35 ITR CHECKLIST STEPS

DOCUMENTS

Make sure to have all COPIES OF FOLLOWINGS DOCUMENTS & CHECK EVERYTHING in ONE GO to decide the SCOPE OF WORK

- Balance sheet, Profit Loss A/c, Capital A/c, Fixed Asset Ledgers, Indirect Incomes ledgers, If Partner in any Firm then Partner’s Capital A/c

- 26AS + TIS +AIS

- Salary Certificate, Agriculture Income Proofs, Bank statements, Interest certificate from SB Bank / FD/ Bonds / MIS / Post etc.

- If there is the sale of shares/ MF, then ask Profit/loss report from the Broker. Decide what is LT / ST & INTRA DAY

- Details of Capital Gain from the sale of any property/Gold/capital assets

- For the Audit case, Do check the Capital Account from BOOKS because the Audit report does not have all Information

- All Investment proofs -, L.I.C. & U.L.I.P. Premium paid receipts, Mediclaim Receipt, Housing Loan Repayment Certificate, Donation receipts, School / College Tuition Fees receipts. (Only tuition fee & Not for any other activity) PPF Passbook duly filled up to MARCH including Interest entry, N.S.C, KVP. Purchased Proof,contri to NPS proof

PRE-CHECKING

FOR NON PRESUMPTIVE & NO AUDIT CASE , Check MIN 6% / 8% – Income from B&P after reducing IFOS /CG / HP income – For any Business Assessee

IF PRESUMPTIVE U/S 44AD/44ADA/44AE THEN – For eligibility of Presumptive check last year return. Also check the 5-year continuity Rule

If last year ITR filed having Business Losses, Then do check 143.1 of last year to confirm the Loss Amount. (Bifurcate loss into unabsorbed depreciation and Business loss if any)

In the case of a partnership firm, Do add All partner’s details PAN +AADHAR + PERCENTAGE in the Partners’ details IN PARTNER MASTER

MASTER update in SOFTWARE –> ADDRESS, PIN CODE, PHONE NUMBER, MOBILE NUMBER, WARD, EMAIL ID, AADHAAR NUMBER

ONLINE ACTIVITY

LOGIN & IMPORT 26AS txt file in the software. ( We still yet to make all entries but I PREFER doing this first)

Open AIS TIS Remain Logged in, We will come back to AIS TIS in later steps

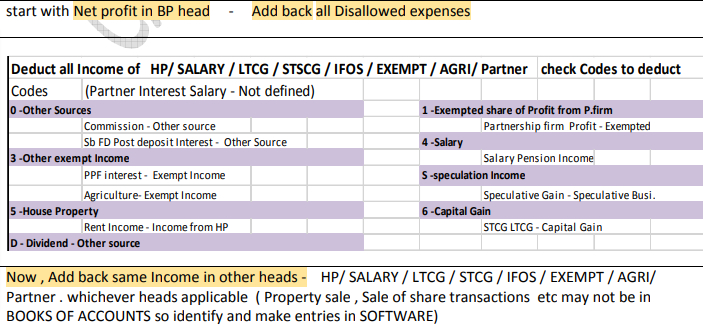

COMPUTATION in Business & Profession

OTHER HEADS AND IMPORTANT ENTRIES IN SOFTWARE – THESE ARE REALLY IMPORTANT

DEDUCTIONS – 80C/80G/80D/80CCD/80U/80DD ETC

Audit special- Check Whole report thoroughly – Make sure check all clauses of 3CD FOR KNOWING ALL DISALLOWANCE / REPORING AND DEDUCTIONS IN CASE OF Individuals

26AS + TIS + AIS SPECIAL – to check them thoroughly-Identify incomes which need to show over And above what client has given – make sure All incomes are covered –

Code selection For TDS / TCS credit – We have to select proper code , If Income of 94A/94I/94J/94H is for

business then Select Business otherwise Other source

LT ST Gains (if any ) of shares if any – Check AIS TIS on Portal .. Download CSV file … if there sale of Shares then ask client about l LT ST sale of shares /MF and intraday trading profit.. For LT, import CSV file in software. Cross check with client ‘s broker statements given. If client does not provide THEN you have to use figures of AIS TIS.

BALANCE SHEET & PROFIT LOSS ( DO match Depreciation and Other incomes in PL must be in specific head only )

ITR 4 SPECIAL (PRESUMTIVE WHEN NO BOOKS) -Four financial parameters – CASH + DRS + CRS + CASH BALANCE. Compulsory need to write.. In case of Profession , Do enter , Receipts details GST NO & GST Turnover

NATURE OF BUSINESS

CODE SELECT DESCRIPTION – TRADING IN THIS ITEMS NAME OF BUSINESS

BUISNESS & AUDIT INFONature of Activity METHOD OF ACCOUNTING RM/FG STOCK METHOD BOOKS 44AA YES

Audit special – BUSI. & AUDIT INFO – WRITE AUDITORS DETAILS & DATE OF TAR & FURNISH OF TAR DATE

Audit special- OTHER INFORMATION OF 3CD. IN CASE OF AUDIT IF ANYTHING DISALLOWED IN REPORT

If Shareholder / director in any Company then Write opening + closing of Unlisted shares details.

IMPORTANT POINTS

- for Speculative Business , You have to Show in Normal then deduct from Normal and Then show in Speculative Business

- for STCG – LTCG , Do not show straight way Profit Loss , Make sure to write Sale Purchase amount and then derive Profit Loss

- Carried Forward Loss must be bifurcated between Business loss &UnabsorbedDeprecation

- If 26AS is showing LIC maturity then write amount in Exempt Income if it is exempted, Otherwise in Other source ( Chek whether TDS deducted)

COMPUTATION& TAX PAYABLE

Check STATEMENT OF INCOME and make sure all incomes are Properly Shown head wise. From AIS/TIS & books. For all other incomes which is also reflected in AIS TIS , Makes sure Incomes in final Computation must be EQUAL TO OR higher than AIS TIS figure

NOTE- Generate computation AS ON DATE , This is useful when Return prepared in last month and upload in Next month due to challan payable .(If challan , then It will change Interest and if Refund , It will reduce Refund)

CHECK Option for new Scheme – If there is any tax payable then do check OPTION as per NEW SCHEME

If Tax payable, Print challan. After payment of tax, enter challan details.

AT TIME OF UPLOADING

Now NAME should match at allplaces – 1. Master 2. Online Profile 3. Verification screen when uploading

If Refund, please write correct Bank account – SB. If last year refund failed then , make correction in bank details

FOR 3 QUESTIONS – if TO 1 CR TO 10 CR =YES/NO + cash< 5%= NO + cash <5%= NO( as applicable)

after upload save COMPUTATION & ITR V AND make BILLS & RECEIPTS ENTRY

E-VERIFY

FILE all documents in client file