9% interest on pending IGST refund: Guj HC

interest on pending IGST refund of exporters:

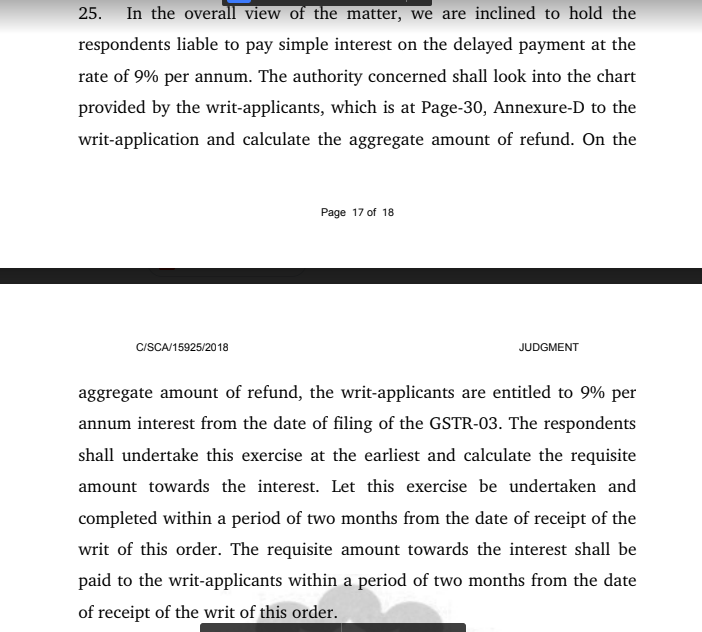

The decision of Gujrat high court in case of M/S SARAF NATURAL STONE Vs UOI Gujrat High court is important. It is held that interest is payable on the pending refund. As per GST provisions, exporters are eligible for a refund within 7 days of application. But refund of many exporters is pending.Interest on pending IGST refund is eligible for interest@9%.

The petitioners states that it appears from the bare perusal of Section 54(6) of the CGST Act read with Rule 91 of the CGST Rule that a registered person exporting goods is entitled to provisional refund of 90% of his refund claim within a period not exceeding seven days from the date of the acknowledgment unless the person claiming refund has, during any

period of five years immediately preceding the tax period to which the claim for refund relates, has been prosecuted for any offence under the Act or under an existing law where the amount of tax evaded exceeds two hundred and fifty lakh rupees or the proper officer, after scrutiny of the claim and the evidence submitted in support thereof is prima facie not satisfied.

The petitioner’s further state that, Rule 96 of the CGST Rule envisages the refund of integrated tax paid on goods exported outside India. Rule 96 provides that the shipping bill filed by an exporter shall be deemed to be an application for refund of integrated tax paid on the goods exported outside India subject to the filing of export general manifest and valid return in Form GSTR3 or Form GSTR3B.

Refund shall be granted in 60 days from the date of receipt of application

The petitioners further state that Section 56 of the CGST Act further provides that if any tax ordered to be refunded under subsection (5) of section 54 to any applicant is not refunded within sixty days from the date of receipt of application under subsection (1) of that section, interest at such rate not exceeding six percent as may be specified in the notification issued by the Government on the recommendations of the GST Council shall be payable in respect of such refund from the date immediately after the expiry of sixty days from the date of receipt of application under the said subsection till the date of refund of such tax.

It is held that taxpayer is eligible for interest on pending IGST refund. Image of order is following.

Make your career in GST litigation. Join our course by Advocate Avinash Poddar ji.

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.