Assessee is under a legal obligation to prove the receipt of share capital/premium

The Assessee is under a legal obligation to prove the receipt of share capital/premium

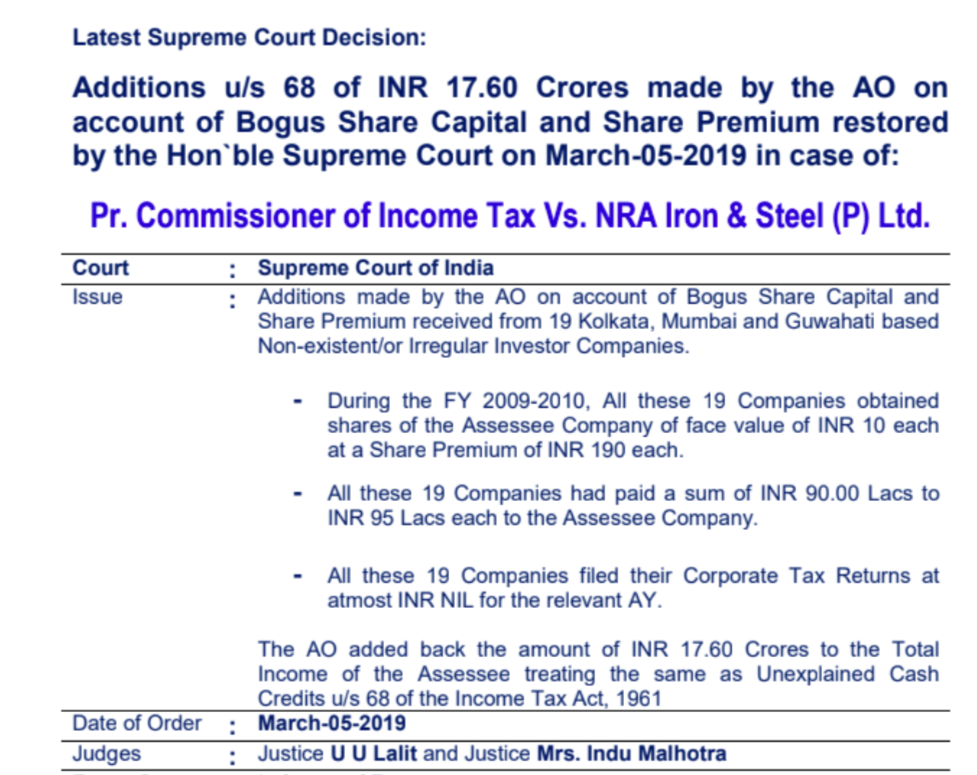

Latest Supreme Court Decision:

Additions u/s 68 of INR 17.60 Crores made by the AO on account of Bogus Share Capital and Share Premium restored by the Hon`ble Supreme Court on March-05-2019 in case of:

Pr. Commissioner of Income Tax Vs. NRA Iron & Steel (P) Ltd.

Court : Supreme Court of India

legal obligation to prove the receipt of share capital/premium

Issue

: Additions made by the AO on account of Bogus Share Capital and Share Premium received from 19 Kolkata, Mumbai and Guwahati based Non-existent/or Irregular Investor Companies.

-

– During the FY 2009-2010, All these 19 Companies obtained shares of the Assessee Company of face value of INR 10 each at a Share Premium of INR 190 each.

-

– All these 19 Companies had paid a sum of INR 90.00 Lacs to INR 95 Lacs each to the Assessee Company.

-

– All these 19 Companies filed their Corporate Tax Returns at atmost INR NIL for the relevant AY.

The AO added back the amount of INR 17.60 Crores to the Total Income of the Assessee treating the same as Unexplained Cash Credits u/s 68 of the Income Tax Act, 1961

|

Date of Order : March-05-2019 |

|

Judges : Justice U U Lalit and Justice Mrs. Indu Malhotra |

|

Favour? : In favour of Revenue |

Decision: By Setting aside, the Order of Hon`ble Delhi Court, the ITAT and CIT(A), the Honourable Supreme Court upheld the additions u/s 68 made by the AO of INR 17.60 Crores with these remarks: 15. On the facts of the present case, clearly the Assessee Company (Respondent) failed to discharge the onus required under Section 68 of the Act, the Assessing Officer was justified in adding back the amounts to the Assessee’s income. |

|

: The practice of conversion of un-accounted money through the cloak of Share Capital/Premium must be subjected to careful scrutiny. This would be particularly so in the case of private placement of shares, where a higher onus is required to be placed on the Assessee since the information is within the personal knowledge of the Assessee. The Assessee is under a legal obligation to prove the receipt of share capital/premium to the satisfaction of the AO, failure of which, would justify addition of the said amount to the income of the Assessee. The author can be reached at 9810290022 |

CA Suresh Wadhwa

CA Suresh Wadhwa

New Delhi, India