7 Important outcome about arrest in GST in case of PV Ramanna Reddy

Table of Contents

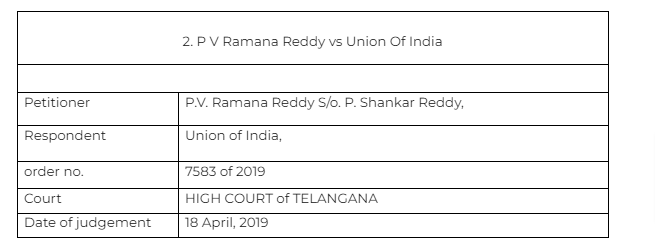

Case Covered:

P V Ramana Reddy vs Union Of India

Citations :

- Badaku Joti Savant v. State of Mysore

- Ramesh Chandra Metha v. State of West Bengal

- Illias v. Collector of Customs

- Percy Rustomji Basta v. State of Maharashtra

- Veera Ibrahim v. State of Maharashtra

- Poolpandi v. Superintendent, Central Excise

- Km. Hema Mishra v. State of Uttar Pradesh

- Kartar Singh v. State of Punjab

Facts of the case

Some important issues were raised in this particular case. This case was covering multiple petitions. All of the appellants were trying to seek bail from arrest. the main allegation of the Department against the petitioners is that they are guilty of circular trading by claiming input tax credit on materials never purchased and passing on such input tax credit to companies to whom they never sold any goods. The Department has estimated that fake GST invoices were issued to the total value of about Rs.1,289 crores and the benefit of wrongful ITC passed on by the petitioners is to the tune of about Rs.225 crores.

Observations & Judgement of the court

1- Can a writ be used to seek anticipatory bail?

Article 226 can be used as a substitute to section 438, Cr.P.C? It was one of the questions for the court to decide.

“Obviously, when provisions of Section 438 of Cr.P.C., are not available to the accused persons in the State of Uttar Pradesh, under the normal circumstances such an accused person would not be entitled to claim such a relief under Article 226 of the Constitution of India. It cannot be converted into a second window for the relief which is consciously denied statutorily making it a case of casus omissus.”

Nevertheless, the learned Judge also held that the High Court is not completely denuded of its powers under Article 226 of the Constitution of India, to grant such a relief in appropriate and deserving cases. The learned Judge pointed out that this power is to be exercised with extreme caution and sparingly in those cases where the arrest of a person would lead to total miscarriage of justice

Kartar Singh and the decision in Km. Hema Mishra

In both these cases the court discussed the use of writ under article 226 for seeking anticipatory bail where it is not otherwise available.

Outcome of the analysis was that it can be used for anticipatory bail but not in normal routine, only in exceptional cases.

The court said there are two important point to take care while addressing a writ for protection from arrest.

(1) the note of caution issued by the Supreme Court that this power should be exercised sparingly in appropriate cases and

(2) that as a fundamental principle, a writ of Mandamus would lie only to compel the performance of a statutory or other duty. There is a fundamental distinction between a petition for anticipatory bail and the writ of mandamus to direct an officer not to effect arrest. A writ of mandamus would lie only to compel the performance of a statutory or other duty. No writ of mandamus would lie to prevent an officer from performing his statutory functions.

2- Whether the arrest in GST will have the applicability of CRPC?

Thorough discussion was made on the fact that the applicability of CRPC in GST arrest will not attract. The CRPC is made applicable via sub section 3 of section 69 but arrest is already made in section 69(1). Thus the CRPC will come into play only after the arrest.

3- Whether an arrest can take place in GST even if the applicant is complying with the notice of appearance?

Section 41A(3) of Cr.P.C., prohibits the arrest of a person who complies and continues to comply with a notice for appearance issued under subSection (1) of Section 41A of Cr.P.C. However, Section 41A(3) of Cr.P.C. also gives discretion to the Police Officer, for reasons to be recorded, to arrest the person even though he complied with and continued to comply with the notice under sub-Section (1) of Section 41A of the Code.

The counsel for the applicant said that since the applicant is complying with the notice issued by the department, they can’t be arrested.

– Though Section 69(1) which confers powers upon the Commissioner to order the arrest of a person does not contain the safeguards that are incorporated in Section 41 and 41A of Cr.P.C., we think Section 70(1) of the CGST Act takes care of the contingency.

But, it may be remembered that Section 41A(3) of Cr.P.C., does not provide an absolute irrevocable guarantee against arrest. Despite the compliance with the notices of appearance, a Police Officer himself is entitled under Section 41A(3) Cr.P.C., for reasons to be recorded, arrest a person

4- Whether it is compulsory to “record the reason” of arrest in case of arrest in the order authorizing the arrest?

The requirement under Section 41A(3) of Cr.P.C. is the “recording of a reason”, while the requirement under Section 69(1) of CGST Act, 2017 is the “reason to believe”. In fact, on the question as to whether or not, reasons to believe should be recorded in the authorization for arrest, the learned Additional Solicitor General submitted that reasons are recorded in files. The learned Additional Solicitor General also produced the files.

- If reasons to believe are recorded in the files, we do not think it is necessary to record those reasons in the authorization for arrest under Section 69(1) of the CGST Act. Since Section 69(1) of the CGST Act, 2017 specifically uses the words “reasons to believe”, in contrast to the words “reasons to be recorded” appearing in Section 41A(3) of Cr.P.C., we think that it is enough if the reasons are found in the file, though not disclosed in the order authorizing the arrest.

5- Can a prosecution be launched only after the completion of the assessment?

to say that a prosecution can be launched only after the completion of the assessment, goes contrary to Section 132 of the CGST Act, 2017. The list of offenses included in sub-Section (1) of Section 132 of CGST Act, 2017 have no co-relation to assessment. Issue of invoices or bills without supply of goods and the availing of ITC by using such invoices or bills, are made offenses under clauses (b) and (c) of sub-Section (1) of Section 132 of the CGST Act. The prosecutions for these offenses do not depend upon the completion of assessment. Therefore, the argument that there cannot be an arrest even before adjudication or assessment, does not appeal to us.

6- There is no necessity to arrest a person for the alleged commission of an offense which is compoundable.

Not sustainable due to these two reasons-

1-The petitioners have not offered to compound the offense, though compounding is permissible even before the institution of prosecution.

2- Under the third proviso to sub-Section (1) of 138, compounding can be allowed only after making payment of tax, interest and penalty involved in such cases

7- the arrest of a person which will not facilitate further investigation, has to be discouraged, since the same has the potential to punish a person before trial.

The objects of pre-trial arrest and detention to custody pending trial, are manifold as indicated in section 41 of the Code. They are:

(a) to prevent such person from committing any further offence;

(b) proper investigation of the offence;

(c) to prevent such person from causing the evidence of the offence to disappear or tampering with such evidence in any manner;

(d) to prevent such person from making any inducement, threat or promise to any person acquainted with the facts of the case so as to dissuade him from disclosing such facts to the Court or to the police officer;

It is true that in some cases arising out of similar provisions for arrest under the Customs Act and other fiscal laws, the Supreme Court indicated that the object of arrest is to further the process of enquiry. But, it does not mean that the furthering of enquiry/ investigation is the only object of arrest.

Read & Download the Full P V Ramana Reddy vs Union Of India

[pdf_attachment file=”1″ name=”optional file name”]

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.