Comprehansive judgment on Rights of DGCI to issue notice- Must read

Table of Contents

DGCI power to issue notices-

Very important decision and I would like to give it a 4/5 for importance. Many time the question is raised on the power of DGCI. Here the answer is given in detail by the honourable CESTATE .

The DGCI has the power to issue the notice. Pls read the observations given below in the article to see more. Also the questions related to the nature of services is also clarified.

Citations

M/s Canon India Pvt Ltd. Vs. Commissioner Of Customs

Hari Khemu Gawali Vs Deputy Commissioner of Police, Bombay and another

Shri Ishar Alloy Steels Ltd Vs Jayaswals Neco Ltd (2001) 3 SCC 609

ETA Travel Agency 2007 (7) STR 454 (TRI)

Pahwa Chemicals Private Limited Vs Commissioner of Central Excise, Delhi,

University of Chicago Public Law & Legal Theory Working Paper No. 161, 2007

Avinder Singh Etc vs State Of Punjab & Anr. Etc,

M/S. Redington (India) Limited vs Principal Additional Director, Directorate General of Goods and Services Tax, Chennai

Mohan Lal Sharma Vs. UOI and Another

Smt. J. Yashoda Vs Smt. K. Shobha Rani

Great Eastern Shipping Company Ltd. Vs State Of Karnataka [2020 (32) G.S.T.L. 3 (S.C.)]

CIT v. Bharti Cellular Ltd. [2009] 319 ITR 139 / [2008] 175

Basti Sugar Mills Co. Ltd. vs. CCE Allahabad

Collector of Customs, Madras & Ors. v. D. Bhoormul

Shivnandan Sharma v. Punjab National Bank Ltd.[955 AIR 404 / 1955 SCR (1)1427]

Silver Jubilee Tailoring House vs Chief Inspector of Shops & Establishments (1974) 3 SCC 498]

Ram Singh vs U.T. of Chandigarh (2004) 1 SCC 126 (Supreme Court)]

Silver Jubilee Tailoring House vs Chief Inspector of Shops & Establishments (1974) 3 SCC 498]

Shivnandan Sharma vs Punjab National Bank Ltd. 955 AIR 404 / 1955 SCR (1)1427]

Union Of India vs M/S Intercontinental Consultants and Technocrats Pvt Ltd [Civil Appeal No. 2013 OF 2014/ 2018 (10)

M/s. Vodafone Idea Ltd. Vs Commissioner of GST & Central Excise.

AC Arulappan Vs. Smt. Ahalya Naik [Appeal (Civil) 5233 of 2001 dated 13.8.2001]

Municipal Committee, Amritsar v. Hazara Singh (1975 (1) SCC 794)

Commissioner of Income Tax Vs. Best and Co. Pvt. Ltd. [AIR 1966 SC 1325]

Details of the case-

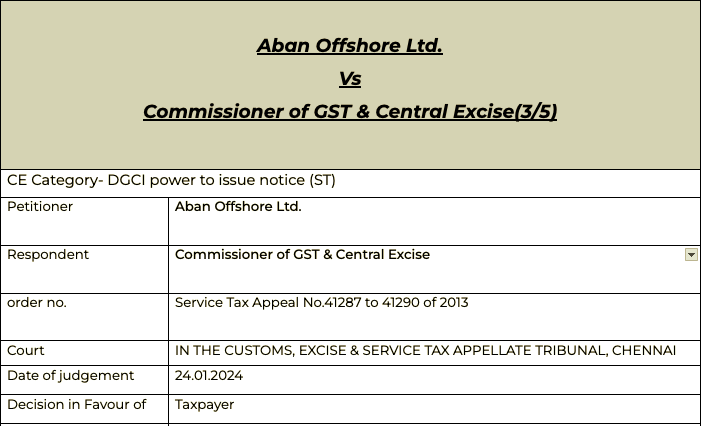

Aban offshore ltd Vs comm of GST and Central Excise

Pleading

These appeals are filed by the appellants against Order in Original No. 117 to 120/2012 dated 28.11.2012 passed by the Commissioner of Service Tax, Chennai. (impugned order)

Facts

Brief facts of the case are that the appellant is engaged in providing offshore drilling services to oil majors. They are also registered with the Service Tax Department for providing other taxable services. While providing the offshore drilling service, the appellant engaged the services of various service providers located outside India, to provide engineering consultancy, management consultancy, testing& inspection and banking service. On receiving intelligence that the appellant has neither obtained service tax registration for receiving the subject services nor paid service tax on reverse charge basis in terms of Rule 2(1)(d)(iv) of Service Tax Rules, 1994, the Directorate General of Central Excise Intelligence (DGCEI), Chennai Zonal Unit’s investigated the matter culminating in issuance of Show Cause Notice’s for the period from 2003 – 04 to September 2011 as detailed in the annexure to the impugned order, under the relevant provisions of the Finance Act, 1994 (FA, 1994). After due process of law, the adjudicating authority revised and confirmed the demand for service tax of Rs.7,31,87,545/- with equal penalty under section 78 of FA 1994 for the extended period and Rs 55,40,497/- along with penalty under section 76 of FA 1994 for the normal period. A penalty was also imposed for non-filing of ST3 Returns. Aggrieved by the said order, the appellant is now before the Tribunal assailing the findings and the demand confirmed.

Observation

The Central Government vide Notification No. 3/2004-ST dated 11.3.2004 have appointed ADG (DGCEI) as a Central Excise Officer for whole of India and have vested in him all the powers that are exercisable by the Central Excise officers and is hence fully competent to issue the present Show Cause Notice under consideration.

Whether DGCEI officers are “Central Excise Officers” or not was examined by the Hon’ble Madras High Court in M/S. Redington (India) Limited (supra). It was held that without doubt, the officers from the Directorate are “Central Excise Officers” as they have been vested with the powers Central Excise officers.

any officer superior to the officer who is empowered to issue demand notice and adjudicate notice under Section 73 of Finance Act, 1994 can do the same if the officer designated is subordinate to him. the Apex Court held that the instructions issued by the Board have to be within the four corners of the Act. If, therefore, the Act vests in the Central Excise Officers jurisdiction to issue show-cause-notices and to adjudicate, the Board has no power to cut down that jurisdiction.

A Constitution Bench of the Apex Court in Hari Khemu Gawali (supra), stated that it is not safe to pronounce on the provisions of one Act with reference to decisions dealing with other Acts which may not be in pari materia. Hence it would be improper to examine the issue of jurisdiction of DGCEI officers based on the Canon India Judgment rendered in a case under the Customs Act 1962.

The Apex Court in its judgment in Mohan Lal Sharma (supra) observed that the cardinal rule in the law of evidence is that only the best available evidence should be brought before the court of law to prove a fact or the point in issue.

The Appellant has questioned the classification of the services as Management Consultancy Services rendered by IOI and are of the view that it is liable to be taxed under the category of Intellectual Property Service. They have however not been able to show that the service is provided by the holder of intellectual property rights although it would be very much in their knowledge, if true.

The appellant has sought to refer to the shareholding pattern to show that IOI shares was less than that prescribed under Section 92A of Income Tax Act to be termed as an Associate Co. It is seen that this information was not placed before the Original Authority. As per Rule 23 of the Customs Excise Service Tax Appellate Tribunal (Procedure) Rules, 1982 parties to the appeal shall not be entitled to produce any additional evidence, either oral or documentary, before the Tribunal. No application was filed and prayer made by the Appellant to produce additional evidence before us. Hence the question of examining any additional evidence at this stage without a proper request does not arise.

We have considered the submissions of the rival parties elaborately above. We find that the lower authority has taken a view which is reasonable, legal and proper and we find ourselves in agreement with the same. The impugned order is hence upheld. The appeals are disposed off accordingly.

Read/download the copy of order

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.