Features of GST Simplified Monthly Return Form

Features of GST Simplified Return Form

The GST Council in its 28th GST Council Meeting held on 21 July 2018, under the Chairmanship of Shri Piyush Goyal, Union Minister for Railways, Coal, Finance & Corporate Affairs has approved the new return formats. The Council had earlier approved the basic principles of GST return design and directed the law committee to finalize the return formats and changes in the law.

In pursuance thereof, the CBIC has placed Note on draft GST simplified returns and return formats in public domain on 30 July 2018 for perusal and feedback of stakeholders. The Note on the draft format of GST simplified return contains two parts i.e. Part – A which specifies the Key features of Monthly Return and Part – B which specifies the Key features of Quarterly Return in GST.

So, let us discuss the features of the new Simplified Monthly Return.

Key features of the new and Simplified Monthly Return (GSTR) are as follows:

Simplified Monthly Return and due-date

- All taxpayers except small taxpayers, composition dealer, Input Service Distributor (ISD), Non-resident registered person, persons liable to deduct tax or collect tax at source u/s 51/52 of CGST Act, 2017 shall file 1 monthly return.

- Dates of return filing will be on staggered manner based on the reported turnover in last year i.e. 2017-18, annualized for the full year. A newly registered taxpayer shall be classified on the basis of self-declaration of the estimated turnover.

- The due date for filing of monthly return for the large taxpayer shall be 20th of the next month.

NIL Return & Small Taxpayers:

- Taxpayers having no purchases, no outward liability, and no input credit to be availed for any quarter of a Financial Year shall file 1 NIL Return for the entire quarter. Such facility shall also be made available by an SMS.

- Taxpayers who have a turnover up to Rs. 5 Cr. in the last financial year, namely, Small Taxpayers shall have an optional facility to file quarterly return with monthly payment of taxes on the self-declaration basis.

Continuous uploading and viewing:

- The supplier shall have this facility of uploading the invoice anytime during the month which shall be continuously visible to the recipient. Only uploaded invoice would be a valid document for availing input tax credit.

- Invoices uploaded by the supplier by 10th of succeeding month shall be auto-populated in the liability table of the main return of the supplier and also the inward tax credit annexure of the recipient by 11th.

- The recipient shall also be able to see the return filing status of the supplier to ensure discharge of GST liability by the supplier w.r.t. the purchases made by him, once the due date for filing the return is over.

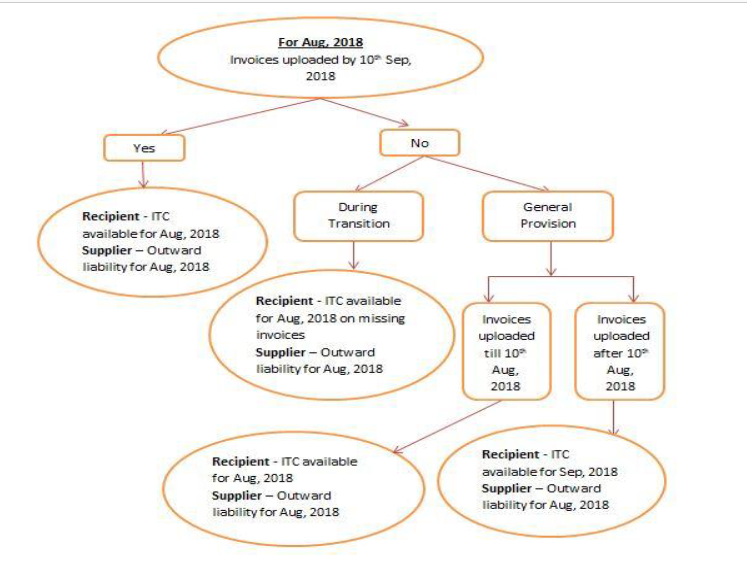

The due date for uploading invoices and action to be taken by the recipient:

- Invoices uploaded by the supplier by 10th of the succeeding month shall be available to the recipient for taking ITC. However, when invoices are uploaded after 10th of the succeeding month, ITC shall be available to the recipient in the following month.

- The supplier’s liability to discharge output tax liability shall arise in the same month w.r.t. both the invoices referred to in the previous point.

- After the 11th of the next month, the recipient shall be able to accept, reject or keep pending a particular invoice but the maximum limit of eligible input tax credit will be based on the invoices uploaded by the supplier up to 10th of the subsequent month.

- In the transition phase of 6 months after the new system of return is implemented, the recipient would be able to avail input tax credit on self-declaration basis even on the invoices not uploaded by the supplier by 10th of the next month or thereafter using the facility of availing input tax credit on missing invoices.

Invoice uploaded but return not filed:

Recovery proceedings shall be initiated against him after allowing for a reasonable time for filing of the simplified monthly return and payment of tax.

Unidirectional Flow of document:

- Only the invoices or debit notes uploaded by the supplier on the common portal shall be the valid document for availing input tax credit by the recipient.

- Credit availed by the recipient on the basis of missing invoices/debit note shall be subject to the invoices/debit note uploaded by the supplier within the prescribed time limit.

- If not uploaded by the supplier within the stipulated time, the ITC availed on the same, shall be recovered by the recipient.

Missing invoice reporting:

- Missing invoices shall be reported by the supplier in the main return for any tax period with interest or penalty as applicable.

- For recipient – Purchase invoices received by recipient in April on which input tax credit has been availed but not uploaded by the supplier, shall be reported by the recipient not later than the return of June filed in July i.e., can be delayed up to two tax periods to allow recipient to follow up and get the missing invoice uploaded from the supplier.

- Taxpayers filing quarterly returns shall report missing invoices in the next quarter.

Offline IT Tool:

- An IT tool/facility for matching of the invoices downloaded in XL format from the viewing facility, with the invoices stored in the accounting software by the taxpayer (recipient), shall be provided.

Payment of tax:

- Liability declared in the return shall be discharged in full at the time of filing of the return by the supplier as currently done under GSTR-3B.

Recovery of input tax credit:

- There shall not be an automatic reversal of input tax credit at the recipient’s end where tax has not been paid by the supplier.

- In case of default in the payment of tax by the supplier, recovery shall be first made by the supplier.

- In cases like missing taxpayer, closure of business by the supplier or supplier not having adequate assets or in cases of connivance between the recipient and the supplier, etc. recovery shall be made from the recipient.

Locking of invoices:

- Facility for locking of invoice by the recipient before the filing of the return by him shall be available.

- On the filing of the return by the recipient, all invoices shall be deemed to be accepted except invoices kept pending or rejected.

- Invoices on which credit has been availed by the recipient (i.e. locked invoices) will not be allowed to be amended by the supplier except by way of issuing credit/debit note.

- A wrongly locked invoice shall be unlocked online by the recipient himself subject to reversal of the input tax credit by him and online confirmation thereof.

Rejected invoices:

- The recipient shall reject the invoices which do not pertain to them.

- To assist the process of rejecting invoices with ease, the matching IT tool shall have facility to create recipient and seller master list, from which correct GSTIN can be matched.

Pending invoices:

- Pending invoices shall be reported by the recipient and no input tax credit shall be availed by the recipient on such pending invoices.

- To reduce the number of pending invoices which needs to be reported, a simplification in the procedure for availing input tax credit shall be carried out. E.g.: input tax credit can be availed by the recipient on invoice issued in April and uploaded by the supplier by 10th May even if the goods or services have been received by the recipient before 20th May i.e. the date on which he is filing his return for the month of April (presently he is eligible for input tax credit only if goods or services have been received by 30th April).

Amendment of invoices:

- Amendment of an invoice may be carried out by the supplier where input tax credit has not been availed and the invoice has not been reported as locked by the recipient.

HSN:

- The table for reporting supplies with the tax liability at various tax rates shall not capture HSN but would continue to capture supplies at different tax rates as is the present practice.

- The details of HSN shall be captured at four digits or more in a separate table in the regular monthly return.

Return format:

- The main return shall have two main tables, one for reporting supplies on which tax liability arises and one for availing input tax credit.

- The return shall have annexure of invoices which shall auto-populate the output liability table in the main return.

Payment of multiple liabilities:

- Liability in the return arising out of invoices of different dates shall be summarised period wise. However, one payment for the total tax liability on all tax invoices shall be allowed to be made.

- Interest shall be calculated on invoices which are reported late.

Amendment Return:

- There would be a facility for the filing of amendment return. Amendment return is different than a regular return.

- There would be a facility to file two amendment returns for each tax period within the time period specified in section 39(9) of the CGST Act, 2017,i.e., by due date for furnishing September month return or second quarter following end of financial year or actual date of furnishing relevant annual return, whichever is earlier.

- Amendment of entries which flow from the annexure of the main return shall be allowed only with the amendment of the details filed in the annexure.

Amendment of missing invoices:

- Amendment of missing invoices reported later by the supplier shall be carried out through the amendment return of the relevant tax period to which the invoice pertains.

- Thus, it is better to avail the amendment facility once all the invoices are uploaded, so that invoices reported late can also be amended through the amendment return.

Amendment of details other than that of invoice:

- All user entries of input tax credit table in the main return would be allowed to be amended.

- Change in the closing balance of the input tax credit shall be affected based on the declaration in the amendment return of the taxpayer. Thus, the opening and closing balances of the intervening month(s) shall not get impacted.

Payment due to amended liability / Negative liability:

- Payment would be allowed to be made through the amendment simplified monthly return.

- Input tax credit, if available in the electronic credit ledger can also be used for payment of the liability in the amendment simplified monthly return.

- Negative liability arising from the amendment return shall be carried forward as the negative liability in the regular simplified monthly return of the next tax period.

Higher late fee for amendment return:

- For change in liability of more than 10% through an amendment return, a higher late fee may be prescribed to ensure that reporting is appropriate in the regular return.

Monthly Accounting:

- All reported liabilities for a month in regular simplified monthly return for a tax period, liabilities from missing invoices uploaded/reported later and liability flowing from the amendment return shall be shown to the taxpayer and the tax officer at one screen on the common portal to assist tax period wise accounting and assessment.

Exports:

- The table for export of goods in return would contain details of the Shipping Bill also.

- The registered person can either fill this information at the time of filing the return or after filing the return at his option. Filing the details of the Shipping bill in the return at a later date shall not be considered as the filing of an amended return.

- A separate facility for uploading shipping bill details at a later date shall be provided to the exporters.

- Once the information on S/B is completed, the entire data shall be transmitted to the ICEGATE. Subsequent amendments in export/Shipping Bill table (via a special facility provided to the exporters) would also be transmitted to ICEGATE.

- Till data starts flowing online from ICEGATE or SEZ online in the input tax credit of the return, credit on imports and supplies from SEZ shall be availed on the self-declaration basis.

Supply-side control:

- For a newly registered taxpayer and a taxpayer who has defaulted in payment of tax beyond a time period and/or above a threshold. Uploading of invoices shall be allowed only up to that threshold amount. Only after the default in the payment of tax is made good respectively.

- If the supplier does not make the default good. The invoice of such supplier shall not be populated in the viewing facility of the recipient and consequently. The recipient would not be able to avail ITC on such invoices till the default in the payment of tax by the supplier for the past period is made good.

Profile-based return.

- A questionnaire shall be used to profile the taxpayer. Only such part of return shall be shown to him which are relevant to his profile. So that, all the sections in the return which are irrelevant for the taxpayer are blocked.

Purchase information in the annual return:

- Invoices/ Supplies on which the recipient does not intend to take input tax credit (such as ineligible ITC supplies). But are kept pending or rejected will have to be reported separately in the Annual return.

Suspension of registration:

- The concept of suspension of registration would be introduced. When a registered person has applied for cancellation of registration. Or when the conditions in law for cancellation of registration are satisfied.

- From the date of suspension to the date of cancellation of registration. The return would not be required to be filed. Also, invoice uploading shall not be allowed for the period beyond the date of suspension.

CA Manshi Jain

CA Manshi Jain

Pune, India