Who can use/file ITR 3

Who can use/file ITR 3

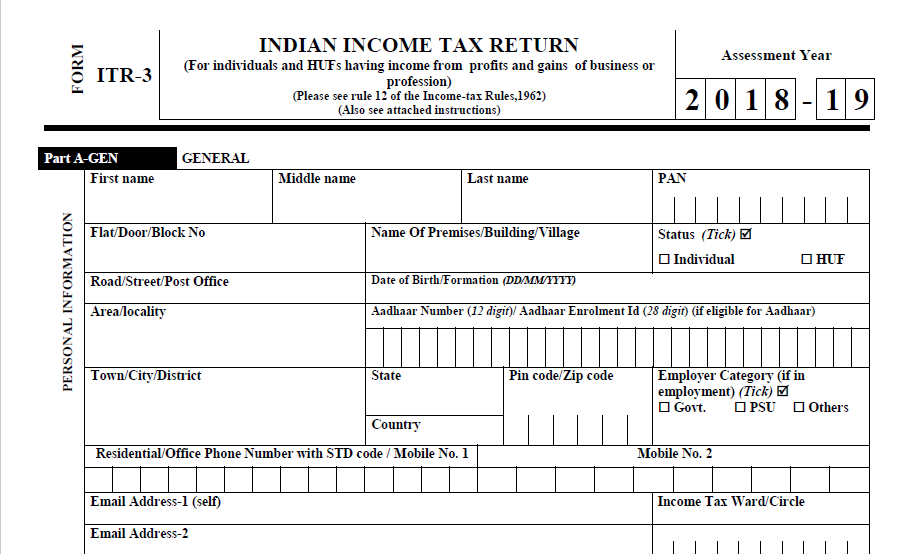

For A.Y 2018-19, Form ITR 3 can be used by an individual or a Hindu Undivided Family who is having income from profits and gains of business or profession. However, for the A.Y 2018-19, ITR 3 is required to be filed by the following persons:

- Whose income is chargeable under Head ”Profits and gains of business or profession”

- An individual who is a director in a company

- Who had investments in unlisted equity shares at any time during the financial year

- Any interest, salary, bonus, commission, or remuneration by whatever name called, due to, or received by him from a partnership firm.

Who cannot use/file ITR-3

Form ITR-3 cannot be used by any person other than an individual or a HUF. Further, an individual or a HUF not having income from business or profession cannot use ITR-3.

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.