What information should be filed in GSTR-9 return

What information should be filed in GSTR-9 return

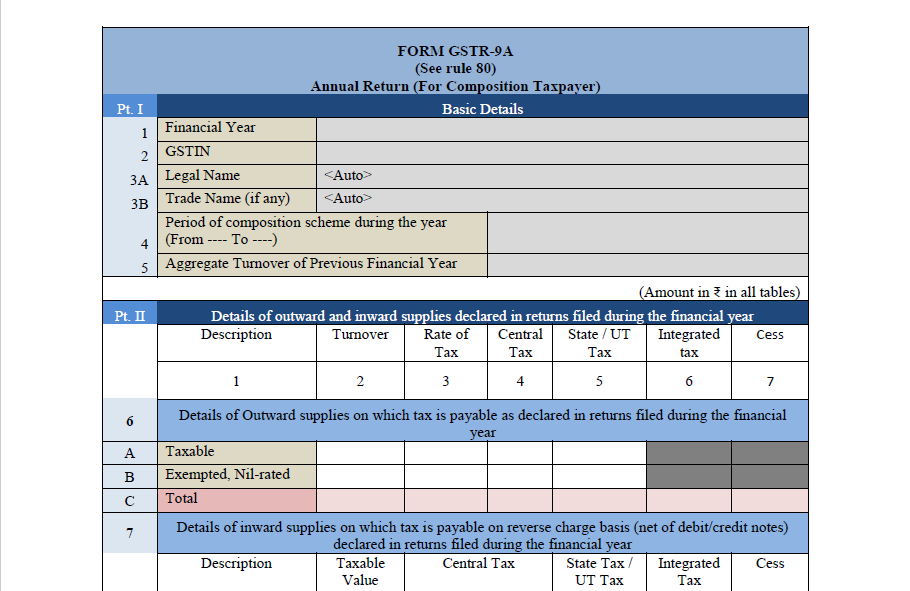

After the format issued under the FORM GSTR-9 (Annual Report and Audit). The confusion was raised regarding the information should be filed in GSTR-9 return. The following information is expected to be filed in GSTR-9A return:

1. The total value of purchases on which ITC availed (inter-State)

2. A total value of purchases on which ITC availed (intra-State)

3. The total value of purchases on which ITC availed (Imports)

4. Other Purchases on which no ITC availed

5. Sales Returns

6. Other Expenditure (Expenditure other than purchases)

7. The total value of supplies on which GST paid (inter-State Supplies)

8. The total value of supplies on which GST Paid (intra-State Supplies)

9. The total value of supplies on which GST Paid (Exports)

10. The total value of supplies on which no GST Paid (Exports)

11. Value of Other Supplies on which no GST paid

12. Purchase Returns

13. Other Income (Income other than from supplies)

14. Return reconciliation Statement

15. Arrears (Audit/Assessment etc.)

16. Refunds

17. Turnover Details

18. Profit as Per the Profit and Loss Statement.

19. Gross Profit

20. Profit after Tax

21. Net Profit

22. Details of Statutory Audit

The penalty for late filing of GSTR-9 return

A per day penalty of Rs.100, up to a maximum amount of Rs.5000 would be applicable for late filing of the GSTR-9 return. Only if all the GSTR-1, GSTR-2 and GSTR-3 returns are filed, the taxpayer would be able to file the GSTR-9 return on the GST Portal.

GSTR-9 Filing – GST Annual Return – Due on 31st December

GSTR-9 or GST Annual Return must be filed by all regular taxpayers registered under GST. The only category of GST registered entities not required to file GSTR-9 filing is input service distributors, casual taxable persons, and non-resident taxable persons. The due date for filing GSTR-9 is 31st December

GSTR-9 Filing

GSTR-9 or GST annual return is a type of GST return that must be filed by regular taxpayers and persons registered under GST composition scheme. GSTR-9 must be filed each year through the GST Common Portal or LEDGERS GST Sofware or at a GST Facilitation Centre

GSTR-9A return

Regular GST taxpayers filing GSTR-1, GSTR-2, and GSTR-3 must file GSTR-9A on or before 31st December, consolidating information furnished during the previous financial year.

GSTR-9B return

GSTR-9B return should be filed by electronic commerce operators who are required to collect tax at source. In addition to GSTR-9B return, electronic commerce operators will also be required to file GSTR-8 return, every month.

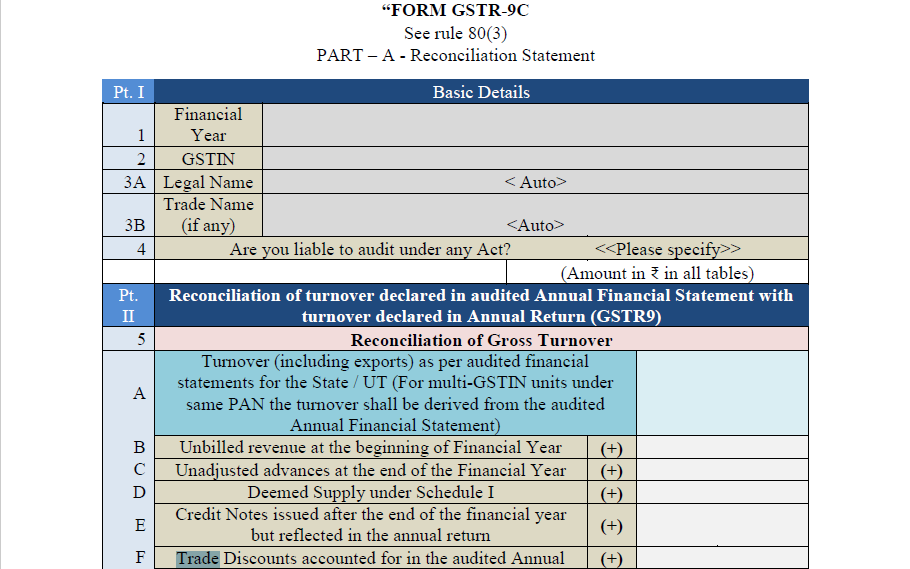

GSTR-9C return

Regular taxpayers registered under GST having an annual aggregate turnover of over Rs.2 crores during a financial year are required to get their accounts audited and file a copy of the audited annual account and reconciliation statement along with the GSTR-9C return. The GST annual audit can be done by a practicing Chartered Accountant or Cost Accountant.

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.