43rd GST Council Meeting Recommendations

Following is our analysis of the recommendations made in the 43rd GST Council meeting:

Table of Contents

- Reduced late fees for taxpayers filing GSTR-3B between 1st June 2021 -31st August 2021

- Rationalization of Late Fees for prospective tax periods

- Reduction of Late fees and Interest for returns of March’21 to May’21

- Extension in the filing of ITC-04 and GSTR-4

- Cumulative Application of condition specified in Rule 36 (4)

- Due date of other compliances extended to 31st May 2021

- Changes in Annual Return and Reconciliation Statement

- Retrospective applicability of interest on net tax liability paid in cash

- GST Act to be amended to make GSTR-1 and 3B as default return

- ITC to landowner promoter from construction services provided by developer promoter for utilization in the subsequent sale by the landowner

- Applicability of GST exemption on Milling of Rice/ Paddy

- Exemption of GST on Covid-19 related relief

- Certain exemptions inserted for the educational sector

- Other amendments relating to government supplies

- Clarificatory amendments in relation to GST Rates

Reduced late fees for taxpayers filing GSTR-3B between 1st June 2021 -31st August 2021

➢ Late Fees for GSTR-3Bof the tax periods from July’17 to April’21 has been capped as below where the same has been filed between 1st June 2021 to 31st August 2021:

o Taxpayers having no liability for the said periods – Rs. 500 (CGST and SGST of Rs. 250 each)

o Other taxpayers – Rs. 1000 (CGST and SGST of Rs. 500 each)

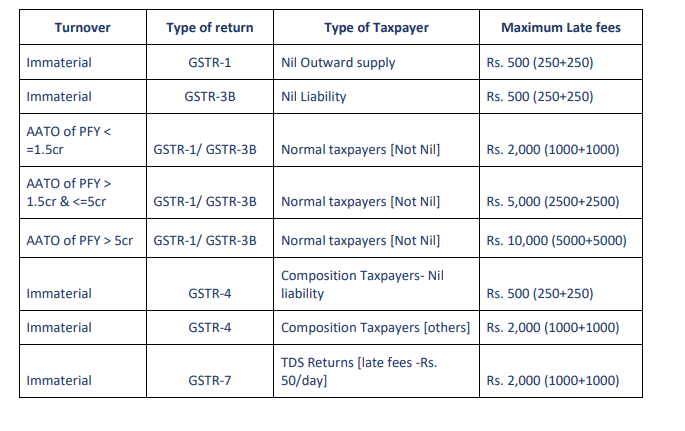

Rationalization of Late Fees for prospective tax periods

➢ Late fees have been rationalized and reduced for small taxpayers for all future tax periods as below:

AATO – Aggregate Turnover

PFY – Preceding Financial Year

Related Topic:

Taxability of works contracts for PSU in GST

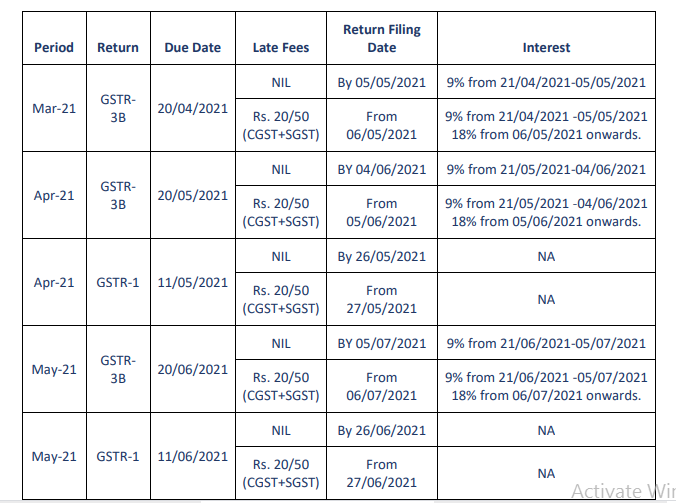

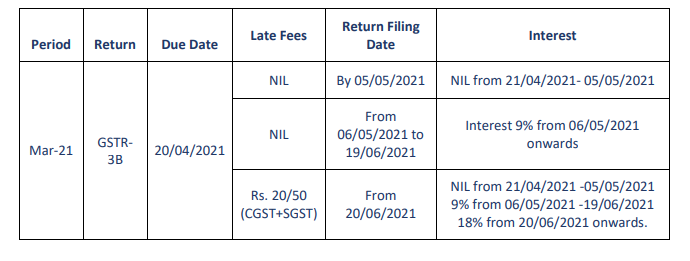

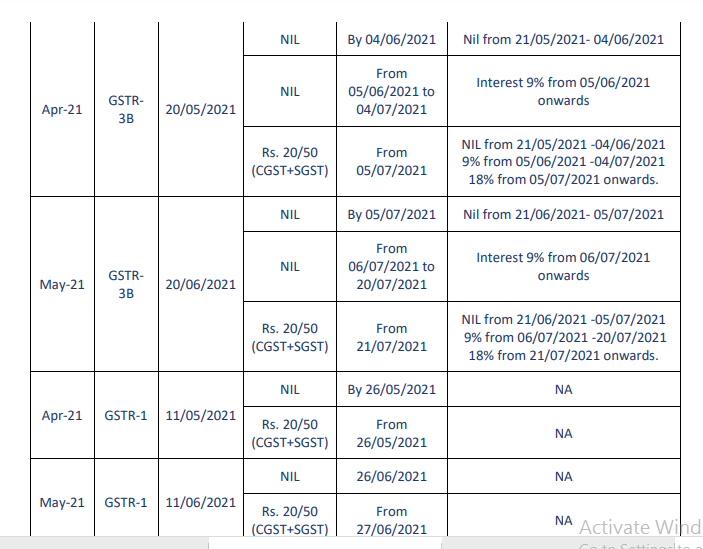

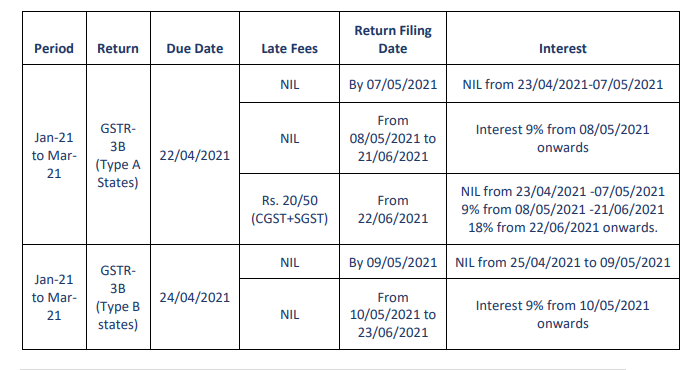

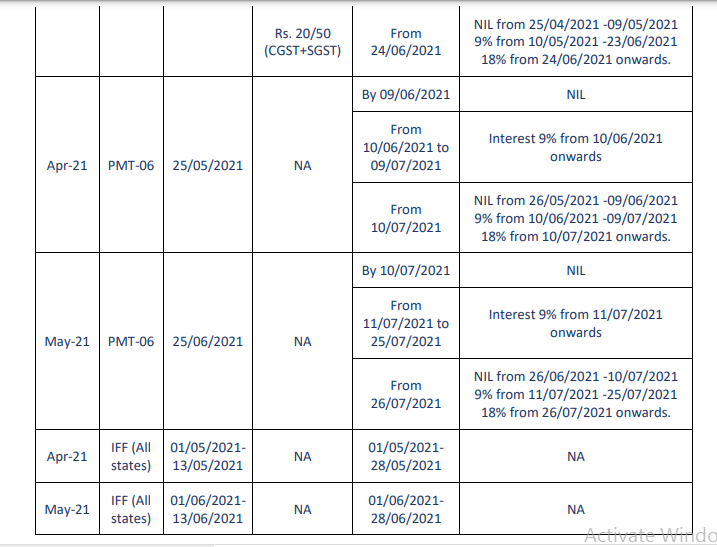

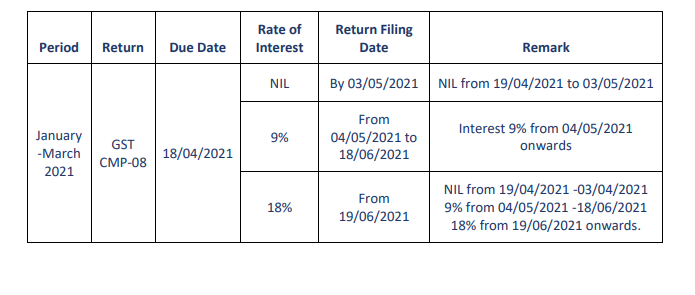

Reduction of Late fees and Interest for returns of March’21 to May’21

Taxpayers having turnover exceeding 5 Crore:

Taxpayers having turnover below 5 Crores and have opted for monthly return filing:

Taxpayers having turnover below 5 Crores and under QRMP Scheme:

Composition taxpayers:

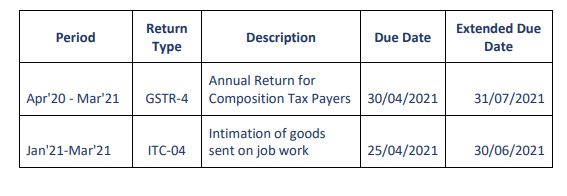

Extension in the filing of ITC-04 and GSTR-4

Cumulative Application of condition specified in Rule 36 (4)

➢ Rule 36(4) of the CGST Act, 2017, restricts availment of ITC to 105% of the ITC reflected in GSTR-2B / 2A as on the due date of filing GSTR-1 by the supplier. With the extensions in GSTR-1 dates, the government has provided that the said restriction shall apply cumulatively for the period April ’21, May ’21, and June ‘21 in GSTR-3B of June’21.

Due date of other compliances extended to 31st May 2021

➢ Where the time limit of any of the following actions falls between 15th April 2021 to 29th June 2021 for completion of various actions by any authority or any person, the due date of the same would get extended to 30th June 2021 subject to certain exceptions

➢ The Supreme Court order had extended the period of limitation with effect from 15th March 2020 till further orders for filing of petitions/applications/suits/appeals / all other proceedings. This is the current status as per the order dated 27th April 2021. Such timelines of the order of the Supreme Court will have to be adhered to wherever applicable.

Related Topic:

GST Applicability on the supply of Ancillary Services in relation to the supply of Electricity

Changes in Annual Return and Reconciliation Statement

➢ With effect from FY 2020-21, it is proposed to have self-certification of GSTR-9C by taxpayers

➢ The limit for filing annual return and reconciliation will be the same as earlier for FY 2020-21:

o up to Rs. 2 crores – Form GSTR-9 and 9A to be optional

o From 2 crores to 5 cores – Form GSTR 9 mandatory but 9C optional

o More than Rs. 5 crores – Both GSTR-9 and 9C mandatory

Retrospective applicability of interest on net tax liability paid in cash

➢ Retrospective application of Section 50 for applicability of interest on net tax liability i.e. for the amount paid through cash only is proposed to be notified at the earliest

GST Act to be amended to make GSTR-1 and 3B as default return

➢ It is proposed to make relevant changes in the provisions of the Act in order to make GSTR-1 and 3B as the default return filing system in GST

ITC to landowner promoter from construction services provided by developer promoter for utilization in the subsequent sale by the landowner

➢ After 1st April 2019, the government had provided that the developer promoter will be paying GST on apartments provided to landowners at the time of issuance of the completion certificate.

➢ However, the landowner was not able to utilize the complete ITC as most of his consideration for the subsequent sale of apartments were received before the issuance of the completion certificate

➢ It is proposed that appropriate changes would be made in the relevant provisions to provide an explicit provision for utilization of ITC by landowners. This will enable them to utilize such ITC for subsequent sale of flats on which GST is payable.

➢ At the same time, the developer promoter will be allowed to pay GST any time before or at the time of issuance of the completion certificate.

Applicability of GST exemption on Milling of Rice/ Paddy

➢ Supply of service by way of milling of wheat/paddy into flour (fortified with minerals etc. by millers or otherwise)/rice

o to Government/ local authority etc. for distribution of such flour or rice under PDS is exempt from GST if the value of goods in such composite supply < =25%.

o if supplied to any person registered in GST, including a person registered for payment of TDS, such services would attract GST at the rate of 5%

Exemption of GST on Covid-19 related relief

➢ Import of COVID-related relief items including AmphotericinB (required for treating Mucormycosis), even if purchased or meant for donating to Govt. or to any relief agency upon recommendation of State authority, to be exempted from IGST till 31st August 2021

➢ As regards individual items, it was decided to constitute a Group of Ministers (GoM) to go into the need for further relief to COVID-19 related individual items immediately. The GOM shall give its report by 08.06.2021

Certain exemptions inserted for the educational sector

➢ Services supplied to an educational institution including Anganwadi (which provide pre-school education also), by way of serving of food including mid-day meals under any midday meals scheme, sponsored by the Government are to be exempt from levy of GST irrespective of funding of such supplies from government grants or corporate donations

➢ Services provided by way of examination including entrance examination, where the fee is charged for such examinations, by National Board of Examination (NBE), or similar Central or State Educational Boards, and input services relating thereto are to exempt from GST.

Other amendments relating to government supplies

➢ To clarify that GST is payable on annuity payments received as deferred payment for construction of the road. The benefit of the exemption is for such annuities which are paid for the service by way of access to a road or a bridge

➢ To clarify those services supplied to a Government Entity by way of construction of a ropeway attract GST at the rate of 18%.

➢ To clarify those services supplied by Govt. to its undertaking/PSU by way of guaranteeing loans taken by such entity from banks and financial institutions is exempt from GST.

Clarificatory amendments in relation to GST Rates

➢ GST rate of 12% to apply on parts of sprinklers/ drip irrigation systems falling under tariff heading 8424 (nozzle/laterals) to apply even if these goods are sold separately.

➢ Leviability of IGST on repair value of goods re-imported after repairs

This publication contains information for general guidance only. It is not intended to address the circumstances of any particular individual or entity. Although the best of endeavor has been made to provide the provisions in a simpler and accurate form, there is no substitute to detailed research with regard to the specific situation of a particular individual or entity. S. Khaitan & Associates or any of its officials do not accept any responsibility for loss incurred by any person for acting or refraining to act as a result of any matter in this publication

Shubham Khaitan

Shubham Khaitan

Kolkata, India