TDS on payment made for the purchase of property in June. |

| 30/07/2020 |

Income Tax |

Form 27D |

Issue of TCS Certificate for Jun quarter. |

| 31/07/2020 |

Income Tax |

Form 24Q, 26Q, 27Q |

TDS Statements for Q4 of 19-20. |

| 31/07/2020 |

Income Tax |

Form 27EQ |

TCS Statements for Q4 of 19-20. |

| 31/07/2020 |

Income Tax |

ITR- 1 to 7 |

Last date for filing Original & Revised ITR for AY 2019-20. |

| 31/07/2020 |

Income Tax |

– |

Payment of life insurance premium, the deposit of PPF, etc. for saving tax of FY 19-20. |

| 31/07/2020 |

Income Tax |

Form 24Q, 26Q, 27Q |

TDS Statements for Q1 of 20-21. |

| 31/07/2020 |

Income Tax |

Form 26QAA |

Quarterly return of non-deduction of tax at source by a bank from interest on fixed deposits for the quarter ending June. |

| 31/07/2020 |

GST |

ITC-03 |

Reversal of ITC in special cases. |

CA Rohit Kapoor

CA Rohit Kapoor