Circular No. 6/2018 – Income Tax

Circular No. 6/2018 – Income Tax

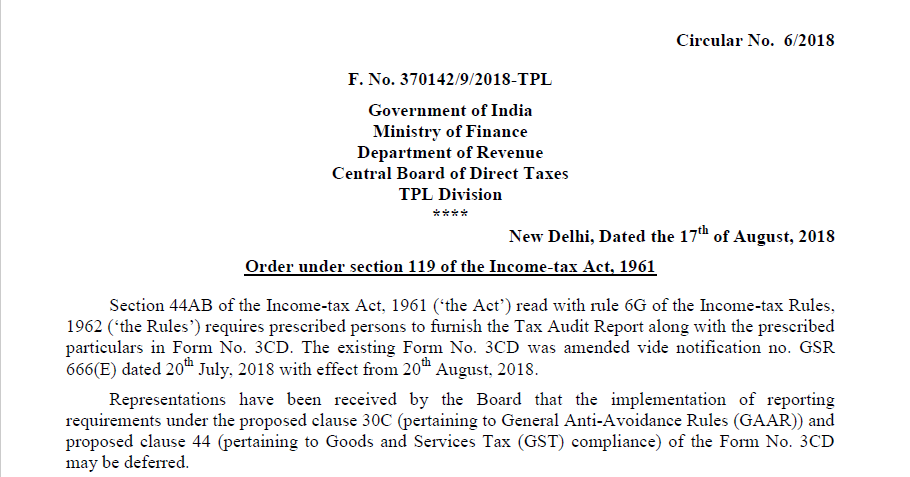

Circular No. 6/2018

F. No. 370142/9/2018-TPL

Government of India

Ministry of Finance

Department of Revenue

Central Board of Direct Taxes

TPL Division

New Delhi, Dated the 17th of August 2018

The order under section 119 of the Income-tax Act, 1961

Section 44AB of the Income-tax Act, 1961 (‘the Act’) read with rule 6G of the Income-tax Rules, 1962 (‘the Rules’) requires prescribed persons to furnish the Tax Audit Report along with the prescribed particulars in Form No. 3CD. The existing Form No. 3CD was amended vide notification no. GSR 666(E) dated 20th July 2018 with effect from 20th August 2018.

Representations have been received by the Board that the implementation of reporting requirements under the proposed clause 30C (pertaining to General Anti-Avoidance Rules (GAAR)) and proposed clause 44 (pertaining to Goods and Services Tax (GST) compliance) of the Form No. 3CD may be deferred.

The matter has been examined and it has been decided by the Board that reporting under the proposed clause 30C and proposed clause 44 of the Tax Audit Report shall be kept in abeyance till 31st March 2019. Therefore, for Tax Audit Reports to be furnished on or after 20th August 2018 but before 1st April 2019, the tax auditors will not be required to furnish details called for under the said clause 30C and clause 44 of the Tax Audit Report.

(Sanyam Suresh Joshi)

DCIT (OSD) (TPL)-III

Download the Circular No. 6/2018 – Income Tax by clicking the below image:

Copy to:

1. PS to FM/OSD to FM/PS to MoS(F)/OSD to MoS(F)

2. PS to Secretary (Revenue)

3. Chairman, CBDT

4. All Members, CBDT

5. All Pr. DGsIT/Pr. CCsIT

6. All Joint Secretaries/CsIT, CBDT

7. Directors/Deputy Secretaries/Under Secretaries of CBDT

8. DIT (RSP&PR)/Systems, New Delhi

9. The C&AG of India (30 copies)

10. The JS & Legal Adviser, Ministry of Law & Justice, New Delhi

11. The Institute of Chartered Accountants of India

12. All Chambers of Commerce

13. CIT (M&TP), Official Spokesperson of CBDT

14. O/o Pr. DGIT (Systems) for uploading on official website

15. JCIT (Database Cell) for uploading on departmental website

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.