100% Online Refund Process from Sept 26, 2019.

100% Online Refund via single authority:

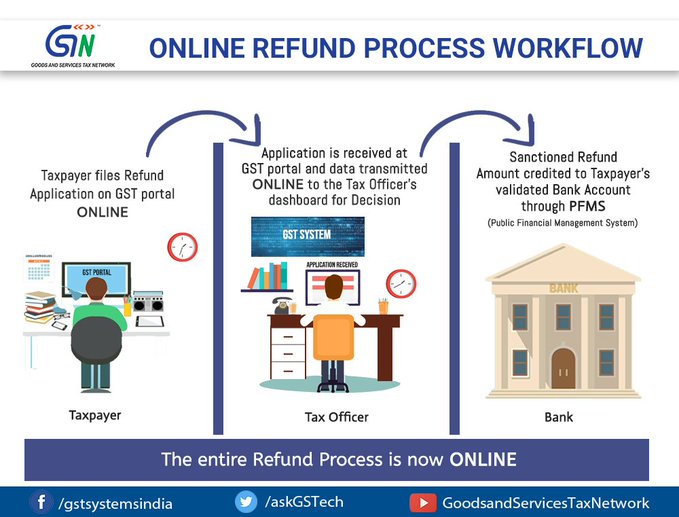

In a new process developed by GSTIN, 100% Online Refund will be processed. This functionality will start working on 26th September 2019. In this online process, the refund will be filed online. The Complete process is automated. Taxpayers are facing many issues in refund processing. All refund applications filed before September 26, 2019, will be processed manually as done under the old refund process. Every taxpayer is eligible for a refund in the following cases: Sec 54 of CGST Act cover these provisions.

- Export of Goods

- Export of services

- inverted rated supply

- taxes wrongly deposited

- Taxes paid in the wrong head when a tax is also paid in correct head

- Late fees deposited by the taxpayer but waived off later on

The process of this functionality is as shown in following image.

The single authority will process this refund. There are many issues in an inverted rated refund. Portal is not supporting its utility. Thus a ray of hope is there. Still, issues in inverted rated supply refund need attention.

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.