Matching GST returns and ITR

Matching GST returns and ITR

The first financial year after the regime of the GST has ended and now the time is for the filing of the Income-tax Return. But there are some confusion and problems arising in the mind of the taxpayers. Because there is some difference in the process and terminology under GST and Income-Tax. So, matching GST returns and ITR will be a big task.

Turnover of Income Tax

The term ‘gross receipts/turnover’ is not defined by the Income-tax Act, 1961. As such, the most prevalent opinion is that in absence of any definition the term ‘gross receipt’/’turnover’ the same should include GST and Cess which have been billed in the tax invoice issued in respect of the supply of taxable goods or services or both.

Further para 5 (ICDS) -2 says that the cost of purchase shall consist of the purchase price including duties and taxes, freight inwards and other expenditures directly attributable to the acquisition. Trade discounts, rebates, and other similar items are to be deducted while determining the cost of purchase. Though ICDS-4 dealing with revenue recognition does not list out the components of the sale price but by applying the matching concept, yet the sales revenue would include the GST as well.

In view of above, the turnover/gross receipts for the purpose of computing presumptive income under section 44AD/44ADA would be inclusive of GST, as section 145 does not provide for any exception from ICDS to those paying income-tax on income derived on the presumptive basis.

GST in return form ITR-4

The persons who are paying income-tax on presumptive basis are required to fill up return form ITR 4 ‘Sugam’. The said return form issued for AY 2018-19 includes the information regarding turnover/gross receipts reported for GST. Precisely, the GSTIN of the person is to be disclosed at row E9 of the return. Further, the amount of turnover/gross receipt as per GST return filed is to be disclosed at row E10.

Through this the Govt. Want to reconcile figures of turnover as reported for income-tax purposes vis-à-vis those reported for GST purposes in order to obviate any possibility of tax evasion. Though the difference of figures shall always be there as the amount of turnover as per IT Return and as per GST return would never match because of following reasons.:

(i) Amount of GST is not included in turnover as per GST return

The turnover/gross receipts as per GST return means the value of outward supplies which includes taxable, exports, exempt, Nil rated as well as non-GST supplies. Thus, the turnover/gross receipts will not include the amount of CGST/SGST/IGST and Cess whereas as discussed supra these taxes and cesses would be included in the amount of turnover/gross receipts for purpose of computing the presumptive income on which income-tax will be paid under Section 44AD/44ADA.

(ii) Implementation of GST from 01-07-2017

As regards filing of return for AY 2018-19, GST regime being implemented from 01-07-2017 The amount of turnover/gross receipt as per GST return filed would be for the period of 9 months. Whereas for income-tax purposes the gross/turnover would be for the full financial year 2017-18.

(iii) Supply to the distinct/related person without consideration

As per Schedule I of the CGST Act, 2017, supply to related or distinct person, even if without consideration is treated as supply and, thus, subject to GST. The value in this regard is determined as per Valuation Rules provided in the CGST Rules, 2017. Accordingly, the value of such supply would be included in GST return, however, such supply being without consideration would not be accounted for in the books of account and, therefore, would not be part of turnover/gross receipt for income-tax purposes. Further, Section 40A(2)(b) of the Income-tax Act, 1961 is in regard to disallowance of excessive expenditure in respect of payment to related persons and not relevant in the above situation.

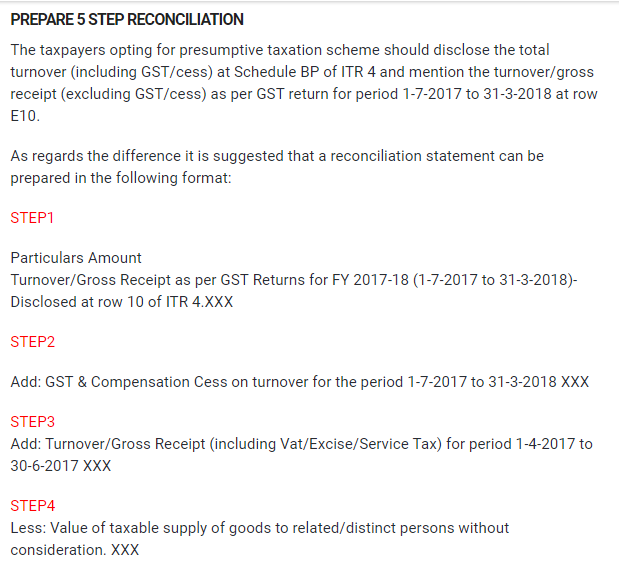

PREPARE 5 STEP RECONCILIATION

The taxpayers opting for presumptive taxation scheme should disclose the total turnover (including GST/cess). At Schedule BP of ITR 4 and mention the turnover/gross receipt (excluding GST/cess). As per GST return for period 1-7-2017 to 31-3-2018 at row E10.

As regards the difference it is suggested that a reconciliation statement can be prepared in the following format:

STEP1

Particulars Amount

Turnover/Gross Receipt as per GST Returns for FY 2017-18 (1-7-2017 to 31-3-2018)- Disclosed at row 10 of ITR 4.XXX

STEP2

Add: GST & Compensation Cess on turnover for the period 1-7-2017 to 31-3-2018 XXX

STEP3

Add: Turnover/Gross Receipt (including Vat/Excise/Service Tax) for period 1-4-2017 to 30-6-2017 XXX

STEP4

Less: Value of taxable supply of goods to related/distinct persons without consideration. XXX

STEP5

Turnover/Gross Receipt for FY 2017-18 for arriving at presumptive income- Disclosed at Schedule BP of ITR 4. XXX

A query is received from the Income Tax Department regarding the difference between turnover as per GST return and that as per Income Tax. The above reconciliation statement can be submitted to them which should lead to the dropping of the query by the Deptt.

CA Amresh Vashisht

Meerut

CA Amresh Vashisht

CA Amresh Vashisht

Meerut, India