composition annual return: 10 facts

Table of Contents

10 facts about composition annual return :

Here we have compiled 10 important facts about the composition annual return. Pls file it within time. Late filing of GST annual return for composition dealer is liable for late fees. Following points will help you to understand this return. Read them before you file your return.

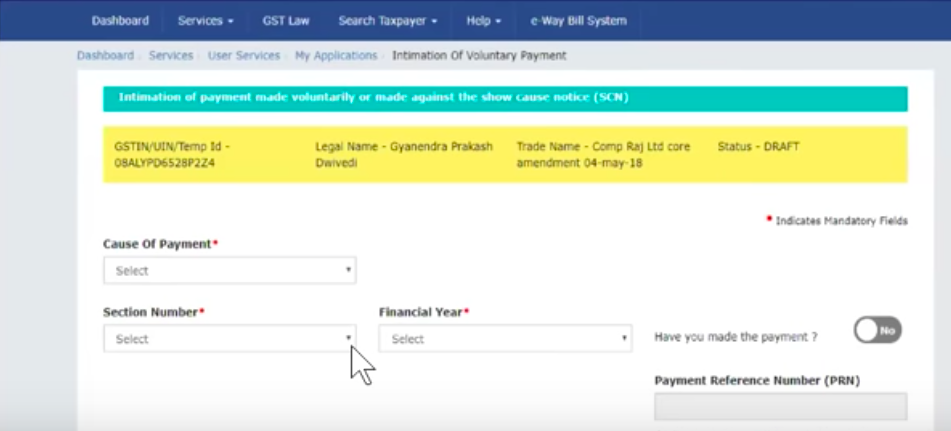

Additional tax liability can be paid via form DRC-03:

Any liability you skipped in GSTR 4 , can be paid via annual return. This functionality is also made available in GST annual return. This additional liability disclosed in GSTR 9A can be paid via form GST DRC 03. The format of DRC 3 is here.

You can fill DRC 03 via this path on your dashboard.

Dashboard after login—–>Services—-> User services——>My application.

You can select DRC 03 from the menu and generate it.

DRC03

You can file NIL annual return also:

This facility is given for dealers not having any transaction. You don’t need to waste time in compiling the annual return. You are eligible to file the NIL annual return. But yes this facility is for a restricted number of people. Who all can file the NIL composition annual return is drafted on this link by our team.

You are liable to file composition annual return even if registration was cancelled:

If you were registered as a composition dealer even for a single day. You are liable to file annual return. Even if your registration is cancelled. Liability to file annual return is there. Please take care to file annual return even if you cancelled your registration.

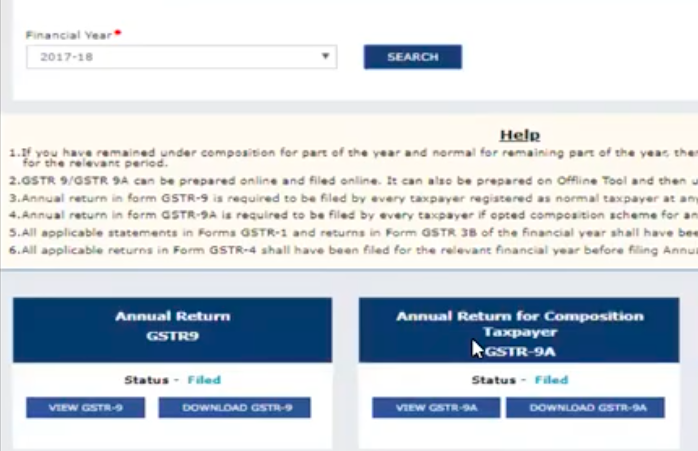

It will be filed in form GSTR 9A:

The prescribed for for annual return of composition dealer is GSTR 9A. This form is available at your dashboard. This is simplified for composition dealers.You can fill it easily. Data filed in GSTR 04 during the year is already auto populated. In case there is no variance in data, you can file it at once. If there is modification in date you can do it. Then file it with correct data. Additional liability can also be entered and paid of. But it can be paid only via cash.

If you shifted from normal to composition or vice versa both annual returns will be filed:

If you shifted from composition or vice versa. Both returns will be filed by you. You will see both returns on your dashboard. No need to say that you are liable to file both of them.

composition annual return

Once filed GST composition annual return cant be revised or modified:

This is very important to know that once you filed the annual return. It cant be altered. Ultimate care should be taken before hitting the file button. You can do the following steps before filing it.

a. Reconcile your data with books of accounts and make a reconciliation.

b. Calculate , if there is any additional liability.

c. Cross verify the return with consolidated data.

d. Download the final return before filing and check it again.

Additional liability can be paid only via electronic cash ledger:

The additional liability can be declared in annual return , GST form 9A. It is important to note that this liability can be paid only via cash ledger. Although this is not provided anywhere in GST Act. This is introduced and imposed only by annual return form. But any payment via DRC 3 can be made only via cash ledger.This will be an extra burden on the head of taxpayer. So you can file your annual return now.

Send your queries at info@consultease.com

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.