Cab/Taxi services provided via E-operator is taxable for E-operator

Cab/Taxi services provided via E-operator is taxable for E-operator: AAR

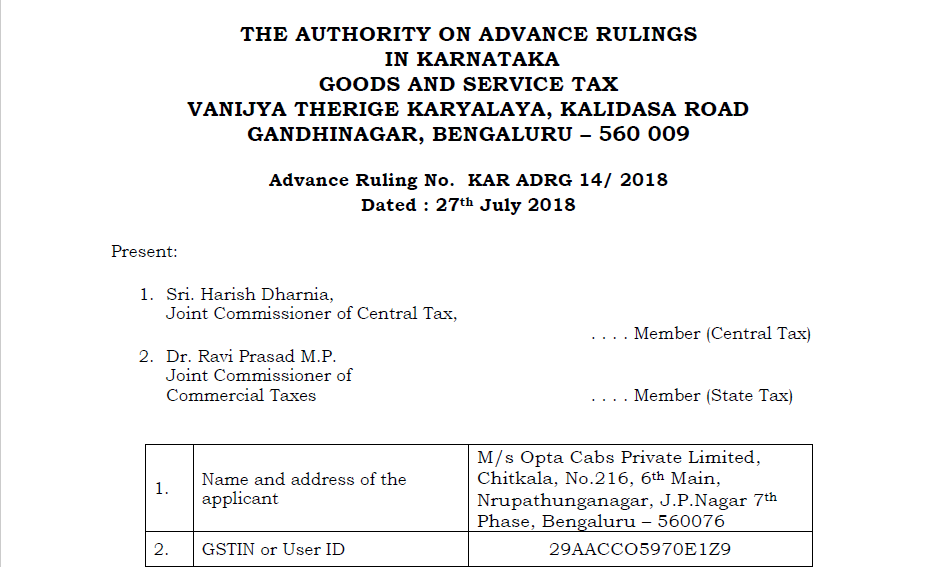

An advance ruling is given by the Authority of the Advance Ruling(AAR) o0f Karnataka. Regarding the cab/taxi services provided to the customers. The Cab/Taxi services provided via E-operator is taxable for E-operator. This ruling was submitted by the M/s Opta Cabs Private Limited, Who is an e-operator. The applicant provides the mobile app to the taxi driver and customers to interact. The main person creating and supplying such services are the cab/taxi drivers. Following is the issue/question raised by the applicant and ruling given by the AAR:

Issue/Question Raised by the Applicant

Whether the money paid by the customer to the driver of the cab for the services of the trip is liable to GST and whether the applicant company is liable to pay GST on this amount.

Download the full explanation and reasoning provided by the both by clicking the below image:

Ruling

The applicant is liable to tax on the amounts billed by him on behalf of the taxi operators for the service provided in the nature of transportation of passengers through it, in accordance with the provisions of sub-section (5) of section 9 of the Central Goods and Services Tax Act 2017 read with Notification No. 17/2017 –Central Tax (Rate) dated 28.06.2017 and the provisions of sub-section (5) of section 9 of the Karnataka Goods and Services Tax Act 2017 read with Notification No. 17/2017 –State Tax (Rate) dated 28.06.2017.

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.