Supply of non-alcoholic beverages/ingredients to SEZ is Taxable

Supply of non-alcoholic beverages/ingredients to SEZ is Taxable: AAR

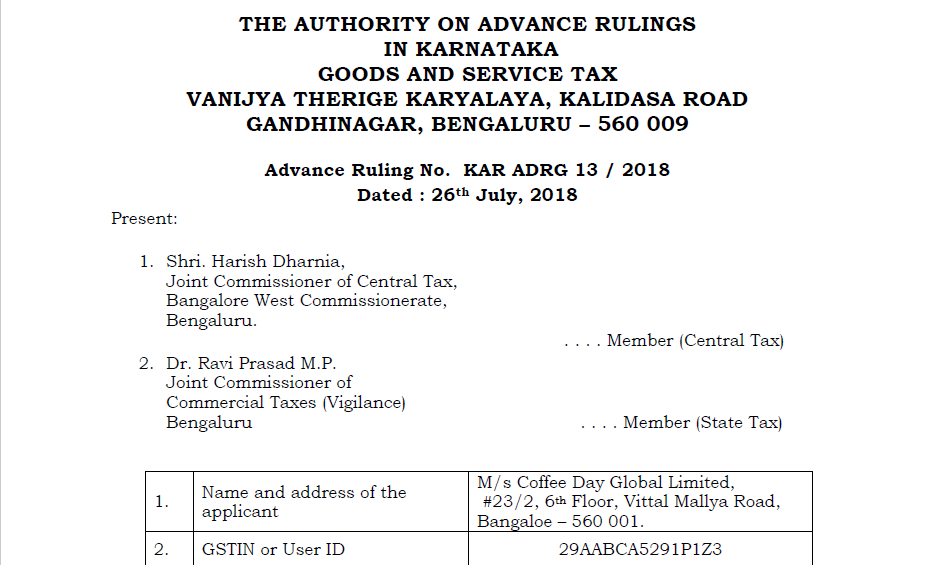

An advance ruling is given by the Authority of the Advance Ruling(AAR) o0f Karnataka. Regarding the ingredients provided by the applicant to the SEZ unit. The supply of non-alcoholic beverages/ingredients to SEZ is made by the applicant. This ruling was submitted by the M/s Coffee Day Global Limited.

Issue/Question raised in Advance ruling

- The applicant installs beverage vending machines inside SEZ premises, prepares beverages using the vending machines & its ingredients, supplies to SEZ units which are consumed by the employees of SEZ units and charge the SEZ units based on the number of cups of beverages supplied. (Per Cup billing)

- The applicant installs beverage vending machines inside SEZ premises, supplies beverage ingredients to the SEZ units and bills based on the quantity of ingredients supplied. SEZ units prepare the beverages using the vending machines and serve them to its employees. There will not be any consideration for the use of the vending machine by the SEZ units.

Download the full explanation and reasoning provided by the both by clicking the below image:

Ruling

The supply of non-alcoholic beverages/ingredients to such beverages, to SEZ units using coffee vending machines by the applicant. Do not qualify as zero-rated supply, as defined under Section 16 of the IGST Act‟2017.

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.