[update from 1/10/2020] 12/2017 CTR Updated-Exemptions in GST

Table of Contents

- Introduction- Exemptions in GST

- Update tax on Export freight from 1/10/2020

- 1. Charitable/religious

- 2. Business Transfer

- 3. To Govt

- 4. Agri, Govt

- 5. FIFA

- 6. Transit cargo to Nepal & Bhutan

- 7. Construction

- 8. Electricity

- 9. Renting

- 10. Hotel

- 11. Transportation of passenger

- 12. Transportation of goods

- 13. Transportation of goods by GTA

- 15. Toll Road

- Related Topic: Serviced apartments are also eligible for exemption under 12/2017

- 16. Agriculture

- 17. Agri, Job work

- 18. Bank

- 19. Interest

- 20. Life Insurance

- 21. Pension Scheme

- 22. Telecom License

- 23. leasing of assets by Indian Railways

- 24. Upfront amount premium, salami, cost

- 25. INCUBATEE, INCUBATOR

- 26. ARBITRAL TRIBUNAL

- 27. VET CLINIC

- 28. LICENSE BY FSSAI

- 29. Journalists

- 30. the lending of books or knowledge enhancing content

- 31. GSTIN

- 32. Exhibition outside India

- 33. organizing an event – sports

- 34. Animals

- 35. FDM

- 36. RTI

- 37. Educational institution

- 38. Sports

- 39. NSDC

- 40. Skill Development

- 42. Health care

- 43. Health care, rehabilitation professional

- 44. To clinical establishment

- 45. Toilets

- 46. Society to members

- 47. Unincorporated body

- 48. Music, Dance

- 50. Fair Price

- Read the Copy:

Introduction- Exemptions in GST

Many items are exempted from GST. Section 11 of the CGST Act provides the right to prescribe the list of exempted items in GST. The following two notifications are issued to list the Exemptions in GST.

- 2/2017-CTR for exempted Goods

- 12/2017 – CTR for exempted services

They are amended from time to time by various notifications. Similar notifications are issued for IGST also.

Related Topic:

GST on Stage and Contract Carriage

Update tax on Export freight from 1/10/2020

GST on export freight. Entry no. 19 B of 12/2017 as amended by notification no. 21/2019-CTR. It exempted the Ocean freight up to 30th September 2020. In absence of any extension, Ocean freight will become taxable from 1st Oct 2020. Thus from 1st October Shipping lines will charge 5% GST on export freight and other related charges. This entry was inserted via notification no. 02/2018- CTR.

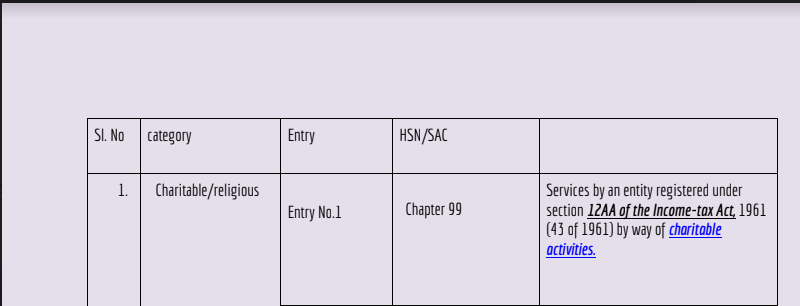

1. Charitable/religious

| Entry | HSN/SAC | Description |

| Entry No.1 | Chapter 99 | Services by an entity registered under section 12AA of the Income-tax Act, 1961 (43 of 1961) by way of charitable activities. |

| Entry No.9D | Chapter 99 | Old Age home run by

|

| Entry No.13 | Heading 9963, 9972,9995 or any other heading of section 9 |

An entity registered in section 12AA or 10(23C)(5) of Income-tax Act Body or authority covered under 10(23BBA) of the Income-tax Act Except – The room rent is Rs. 1000 or more per day – Community hall/mandap rent Rs. 10000 or more per day – Rent of shop /business place rent is Rs. 10000 or more. |

| Entry No.60 | Heading 9991 | Religious pilgrimage facilitated by GoI under bilateral agreement by a specified organization |

| Entry No.80 | Heading 9996 | Training or coaching in recreational activities relating to

By entities registered in sec 12AA of IT Act |

2. Business Transfer

| Entry No. 2 | Chapter 99 | Transfer of a business as a going concern |

3. To Govt

| Entry No. 3 | Chapter 99 | Pure services to CG, SG, UT, or LA for 243G or 243W. AAR- M/s. Super Wealth Financial Enterprises (P) Ltd. |

| Entry No.[3A] | Chapter 99 | Services provided to CG, SG, UT or LA having up to 25% goods for 243G or 243W |

| Entry No.4 | Chapter 99 | Services by a governmental authority for 243W of CoI |

| Entry No.5 | Chapter 99 | Services by a governmental authority for 243G of CoI |

| Entry No.6 | Chapter 99 | Services by CG, SG, UT or LA, except

|

| Entry No.7 | Chapter 99 | Services provided by CG, SG, UT or LA to a Business entity (T/O less than 20/10 Lakh) except:

|

| Entry No.8 | Chapter 99 | Services provided by CG, SG, UT or LA to another CG, SG, UT or LA except

|

| Entry No.9 | Chapter 99 | Services provided by CG, SG, UT or LA with consideration of 5000 or less except

[In case of Continuous Supply Annual Amount is 5000 or less] |

| Entry No.9C | Chapter 99 | Services provided by Govt. entity to CG, SG, UT, LA, or any person specified by CG, SG, UT, or LA. (In the form of Grant). |

| Entry No.34A | Heading 9971 | By CG, SG, or UT by way of guaranteeing the loans of their undertaking or PSU’s from banking companies or financial institutions. |

| Entry No.47 | Heading 9983 or 9991 | By CG, SG, UT or LA by way of-

|

| Entry No.61 | Heading 9991 | By CG, SG, UT, or LA issuance of passport, visa, driving license, birth certificate, or death certificate. |

| Entry No.62 | Heading 9991 or 9997 | By CG, SG, UT, or LA by way of tolerating non-performance and the fines & damages to be paid to CG, SG, UT, or LA under such contract. |

| Entry No.63 | Heading 9991 | By CG, SG, UT, or LA by way of assigning the right to use natural resources to an individual farmer for the cultivation of plants & Animals, except horse(for fiber, food, fuel, or other similar products). |

| Entry No.64 | Heading 9991 or 9973 | By CG, SG, UT, or LA by way of assigning the right to use natural resources, where right was given by CG, SG, UT, or LA before 1st April 2016.

The exemption is limited to tax payable only. |

| Entry No.65 | Heading 9991 | By CG, SG, or UT by way of deputing officers after office hours or on holidays for inspection or container stuffing or such other duties in relation to import export cargo on payment of Merchant Overtime charges. |

| Entry No.[65B | Heading 9991 or any other heading | By SG Right to collect Royalty on behalf of SG on the minerals dispatched by mining leaseholders. |

4. Agri, Govt

| Entry No.58 | Heading 9988 or 9992 | By NCCCD by way of cold chain knowledge dissemination. |

5. FIFA

| Entry No. 9A | Chapter 99 | Any Activity for FIFA Word cup 2017. |

6. Transit cargo to Nepal & Bhutan

| Entry No. 9B | Chapter 99 | Supply of services associated with transit cargo to Nepal and Bhutan (landlocked countries). |

7. Construction

| Entry No.10 | Heading 9954 | Pure labor contract for the construction(+9) of civil structure or any other original works pertaining to BLIHC or enhancement under HAUM or PMAY. |

| Entry No.11 | Heading 9954 | Pure labor contracts of construction, erection, commissioning or installation of original works pertaining to a single residential unit otherwise than as a part of a residential complex. |

8. Electricity

| Entry No.10A | Heading 9954 | EDU by way of construction, erection, commissioning or installation of infrastructure for extending the electricity distribution network up to the tube well of the farmer or agriculturalist for agricultural use. |

| Entry No.25 | Heading 9969 | extending the electricity distribution network up to the tube well of the farmer or agriculturalist for agricultural use. |

9. Renting

| Entry No.12 | Heading 9963 or 9972 | Services by way of renting a residential dwelling for use as a residence. |

10. Hotel

| Entry No.14 | Heading 9963 | Hotel room up to 1000/day. |

11. Transportation of passenger

| Entry No.15 | Heading 9964 |

|

| Entry No.16 | Heading 9964 | Transportation of passengers provided to Centre government in a regional connectivity scheme airport. |

| Entry No.17 | Heading 9964 |

|

12. Transportation of goods

| Entry No.18 | Heading 9965 | Transportation by way of the road, except

By inland waterways. |

| Entry No.19 | Heading 9965 | Air-transportation of goods from outside India to India. |

| Entry No.[19A | Heading 9965 | Air-transportation of goods from India to Outside India. |

| Entry No.[19B | Heading 9965 | Sea transportation of goods from India to Outside India. |

| Entry No.20 | Heading 9965 | Transportation of goods by rail or a vessel. |

| Entry No.21 | Heading 9965 or 9967 | Services provided by a goods transport agency, by way of transport in a goods carriage of –

(a) agricultural produce; (b) goods, where consideration charged for the transportation of goods on a consignment transported in a single carriage does not exceed one thousand five hundred rupees; (c) goods, where consideration charged for transportation of all such goods for a single consignee does not exceed rupees seven hundred and fifty; (d) milk, salt, and food grain including flour, pulses, and rice; (e) organic manure; (f) newspaper or magazines registered with the Registrar of Newspapers; (g) relief materials meant for victims of natural or man-made disasters, calamities, accidents or mishap; or (h) defense or military equipment. |

13. Transportation of goods by GTA

| Entry No.[21A | Heading 9965 or 9967 | Services by GTA to an unregistered individual/CTP/HUF |

| Entry No.[21B | Heading 9965 or 9967 | GTA services to following:

(a) a Department or Establishment of the Central Government or State Government or Union territory; or (b) local authority; or (c) Governmental agencies, which have taken registration under the Central Goods and Services Tax Act, 2017 (12 of 2017) only for the purpose of deducting tax under Section 51 and not for making a taxable supply of goods or services. |

14. Hire, Rent, Transportation of passenger

| Entry No.22 | Heading 9966 or Heading 9973 | Giving a means of transportation:

|

15. Toll Road

| Entry No.23 | Heading 9967 | Service by way of access to a road or a bridge on payment of toll charges. |

| Entry No.[23A | Heading 9967 | Service by way of access to a road or a bridge on payment of the annuity. |

Related Topic:

Serviced apartments are also eligible for exemption under 12/2017

16. Agriculture

| Entry No.24 | Heading 9967 or Heading 9985 | Services by way of loading, unloading, packing, storage, or warehousing of rice. |

| Entry No.[24A | Heading 9967 or Heading 9985 | Services by way of warehousing of minor forest produce. |

| Entry No.[53A | Heading 9985 | Services by way of fumigation in a warehouse of agricultural produce. |

| Entry No.54 | Heading 9986 | Following activities for cultivation and rearing of animals (except horse:

|

| Entry No.57 | Heading 9988 or any other Heading of Section 8 and Section 9 | Services by way of preconditioning, pre-cooling, ripening, waxing, retail packing, labeling of fruits and vegetables which do not change or alter the essential characteristics of the said fruits or vegetables |

17. Agri, Job work

| Entry No.55 | Heading 9986 | Carrying out an intermediate production process as job work in relation to the cultivation of plants and rearing of all life forms of animals, except the rearing of horses. |

18. Bank

| Entry No.26 | Heading 9971 | Services by the Reserve Bank of India. |

| Entry No.[27A | Heading 9971 | Services provided by a banking company to Basic Saving Bank Deposit (BSBD) account holders under (PMJDY) |

| Entry No.28 | Heading 9971 or Heading 9991 | Services provided by a banking company to Basic Saving Bank Deposit (BSBD) account holders under Pradhan Mantri Jan Dhan Yojana (PMJDY) |

| Entry No.34 | Heading 9971 | Services by an acquiring bank, to any person in relation to settlement of an amount up to two thousand rupees in a single transaction transacted through credit card, debit card, charge card or other payment card service |

19. Interest

| Entry No.27 | Heading 9971 |

|

20. Life Insurance

| Entry No.29 | Heading 9971 or Heading 9991 | Services of life insurance Provided to members of the Army, Naval & Air force by their GIF. |

| Entry No.[29A | Heading 9971

or Heading 9991 |

Life insurance to coastal guards by NGIF. |

| Entry No.35 | Heading 9971

or Heading 9991 |

General insurance services under specified schemes. |

| Entry No.36 | Heading 9971

or Heading 9991 |

Life insurance services under specified schemes. |

| Entry No.[36A | Heading 9971 or Heading 9991 | Services by way of reinsurance of the insurance schemes specified in serial number 35 or 36 [or 40 inserted from 26.7.2018 via 14/2018 CTR] |

| Entry No.38 | Heading 9971 or 9991 | Services by way of the collection of contributions under any pension scheme of the State Governments. |

| Entry No.40 | Heading 9971 or 9991 | Services under any insurance scheme to CG, SG, UT. |

21. Pension Scheme

| Entry No.37 | Heading 9971 or Heading 9991 | Services by way of the collection of contributions under the Atal Pension Yojana. |

22. Telecom License

| Entry No.42 | Heading 9973 or Heading 9991 | By CG, SG, UT, LA to operate as a telecom operator prior to 1-4-2016. |

23. leasing of assets by Indian Railways

| Entry No.43 | Heading 9973 | Leasing of assets by IRFC to Indian railways |

24. Upfront amount premium, salami, cost

| Entry No. 41 | Heading 9972 | The upfront amount charged for the lease of an industrial plot of 30 years or more by mentioned entities to the industrial units or the developers in any industrial or financial business area |

25. INCUBATEE, INCUBATOR

| Entry No. 44 | Heading.9981 | Services provided by an incubatee up to 50 lac |

| Entry No. 48 | Heading.9983 any other Heading of Chapter 99 | Taxable services, provided or to be provided by organizations under the Department of Biotechnology, GOI. |

26. ARBITRAL TRIBUNAL

| Entry No.45 | Heading.9982 OR 9991 | a) Services by Arbitral Tribunal:

b) By partnership firm or individual advocate except senior advocate by way of legal services: – to other advocate or firm – any person other than business entity having turnover of more than 20(10) lac. – CG/SG/UT/LA/GA/GE c) By senior advocate to – any person other than business entity having turnover of more than 20(10) lac. – CG/SG/UT/LA/GA/GE |

27. VET CLINIC

| Entry No.46 | Heading.9983 | Services by a veterinary clinic in relation to health care of animals or birds. |

28. LICENSE BY FSSAI

| Entry No.[47A | Heading.9983 or 9991 | Services by way of licensing, registration and analysis or testing of food samples supplied by the Food Safety and Standards Authority of India (FSSAI) to Food Business Operators |

29. Journalists

| Entry No.49 | Heading.9984 | Services by way of collecting or providing news by an independent journalist, Press Trust of India, or United News of India. |

30. the lending of books or knowledge enhancing content

| Entry No. 50 | Heading.9984 | Services of public libraries by way of lending of books, publications, or any other knowledge enhancing content or material. |

31. GSTIN

| Entry No. 51 | Heading.9984 | Services provided by the GSTIN to the CG/SG/UT for the implementation of GST. |

32. Exhibition outside India

| Entry No.52 | Heading 9985 | Services by an organizer to any person in respect of a business exhibition held outside India. |

33. organizing an event – sports

| Entry No. 53 | Heading 9985 | Services by way of sponsorship of sporting events organized by mentioned organizations. |

34. Animals

| Entry No.[55A | Heading 9986 | Services by way of artificial insemination of livestock (other than horses). |

| Entry No.56 | Heading 9988 | Services by way of slaughtering of animals. |

35. FDM

| Entry No.59 | Heading 9999 | Services by a foreign diplomatic mission located in India. |

36. RTI

| Entry No.[65A | Heading 9991 | Services by way of providing information under the Right to Information Act, 2005 (22 of 2005). |

37. Educational institution

| Entry No.66 | Heading 9992 or Heading 9963] |

– services relating to admission to or conduct of examination

– Supply of online education journals or periodicals. |

38. Sports

| Entry No.68 | Heading 9992 or Heading 9996 | Provided to Recognized Sports body by:

|

| Entry No.82 | Chapter 9996 | Services by way of right to admission to the events organized under FIFA U-17 World Cup 2017. |

39. NSDC

| Entry No.69 | Heading 9992 or Heading 9983 or Heading 9991 | Any Services provided by:

|

40. Skill Development

| Entry No.70 | Heading 9983 or Heading 9985 or Heading 9992 | Services of assessing bodies empanelled centrally by the DG of Training, Ministry of Skill Development and Entrepreneurship by way of assessments. |

| Entry No.71 | Heading 9992 | By training providers (Project implementation agencies) under DDUGKY implemented by the MRD, GoI by way of offering skill or vocational training courses. |

| Entry No.72 | Heading 9992 | To the CG, SG, UT administration under any training program for which total expenditure is borne by the CG, SG, UT administration |

41. Blood banks

| Entry No.73 | Heading 9993 | By the cord blood banks by way of preservation of stem cells or any other service in relation to such preservation. |

42. Health care

| Entry No.74 | Heading 9993 | By way of:

|

43. Health care, rehabilitation professional

| Entry No. 74A | Heading 9993 | Services provided by rehabilitation professionals recognized under the Rehabilitation Council of India Act, |

44. To clinical establishment

| Entry No.75 | Heading 9994 | To clinical establishment by way of treatment or disposal of biomedical waste. |

45. Toilets

| Entry No.76 | Heading 9994 | Facilities of bathroom, washrooms, lavatories, urinal or toilets |

46. Society to members

| Entry No.77 | Heading 9995 | Service by an unincorporated body or a non- profit entity registered under any law for the time being in force,

(a) as a trade union; (b) for the provision of carrying out any activity which is exempt from the levy of Goods and service Tax; or (c) up to an amount of [seven thousand five hundred]61 rupees per month per member in a housing society or a residential complex. |

47. Unincorporated body

| Entry No. 77A | Heading 9995 | Services provided by an unincorporated body or a nonprofit entity registered under any law for the time being in force, engaged in,- (i) activities relating to the welfare of industrial or agricultural labour or farmers; or (ii) promotion of trade, commerce, industry, agriculture, art, science, literature, culture, sports, education, social welfare, charitable activities and protection of the environment, to its own members against consideration in the form of membership fee up to an amount of one thousand rupees (Rs 1000/-) per member per year. |

48. Music, Dance

| Entry No.78 | Heading 9996 | Services by an artist by way of a performance in folk or classical art forms of- (a) music, or (b) dance, or (c) theatre, if the consideration charged for such performance is not more than one lakh and fifty thousand rupees: Provided that the exemption shall not apply to service provided by such artist as a brand ambassador. |

49. Entry

| Entry No.79 | Heading 9996 | Services by way of admission to a museum, national park, wildlife sanctuary, tiger reserve, or zoo. |

| Entry No.[79A | Heading 9996 | Services by way of admission to a protected monument so declared under the Ancient Monuments and Archaeological Sites and Remain Act 1958 (24 of 1958) or any of the State Acts, for the time being in force. |

| Entry No.81 | Heading 9996 | Services by way of right to admission to- (a) circus, dance, or theatrical performance including drama or ballet; (b) award function, concert, pageant, musical performance or any sporting event other than a recognized sporting event; (c) recognized sporting event; (d) planetarium, where the consideration for the right to admission to the events or places as referred to in items (a), (b), (c) or (d) above is not more than Rs 500 per person. |

50. Fair Price

| Entry No.11A | Heading 9961 or Heading 9962 | Service provided by Fair Price Shops to Central Government, State Government or Union territory by way of sale of food grains, kerosene, sugar, edible oil, etc. under Public Distribution System against consideration in the form of commission or margin2 |

Read the Copy:

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.