PPT on Analysis of New System of GST Return

Analysis of New System of GST Return by CA Swapnil Munot

Overview of New System of GST Return

Let us do the Analysis of New System of GST Return:

1st Phase: Software Preparation

- GST Council in its 27th meet dated 4th May 18, has taken the decision to introduce the new simplified system of GST Return.

- Up to Mar 19, GSTN will design new GST Monthly Return. Till that time, GSTR 3B & GSTR 1 filing will continue.

- There will be Single Monthly Return for everybody Except, For composition dealers/no supply cases, it will be quarterly return.

2nd Phase: Credit allowed on Provisional Basis.

- Sales details are to be furnished in the new Return System. Buyer can claim provisional credit, irrespective of whether the supplier has uploaded details of it.

- However, GSTIN will give the difference of credit claimed vs credit declared by the supplier. Buyer should find of the reason of difference and should take corrective action accordingly.

Download the full PPT on Analysis of New System of GST Return by CA Swapnil Muhot by clicking the below image:

3rd Phase: Credit auto calculated as per details furnished by the supplier.

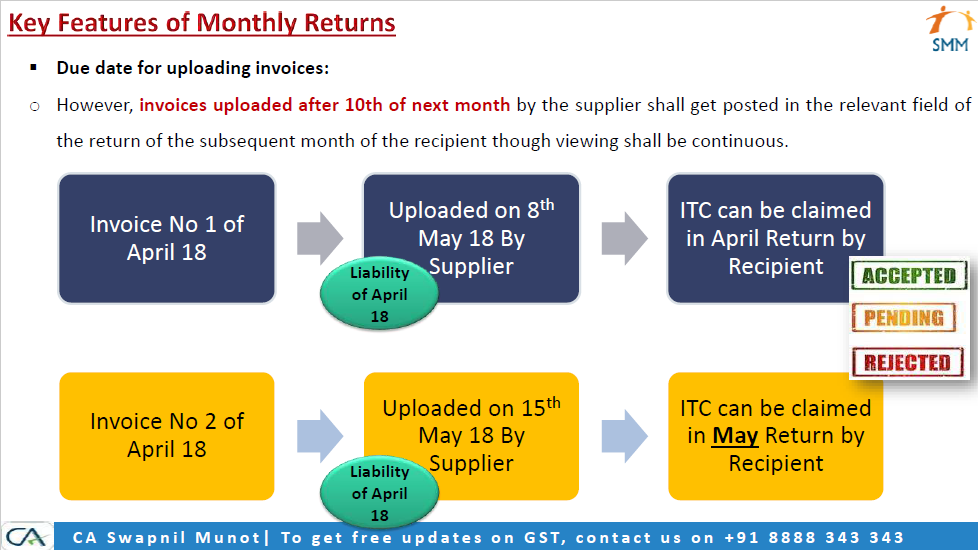

- Sales Liability Calculation: It will be as per B 2 B and B 2 C details furnished.

- Input Tax Credit Calculation: Only way to get credit is if the supplier has uploaded the details to the system. ITC will be auto computed by GST System.

- Purchase side details are not required to be punched and same will be auto-populated.

- Ultimately credit will be available only if the supplier has uploaded sales details on the portal.

- If the supplier doesn’t pay tax to the government, the government will first catch supplier and then the buyer.

Important Challenges:

- Amendment in Act and Rules

- The draft Return form is out for comment

- Credit Reconciliation – Biggest Task which accounts department will be doing

Swapnil Munot

Swapnil Munot

Delhi, India

CA Swapnil Munot is having keen interest & expertise in Indirect Tax and Foreign Trade policy. He has authored a book on GST, titled “HANDBOOK ON GST”. Also authored E-Book on “GST E Way Bill” and “GST Amendment Act”. He has conducted 290+ Seminars across India on GST for Government Officers, Commissioners, Professionals and Industries at the various forums – FIEO, ICAI, MCCIA, MSME, WMTPA, CII, NACIN, ICMA (Now ICAI), YASHADA, Various Associations, Institution, and Colleges, etc.