Central Goods and Services Tax (Amendment) Act, 2018

The Central Goods and Services Tax (Amendment) Act, 2018

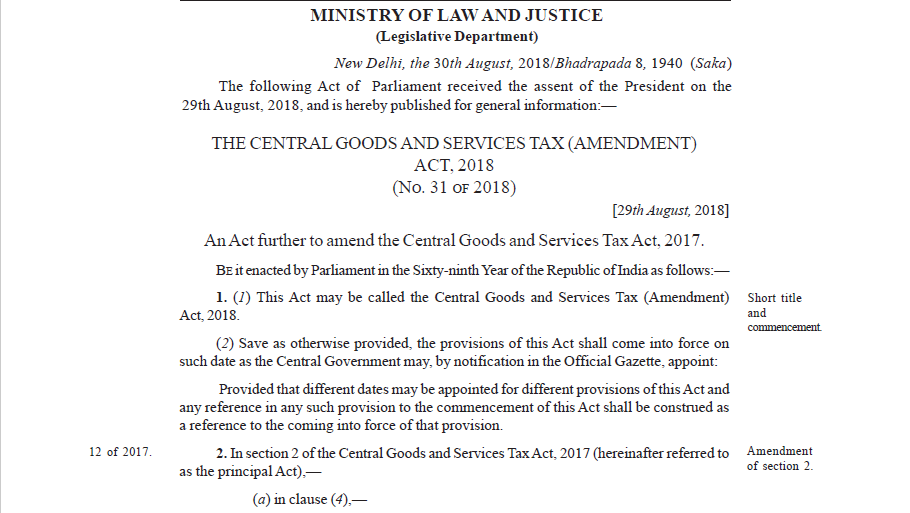

Central Goods and Services Tax (Amendment) Act, 2018 was pus published in The Gazette of India. The Central Goods and Services Tax (Amendment) Act, 2018 of Parliament received the assent of the President on the 29th August 2018. After the assent, the act was published for the public.

The text of the Act:

1. (1) This Act may be called the Central Goods and Services Tax (Amendment) Act, 2018.

(2) Save as otherwise provided, the provisions of this Act shall come into force on such date as the Central Government may, by notification in the Official Gazette, appoint:

Provided that different dates may be appointed for different provisions of this Act and any reference in any such provision to the commencement of this Act shall be construed as a reference to the coming into force of that provision.

Related Topic:

Bharat Raj Punj Vs Commissioner of Central Goods And Service Tax (Rajasthan High Court)

2. In section 2 of the Central Goods and Services Tax Act, 2017 (hereinafter referred to as the principal Act),––

(a) in clause (4),––

(i) for the words “Central Board of Excise and Customs”, the words “Central Board of Indirect Taxes and Customs” shall be substituted;

(ii) for the words “the Appellate Authority and the Appellate Tribunal”, the words, brackets and figures “the Appellate Authority, the Appellate Tribunal and the Authority referred to in sub-section (2) of section 171” shall be substituted;

Download the full CGST(Amendment) Act, 2018 by clicking the below image:

Source: The Gazette of India.

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.