10 tips to build and track your mutual funds portfolio

In this article we are going to give answers to some basic questions every investor have in mind.

How to invest in mutual funds?

How to build a mutual fund’s portfolio?

How to track my mutual fund’s portfolio?

When should I book profits ?

When should I make additional/top up investments?

How to choose the best mutual funds for my portfolio?

How to make income tax savvy investments?

If you have any of these dilemma in your mind you should read this article.Let us start with our first concern.

How to invest in mutual funds?: We can invest in mutual funds via two routes.

First is through a financial advisor or broker:In this route generally investor also gets the advisory on funds. Other services will also be provided by the advisor. Some brokers also provide for online windows for investment. All you need to do is to login and make purchase in the scheme you desire and make instant payment via online route.

Second route is direct investment. SEBI also allow an investor to invest directly into the fund without any advisor. Investors who track their portfolio themselves and who don’t want to take services of and advisor can choose this option.

How to Build a mutual funds portfolio? :

Start investing as soon as possible because in this stream timing is the most important thing. It’s not that you will have to hold for ever but you should be able to hold till the investment reaps the fruit. We all know that equity moves in any one of two directions either up or down. Our basic goal should be to try to enter into the investment when it is already down and sell it when it go up and book profits and preserve our cash so that we will be able to invest again when it will come down because it will move in both directions. It is impossible that it will move in one direction for ever. Timing is the most crucial thing and your profits will depend on your timing only.

How to track my mutual funds portfolio?:

It is also important to track your portfolio time to time and keep an eye on it. We find it hard to track our portfolio and sometimes unable to reach it. I get so many clients with this problem that they invested either directly or through some broker who left his services after some time and now they want to redeem but they don’t have any access to it. They don’t even remember the folio number and scheme name completely. To those investors I would like to suggest some easy tips to access your portfolio. You can access your folio details by submitting your details on any of below websites.

Go to the UTI mutual funds or Karvy/CAMS website and fill in your details. Let me explain step by step for UTI mutual funds website. You can try the same on Karvy or CAMS also.

Go to the UTI mutual funds website and you will see this window. Click on customer service as highlighted in the following image.

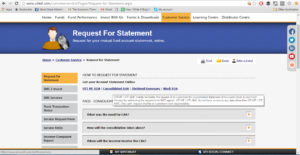

When you will click on customer service you will get the following window. Choose consolidate statement as highlighted in image 2 below.

Then you will be redirected to this window (see Image 3) and here you need to fill in your e-mail ID the one you mentioned in your application form of mutual fund and chose a password. A consolidated statement of all investment made by you will be sent to your e-mail ID. Mail would be from KARVY. Then open the e-mail and download the pdf, which will be password protected and enter your password and you will be able to see all your investments with current value, number of units and folio number.

Hope this will help you. Also if you have invested into ICICI, HDFC , Axis or any reputed company you can just visit their website and register your folio there and you will be able to access it online.

When should I book profits?:

This is the most important question and most of the people don’t even ask it. If you won’t book your profits at correct timing not only you can lose that profit (because market can move in both directions) but also lose the opportunity to invest again at lower level. Thus it is important to book profits time to time. But we need to take care of some important factors.

- Try to book profits after one year of investment as your investments will be long term and the profit arise on their sale will be long term capital gain. It would be exempt from tax. If there is not a huge risk in coming future try to hold your investments for at least one year.

- Never ever book a loss in mutual funds. If you have made any lump sum investment and now your fund is at considerable low points you can start a small SIP to average gradually and once it will start covering you will be able to book profit.

- When market hit an all-time high or 3-4 year’s high start booking profit in your investment gradually. There are chances of correction whenever market touches a record high. If you will book partial profits at that time you will be able to re-invest it again when market will be down.

- Book your profits to diversify. Like in my last article I took the example of ICICI us blue-chip equity and ICICI value discovery. When the ICICI value discovery was down the ICICI US blue-chip was high. That was the perfect timing to book profits in ICICI us blue-chip and put that money in ICICI value discovery. Your gains should have been doubled by this strategy.

When should I make additional/top up investments?:

As always suggested that we should invest systematically but sometime we see a huge meltdown in market which is all of sudden and then we realise that we have already put a huge amount and minor SIP will not be able to average the investment at this time. In this case you can go for additional or top us investments. Also if any of your fund is consistently doing good and you expect that it still have a huge potential then before it reaches to a saturation points it would be better to invest more and book the profits when it reach at peak level.( Although no one can predict the exact top and bottom for any fund but still we can have an idea of long term direction of funds.)

How to choose the best mutual funds for my portfolio?:

You want to choose best in everything then why not in investments as our future will be dependent on it. It’s not a rocket science basic rules will apply here also.

- First of all go with a strong fund house having a strong track record of giving return and there should be no default in any of their funds in past.

- Check the fund manager for a particular fund and their past performance.

- Check the sector or type of equity they will be going to cover. Choose the strongest sector and strongest funds in that strongest sector. Return of different funds will defer as per their inherent nature and market condition. e.g. when banking will be down every fund of banking sector will give the negative return but still quantum of that negative return will be different and still some of them may be in minor profit also.

- See the change in economy while choosing a fund. Like in reverse repo cut cycle return of short term debt will be less in comparison to long term debt.

- Check the expanse ration of the fund you are planning to invest in. Although there is a cap on expanses by SEBI but still they vary from fund to fund.

- Most of mutual funds have a lock-in period ranging from 15 days to 3 years. Take care to check the lock in period of the fund you want to invest as redemption before that lock-in period will liable you for a penalty. Make sure that you will be able to hold that fund at least for the period of lock in to protect yourself from any penalty.

How to make income tax savvy investments?:

Tax treatment of your return will decide the final sum in your hands.It is suggested to see the tax treatment of your mutual funds investment. As I told earlier in case your Equity (STT paid) funds are held for more than a year your profits will be exempted. But in case of Gold funds ?? no STT is paid. In case of funds investing in US equity or in emerging markets equity STT will not be there. Absence of STT will make them liable for long term capital gains although they also get the indexation benefit and tax will be @20% only.

ELSS are the only mutual funds to fetch you any benefit under section 80C of Income tax Act 961.

In liquid funds if you have chosen the dividend option then that dividend will be exempt in your hand although company will pay DDT on it.

But if you have chosen growth option then profit will be capital gains.(long term or short term depending on period of holding)

For any query or confusion we are happy to help. You can whatsapp on 9953077844 or send a mail at shaifaly.ca@gmail.com

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.