Practical issues in Exports and Inverted Duty Refund

Practical issues in Exports and Inverted Duty Refund

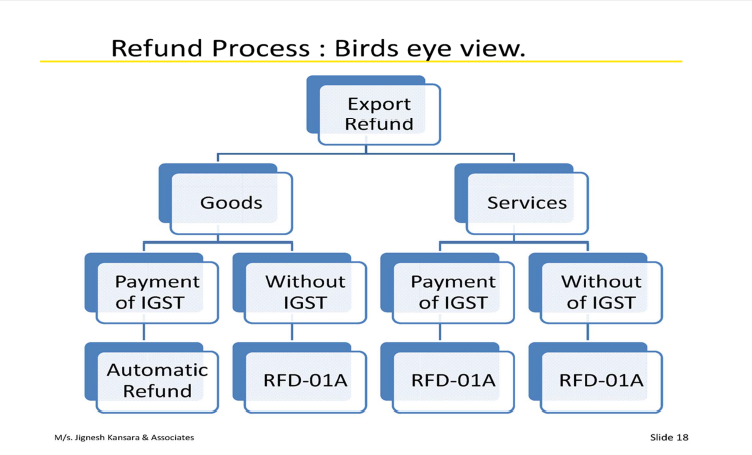

In this Ppt, we will discuss the Export and inverted Duty refund to be claimed by the taxpayer from the government. Even after two Refund fortnights, there are still so many refund applications are Stuck in the process. We will also explain and discuss the various cases for the refund. The cases include the practical problems faced by the normal taxpayers.

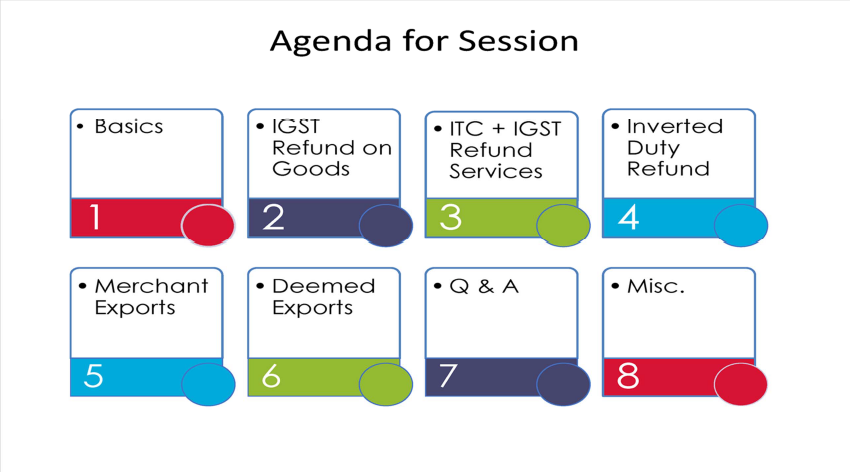

Following is the Agenda of the session or Ppt:

Definition of Export

- 2(5) of IGST Act: “export of goods” with its grammatical variations and cognate expressions, means taking goods out of India to a place outside India;

- 2(6) of IGST Act: “export of services” means the supply of any service when,––

(i) the supplier of service is located in India;

(ii) the recipient of service is located outside India;

(iii) the place of supply of service is outside India;

(iv) the payment for such service has been received by the supplier of service in convertible foreign exchange; and

(v) the supplier of service and the recipient of service are not merely establishments of a distinct person in accordance with Explanation 1 in section 8;

Download the Full Ppt on Practical issues in Exports and Inverted Duty Refund by CA Jignesh Kansara:

CA Jignesh Kansara

CA Jignesh Kansara

Mumbai, India