101st Constitution Amendment Act, 2016

101st Constitution Amendment Act, 2016

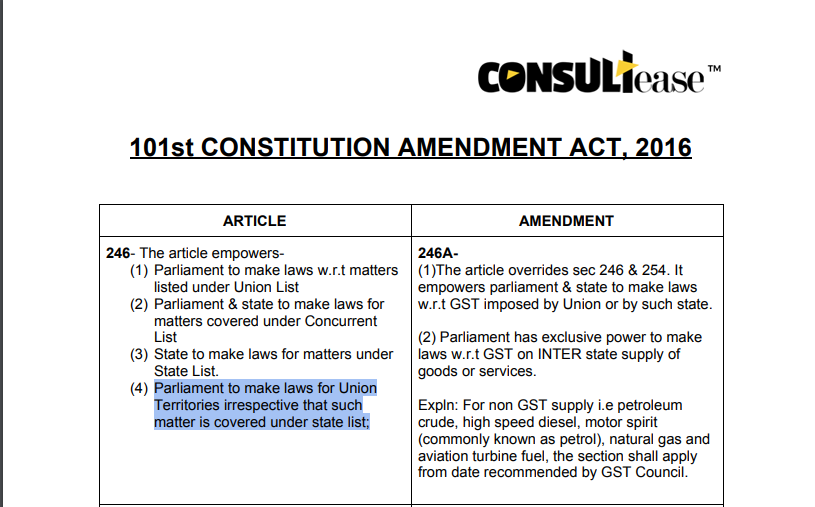

| ARTICLE | AMENDMENT |

246– The article empowers-

|

246A-

(1)The article overrides sec 246 & 254. It empowers parliament & state to make laws w.r.t GST imposed by Union or by such state. (2) Parliament has exclusive power to make laws w.r.t GST on INTER state supply of goods or services. Expln: For non-GST supply i.e petroleum crude, high-speed diesel, motor spirit (commonly known as petrol), natural gas, and aviation turbine fuel, the section shall apply from the date recommended by GST Council. |

248- The article empowers-

|

248-

Impact- parliament has the power to make laws keeping in view article 246A. |

249-

|

249-

Impact- the article is also applicable to article 246A. |

| 250- (1) The article overrides whole of the chapter where-

Parliament has the power to make laws in respect of matters covered under State List, if a proclamation of emergency is in operation, for the whole or part of the territory. |

250-

Impact- parliament has power to make laws w.r.t the GST Act if a proclamation of emergency is in operation. |

| 268- (1) The article deals with levy and apportionment of duties between center and states. Stamp duty and such duties of excise on medicinal and toilet preparations are levied by GOI. | 268- (1) the words “and such duties of excise on medicinal and toilet preparations” shall be omitted. |

| 268A-

Service tax levied by Union and collected and appropriated by the Union and the State |

268A- Now omitted via amendment. |

| 269- The article empowers GOI to levy & collect tax on purchase and sale of goods & tax on consignment of goods but shall be assigned to states. | 269- This article is NA to article 269A.

Also, 269A got inserted which provides for Levy and collection of goods and services tax in the course of inter-State trade or commerce.-

Expln- for the purpose of this clause import shall be deemed to be considered as Inter-State supply.

|

270-

|

270-

Two new clauses have been inserted- (1A) Tax collected by the union under Article 246A(1) shall also be distributed between union and states in the manner specified in clause 2 of the present article. (1B) The tax levied under article 246A and 269A i.e IGST credit which is used to payment of the tax levied by the union under Article 246A(1) i.e IGST and the apportioned IGST levied by GOI under article 269A shall also be apportioned between union and state in the manner specified under clause 2 of the article. |

| 271- The article empowers parliament to impose a surcharge on taxes referred to in those articles for the purpose of the union and all proceeds of the surcharge shall form part of the consolidated fund of India. | 271- exception has been provided to GST under 246A, meaning thereby no surcharge shall be levied under GST. |

279A- The article provides for constitution of GST Council where-

|

|

286- Restrictions as to the imposition of tax on the sale or purchase of goods.

|

286-

For the words sale and purchase of goods, the supply of goods or services or both shall be substituted.

|

| 366- The article provides for the definition of various terms | 366- Following definitions added-

(12A) goods and services tax means any tax on supply of goods, or services or both except taxes on the supply of the alcoholic liquor for human consumption; (26A) “Services” means anything other than goods; (26B) “State” with reference to articles 246A, 268, 269, 269A and article 279A includes a Union territory with Legislature;’. |

| 368- The article empowers parliament to amend the constitution.

(2) Amendment can be done only by the introduction of a bill in both the houses of parliament to be passed by a majority of voting and then president assent is required to form an act. Provided that-

Amend shall be ratified by legislatures of not less than half of states before president assent |

368-

(2)(a) for the words and figures “article 162 or article 241”, “article 162, article 241 or article 279A” shall be substituted. |

| Seventh schedule- Union List- List I | Entry No. 84 substituted by-

Duties of excise on the following goods manufactured or produced in India, namely:— (a) petroleum crude; (b) high-speed diesel; (c) motor spirit (commonly known as petrol); (d) natural gas; (e) aviation turbine fuel; and (f) tobacco and tobacco products.”; |

| Seventh schedule- Union List- List II | for entry 54, the following entry shall be substituted, namely:—

“54. Taxes on the sale of petroleum crude, high-speed diesel, motor spirit (commonly known as petrol), natural gas, aviation turbine fuel, and alcoholic liquor for human consumption, but not including the sale in the course of inter-State trade or commerce or sale in the course of international trade or commerce of such goods.”; |

| Transitional Provision | Any provision of any law relating to goods or services or both immediately before the commencement of this act, which is inconsistent with provisions of present constitution amends act shall continue to stay in force until amended or repealed by authority or until the expiry of one year from such commencement, whichever is earlier. |

| Power of President to remove difficulties |

Provided that no such order can be made after the expiry of 3 years from the date of assent. 2. Every order made has to be laid before each house of parliament. |

Related Topic:

What is difference in Repeal and amendment