Change in Income Tax Return Form – AY 2018-19

Change in Income Tax Return Form – AY 2018-19

Introduction:

- The Central Board of Direct Taxes (CBDT) has notified Income Tax Return Forms (ITR Forms) for the Assessment Year 2018-19

- There is no change in the manner of filing of ITR Forms as compared to last year. All these ITR Forms are to be filed electronically

- All these ITR Forms are to be filed electronically.

- However, where the return is furnished in ITR Form-1 (Sahaj) or ITR-4 (Sugam), the following persons have an option to file the return in paper form:

(i)an Individual of the age of 80 years or more at any time during the previous year; or

(ii)an Individual or HUF whose income does not exceed five lakh rupees and who has not claimed any refund in the Return of Income.

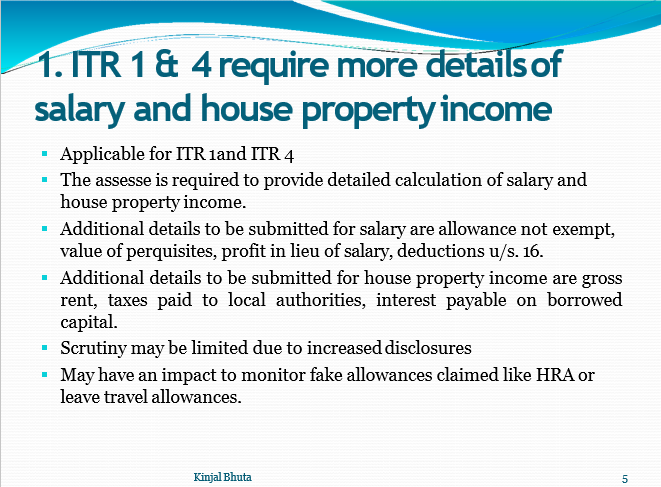

The changes are more disclosure-oriented in all the forms.

All forms are now available to file electronically.

Download the full ppt by clicking the image:

Forms – Applicability

ITR 1 – Sahaj – Resident Individuals having income from Salaries, one house property, other sources and having total income up to Rs.50 lakhs.

ITR 2- For Individuals and HUFs not having income from profits and gains of business or profession.

ITR 3- For individuals and HUFs having income from profits and gains of business or profession

ITR -4 Sugam – For presumptive income from business and profession

ITR- 5 – [For persons other than,- (i) individual, (ii) HUF, (iii) company and (iv) person filing Form ITR-7

ITR 6 – For Companies other than companies claiming exemption under section 11

ITR 7 – For persons including companies required to furnish return under sections 139(4A) or 139(4B) or 139(4C) or 139(4D) or 139(4E) or 139(4F)