CGST Thirteenth amendment Rules 2018

CGST Thirteenth amendment Rules 2018:

In the Central Goods and Services Tax Rules, 2017 (hereinafter referred to as the said rules), after rule 83, the following rule shall be inserted, namely:- “

83A. Examination of Goods and Services Tax Practitioners.- (1) Every person referred to in clause (b) of sub-rule (1) of rule 83 and who is enrolled as a goods and services tax practitioner under sub-rule (2) of the said rule, shall pass an examination as per sub-rule (3) of the said rule.

(2) The National Academy of Customs, Indirect Taxes and Narcotics (hereinafter referred to as “NACIN”) shall conduct the examination.

(3) Frequency of examination.- The examination shall be conducted twice in a year as per the schedule of the examination published by NACIN every year on the official websites of the Board, NACIN, common portal, GST Council Secretariat and in the leading English and regional newspapers.

(4) Registration for the examination and payment of fee.– (i) A person who is required to pass the examination shall register online on a website specified by NACIN.

(ii) A person who registers for the examination shall pay examination fee as specified by NACIN, and the amount for the same and the manner of its payment shall be specified by NACIN on the official websites of the Board, NACIN and common portal.

(5) Examination centers.– The examination shall be held across India at the designated centers. The candidate shall be given an option to choose from the list of centers as provided by NACIN at the time of registration.

(6) Period for passing the examination and number of attempts allowed.- (i) A person enrolled as a goods and services tax practitioner in terms of sub-rule (2) of rule 83 is required to pass the examination within two years of enrolment:

Provided that if a person is enrolled as a goods and services tax practitioner before 1st of July 2018, he shall get one more year to pass the examination:

Provided further that for a goods and services tax practitioner to whom the provisions of clause (b) of sub-rule (1) of rule 83 apply, the period to pass the examination will be as specified in the second proviso of sub-rule (3) of said rule.

(ii) A person required to pass the examination may avail of any number of attempts but these attempts shall be within the period as specified in clause (i).

(iii) A person shall register and pay the requisite fee every time he intends to appear at the examination.

(iv) In case the goods and services tax practitioner having applied for appearing in the examination is prevented from availing one or more attempts due to unforeseen circumstances such as critical illness, accident or natural calamity, he may make a request in writing to the jurisdictional Commissioner for granting him one additional attempt to pass the examination, within thirty days of conduct of the said examination. NACIN may consider such requests on merits based on recommendations of the jurisdictional Commissioner.

(7) Nature of examination.-The examination shall be a Computer Based Test. It shall have one question paper consisting of Multiple Choice Questions. The pattern and syllabus are specified in Annexure-A.

(8) Qualifying marks.- A person shall be required to secure fifty percent. of the total marks.

(9) Guidelines for the candidates.- (i) NACIN shall issue examination guidelines covering issues such as procedure of registration, payment of fee, nature of identity documents, provision of admit card, manner of reporting at the examination center, prohibition on possession of certain items in the examination center, procedure of making representation and the manner of its disposal.

(ii) Any person who is or has been found to be indulging in unfair means or practices shall be dealt in accordance with the provisions of sub-rule (10). An illustrative list of use of unfair means or practices by a person is as under: –

(a) obtaining support for his candidature by any means;

(b) impersonating;

(c) submitting fabricated documents;

(d) resorting to any unfair means or practices in connection with the examination or in connection with the result of the examination;

(e) found in possession of any paper, book, note or any other material, the use of which is not permitted in the examination center;

(f) communicating with others or exchanging calculators, chits, papers etc. (on which something is written);

(g) misbehaving in the examination center in any manner;

(h) tampering with the hardware and/or software deployed; and

(i) attempting to commit or, as the case may be, to abet in the commission of all or any of the acts specified in the foregoing clauses.

(10) Disqualification of person using unfair means or practice.- If any person is or has been found to be indulging in use of unfair means or practices, NACIN may, after considering his representation, if any, declare him disqualified for the examination.

(11) Declaration of result.- NACIN shall declare the results within one month of the conduct of examination on the official websites of the Board, NACIN, GST Council Secretariat, common portal and State Tax Department of the respective States or Union territories, if any. The results shall also be communicated to the applicants by e-mail and/or by post.

(12) Handling representations.- A person not satisfied with his result may represent in writing, clearly specifying the reasons therein to NACIN or the jurisdictional Commissioner as per the procedure established by NACIN on the official websites of the Board, NACIN and common portal.

(13) Power to relax.– Where the Board or State Tax Commissioner is of the opinion that it is necessary or expedient to do so, it may, on the recommendations of the Council, relax any of the provisions of this rule with respect to any class or category of persons.

Explanation:– For the purposes of this sub-rule, the expressions –

(a) “jurisdictional Commissioner” means the Commissioner having jurisdiction over the place declared as address in the application for enrolment as the GST Practitioner in FORM GST PCT-1. It shall refer to the Commissioner of Central Tax if the enrolling authority in FORM GST PCT-1 has been selected as Centre, or the Commissioner of State Tax if the enrolling authority in FORM GST PCT1 has been selected as State;

(b) NACIN means as notifbied y notification No. 24/2018-Central Tax, dated 28.05.2018.

Annexure-A

[See sub-rule 7]

Pattern and Syllabus of the Examination

PAPER: GST Law & Procedures:

| Time allowed: | 2 hours and 30 minutes |

| Number of Multiple Choice Questions: | 100 |

| Language of Questions: | English and Hindi |

| Maximum marks: | 200 |

| Qualifying marks: 1 | 100 |

| No negative marking |

Syllabus:

| 1. | The Central Goods and Services Tax Act, 2017 |

| 2. | The Integrated Goods and Services Tax Act, 2017 |

| 3. | All The State Goods and Services Tax Acts, 2017 |

| 4. | The Union territory Goods and Services Tax Act, 2017 |

| 5. | The Goods and Services Tax (Compensation to States) Act, 2017 |

| 6. | The Central Goods and Services Tax Rules, 2017 |

| 7. | The Integrated Goods and Services Tax Rules, 2017 |

| 8. | All The State Goods and Services Tax Rules, 2017 |

| 9. | Notifications, Circulars and orders issued from time to time under the said Acts and Rules.”. |

3. In the said rules, in rule 109A,

(a) in sub-rule (1), in clause (b), for the words and brackets “the Additional Commissioner (Appeals)”, the following words and brackets shall be substituted, namely:- “any officer not below the rank of Joint Commissioner (Appeals)”;

(b) in sub-rule (2), in clause (b), for the words and brackets “the Additional Commissioner (Appeals)”, the following words and brackets shall be substituted, namely:-

“any officer not below the rank of Joint Commissioner (Appeals)”.

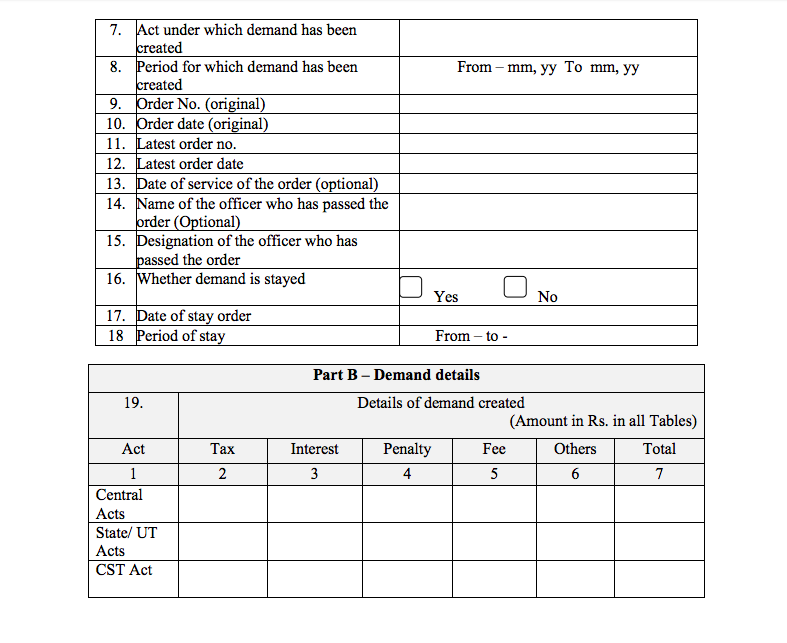

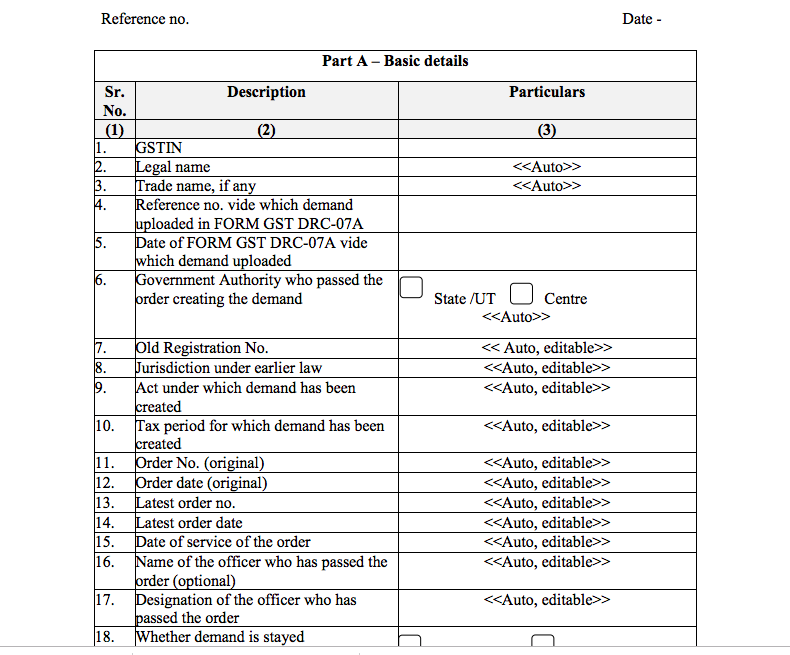

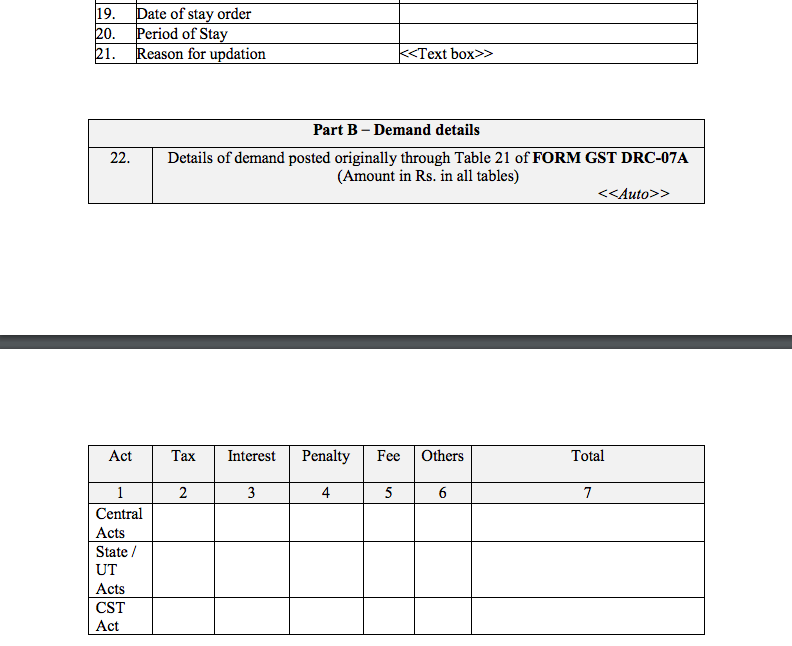

4. In the said rules, after rule 142, the following rule shall be inserted, namely:-

“142A. Procedure for recovery of dues under existing laws. – (1) A summary of order issued under any of the existing laws creating demand of tax, interest, penalty, fee or any other dues which becomes recoverable consequent to proceedings launched under the existing law before, on or after the appointed day shall, unless recovered under that law, be recovered under the Act and may be uploaded in FORM GST DRC-07A electronically on the common portal for recovery under the Act and the demand of the order shall be posted in Part II of Electronic Liability Register in FORM GST PMT-01.

(2) Where the demand of an order uploaded under sub-rule (1) is rectified or modified or quashed in any proceedings, including in appeal, review or revision, or the recovery is made under the existing laws, a summary thereof shall be uploaded on the common portal in FORM GST DRC-08A and Part II of Electronic Liability Register in FORM GST PMT-01 shall be updated accordingly.”.

5. In the said rules, in FORM GST REG-16,-

(a) against serial number 7, for the heading, the following heading shall be substituted, namely:-

“In case of transfer, merger of business and change in constitution leading to change in PAN, particulars of registration of entity in which merged, amalgamated, transferred, etc.”;

(b) in the instruction, after the Table, for the paragraphs beginning with the words “In case of death of sole proprietor” and ending with the words “surrender of registration falls”, the following paragraphs shall be substituted, namely:-

“In case of death of sole proprietor, application shall be made by the legal heir / successor before the concerned tax authorities. The new entity in which the applicant proposes to amalgamate itself shall register with the tax authority before submission of the application for cancellation. This application shall be made only after the new entity is registered.

Before applying for cancellation, please file your tax return due for the tax period in which the effective date of surrender of registration falls or furnish an application to the effect that no taxable supplies have been made during the intervening period (i.e. from the date of registration to the date of application for cancellation of registration).”.

6. In the said rules, in FORM GSTR-4, in the Instructions, for Sl. No. 10, the following shall be substituted, namely:-

“10. Information against the Serial 4A of Table 4 shall not be furnished.”.

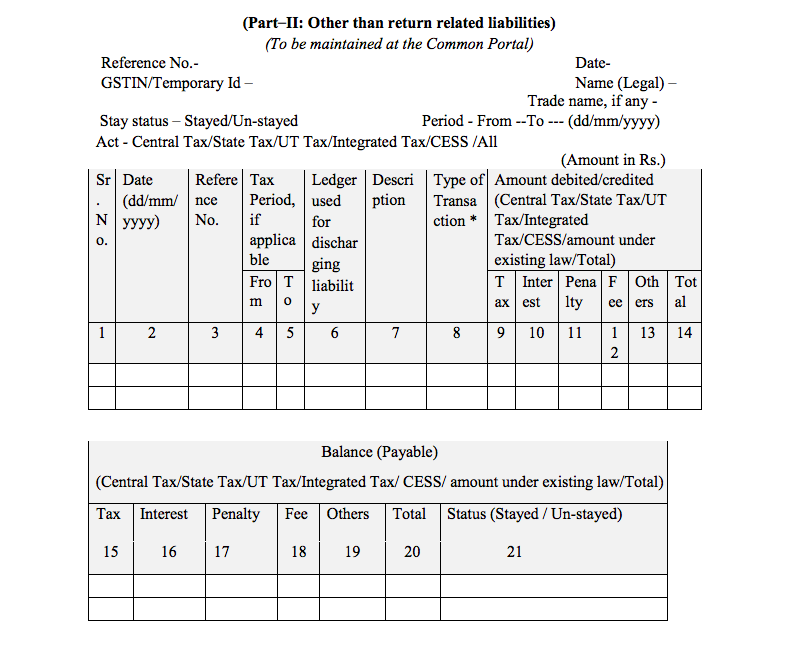

7. In the said rules, for FORM GST PMT-01 relating to “Part II: Other than return related liabilities”, the following form shall be substituted, namely:-

“Form GST PMT –01

[See rule 85(1)]

Electronic Liability Register of Registered Person

Form GST PMT 01

*[Debit (DR) (Payable)] / [Credit (CR) (Paid)] / Reduction (RD)/ Refund adjusted (RF)]

Note –

1. All liabilities accruing, other than return related liabilities, will be recorded in this ledger. Complete description of the transaction shall be recorded accordingly.

2. All payments made out of cash or credit ledger against the liabilities would be recorded accordingly.

3. Reduction or enhancement in the amount payable due to decision of appeal, rectification, revision, review etc. will be reflected here.

4. Negative balance can occur for a single Demand ID also if appeal is allowed/ partly allowed. Overall closing balance may still be positive.

5. Refund of pre-deposit can be claimed for a particular demand ID if appeal is allowed even though the overall balance may still be positive subject to the adjustment of the refund against any liability by the proper officer.

6. The closing balance in this part shall not have any effect on filing of return.

7. Reduction in amount of penalty would be automatic if payment is made within the time specified in the Act or the rules.

8. Payment made against the show cause notice or any other payment made voluntarily shall be shown in the register at the time of making payment through credit or cash. Debit and credit entry will be created simultaneously.”.

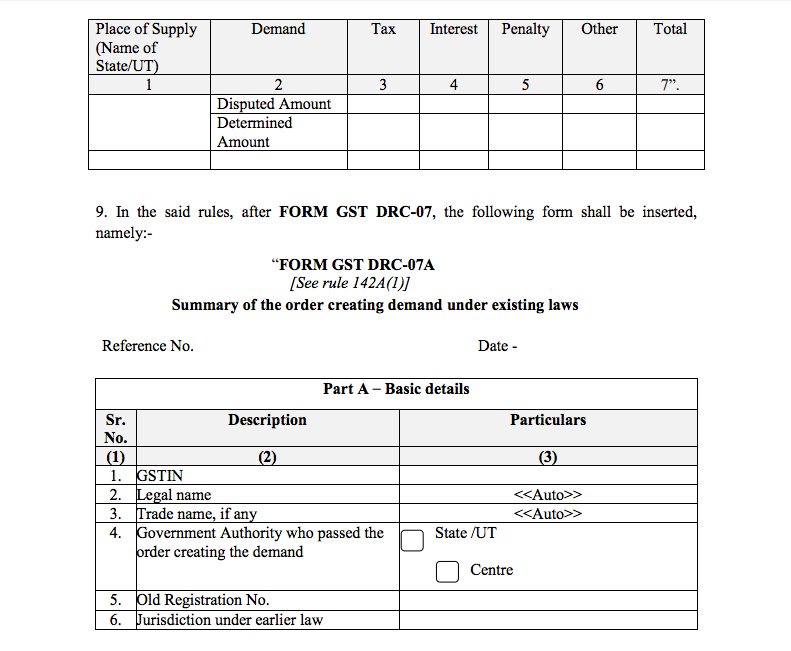

8. In the said rules, in FORM GST APL-04, after serial number 9, and the Table relating thereto, the following shall be inserted, namely:-

“10. Details of IGST Demand

FORM GST DRC 7A

1. In case of demands relating to short payment of tax declared in return, acknowledgement / reference number of the return may be mentioned.

1. In case of demands relating to short payment of tax declared in return, acknowledgement / reference number of the return may be mentioned.

2. Only recoverable demands shall be posted for recovery under GST laws. Once, a demand has been created through FORM GST DRC-07A, and the status of the demand changes subsequently, the status may be amended through FORM GST DRC-08A.

3. Demand paid up to the date of uploading the summary of the order should only be mentioned in Table 20. Different heads of the liabilities under existing laws should be synchronized with the heads defined under Central or State tax.

4. Latest order number means the last order passed by the relevant authority for the particular demand.

5. Copy of the order vide which demand has been created can be attached. Documents in support of tax payment can also be uploaded, if available.”.

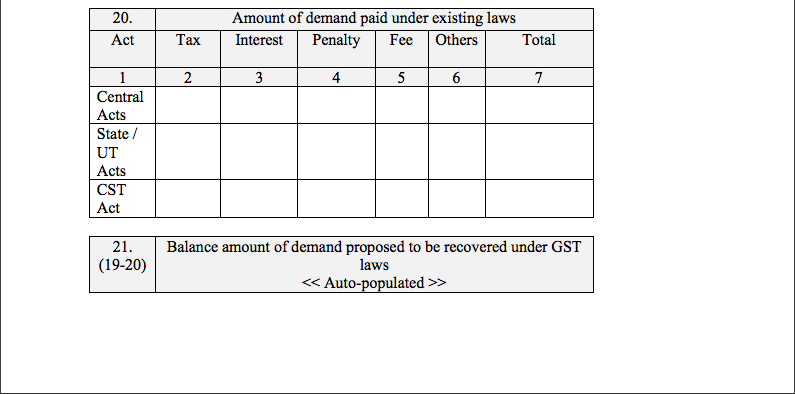

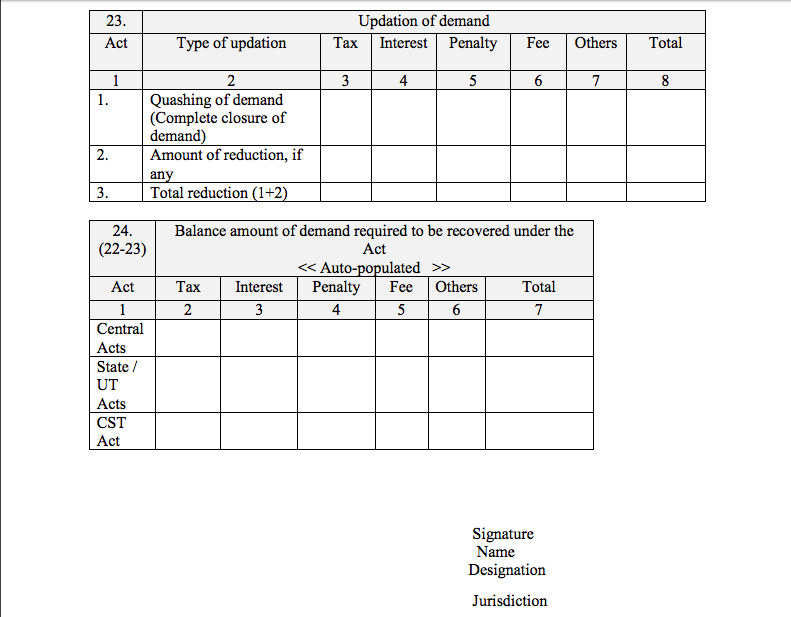

10. In the said rules, after FORM GST DRC-08, the following form shall be inserted, namely:-

“FORM GST DRC-08A

[See rule 142A(2)]

Amendment/Modification of summary of the order creating demand under existing laws

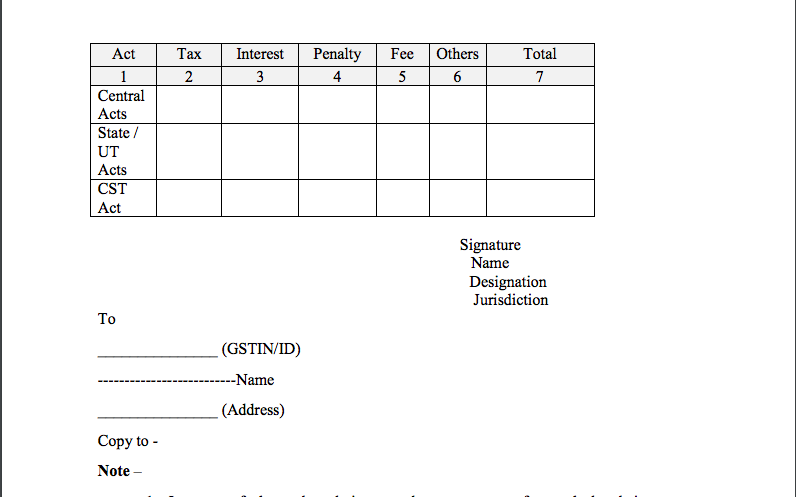

To

_____________(GSTIN/ID)

———————-(Name)

_____________(Address)

Note –

1. Reduction includes payment made under existing laws. If the demand of tax is to be increased then a fresh demand may be created under FORM GST DRC-07A.

2. Copy of the order vide which demand has been modified /rectified / revised/ updated can be uploaded. Payment document can also be attached.

3. Amount recovered under the Act including adjustment made of refund claim will be automatically updated in the liability register. This form shall not be filed for such recoveries.”.

[F. No. CBEC/20/06/17/2018-GST]

(Dr. Sreeparvathy S.L.)

Under Secretary to the Government of India

Note:- The principal rules were published in the Gazette of India, Extraordinary, Part II, Section 3, Sub-section (i) vide notification No. 3/2017-Central Tax, dated the 19th June,2017, published vide number G.S.R 610 (E), dated the 19th June, 2017 and last amended vide notification No. 54/2018 – Central Tax, dated the 9 th October, 2018, published vide number G.S.R 1011 (E), dated the 9 th October, 2018.

CGST Thirteenth amendment Rules 2018 as introduced by CBIC.

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.