What is a Limited Liability Partnership

What Is a Limited Liability Partnership

Limited Liability Partnership (LLP) was introduced in India by way of the Limited Liability Partnership Act, 2008. The main advantage of a Limited Liability Partnership over a traditional partnership firm is that in an LLP, one partner is not responsible or liable for another partner’s misconduct or negligence. An LLP also provides limited liability protection for the owners from the debts of the LLP. Therefore, all partners in an LLP enjoy a form of limited liability protection for each individual’s protection within the partnership, similar to that of the shareholders of a private limited company. However, unlike private limited company shareholder, the partners of an LLP have the right to manage the business directly. Since, its introduction in 2010, LLPs have been well received with over 1 lakhs registrations so far until September 2014.

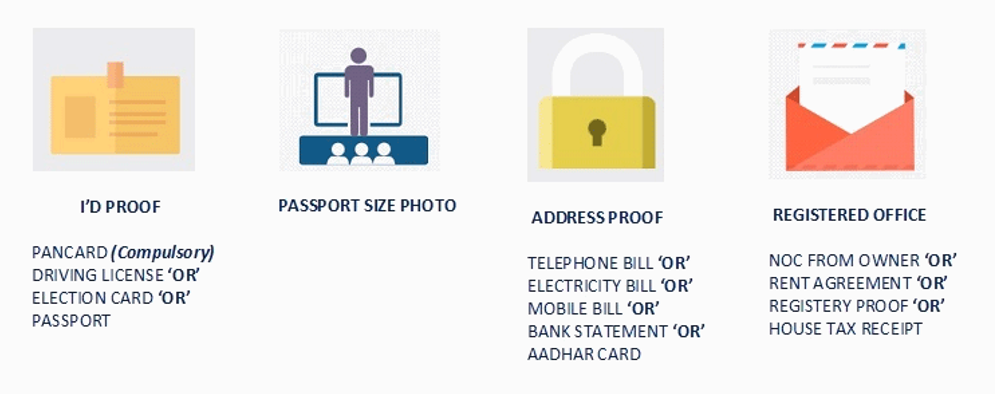

Documents Required

Frequently Asked Questions

What is the Designated Partner Identification Number (DPIN)?

Designated Partner Identification Number is a unique identification number assigned to all existing and proposed Designated Partner of an LLP. It is mandatory for all present or proposed Designated Partner to have a Designated Partner Identification Number. Designated Partner Identification Number never expires and a person can have only one Designated Partner Identification Number.

What is the capital required to start a Limited Liability Partnership?

A limited liability partnership can be started with any amount of capital. A partner’s tangible or intangible assets can be counted as a benefit to the LLP.

How many people are required to incorporate a Limited Liability Partnership?

To incorporate a Limited Liability Partnership, a minimum of two people are required. A Limited Liability Partnership must have a minimum of two Partners and can have a maximum of any number of Partners.

What are the requirements to be a Partner in an LLP?

The Designated Partners needs to be over 18 years of age and must be a natural person. There are no limitations in terms of citizenship or residency. Therefore, the LLP Act 2008 allows Foreign Nationals including Foreign Companies & LLPs to incorporate an LLP in India provided at least one designated partner is resident of India.

Can an LLP be incorporated for undertaking “Not-For-Profit” activities?

No, one of the essential requirements for setting LLP is ‘carrying on a lawful business with a view to profit’. Therefore, LLP cannot be incorporated for undertaking “Not-For-Profit” activities.

Is an office required for starting a Limited Liability Partnership?

An address in India where the registered office of the LLP will be situated is required. The premises can be a commercial / industrial/residential where communication from the MCA will be received.

What are the documents required for the incorporation of LLP?

For Indian citizens, a PAN card is required. Address proof and identity proof is also mandatory. In addition, the landlord of the registered office premises must provide a No Objection Certificate for having the registered office in his/her premises and must submit his/her identity proof and address proof.

Do I have to be present in person to incorporate a LLP?

No, you will not have to be present at our office or appear at any office for the incorporation of a Limited Liability Partnership. All the documents can be uploaded online.

How long will it take to incorporate an LLP?

Legalwiz.in can incorporate a Limited Liability Partnership in 14-20 days. The time taken for incorporation will depend on submission of relevant documents by the client and speed of Government Approvals. To ensure speedy incorporation, please choose a unique name for your LLP and ensure you have all the required documents prior to starting the incorporation process.

Related Topic:

PPT on Limited Liability Partnership

What do I need to quickly incorporate my LLP?

To incorporate an LLP quickly, make sure the proposed name of the Limited Liability Partnership is very unique. Names that are similar to an existing private limited company / limited liability partnership/trademark can be rejected and additional time will be required for resubmission of names.

What are the annual compliance requirements for an LLP?

LLPs are required to file an annual filing with the Registrar each year. However, if the LLP has a turnover of less than Rs.40 lakhs and/or has a capital contribution of less than Rs.25 lakhs, the financial statements do not have to be audited.

Is Foreign Direct Investment (FDI) allowed in LLP?

Yes, Foreign Direct Investment (FDI) is allowed in LLP under the automatic route in sectors allowed by the Foreign Investments Promotion Board (FIPB). However, Foreign Institutional Investors (Flls) and Foreign Venture Capital Investors (FVCIs) will not be permitted to invest in LLPs. LLPs will also not be permitted to avail External Commercial Borrowings (ECBs.)

Can an existing partnership firm or company be converted to LLP?

Yes, an existing partnership firm or a company that is unlisted can be converted into LLP. There are many advantages of converting a partnership firm into an LLP; however, the same doesn’t apply for the conversion of a Company to a LLP.

CS Bhumika Rajput

CS Bhumika Rajput

Ahemdabad, India