Mapping of turnover from GSTR 9 to GSTR 9C

Mapping of turnover from GSTR 9 to GSTR 9C:

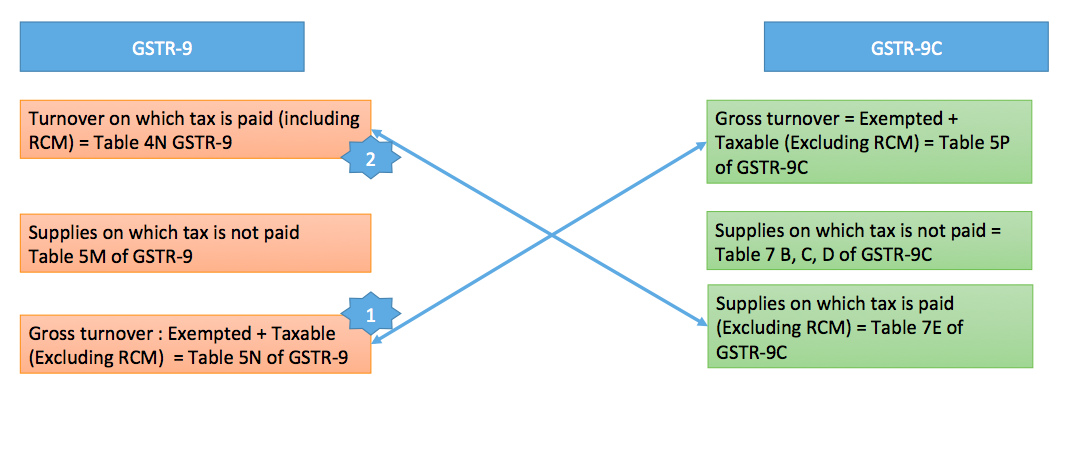

In this article we have discussed the Mapping of turnover from GSTR 9 to GSTR 9C. We will discuss all the mapping one by one. But in this particular write up we will cover the turnover only.

Flow of turnover data in GSTR 9:

In GSTR 9 it start from the supplies on which tax has been paid. Then Inward supplies on which tax is paid in RCM is added i Table 4G. Next table is for supplies on which tax is not paid. It is covered in Table 5 of GST Annual return form GSTR 9. Then 5N is calculated.

5N= 4N+5M-4G

It is the value of outward supplies on which tax has been paid excluding RCM.

Flow of data in GSTR 9C:

In GSTR 9C the flow of data is reverse. Table 5 start with turnover in financials. Then this data is drilled down to reach at the total turnover. Table 7 compiles all the outward supplies on which tax is not paid. After that the amount of supplies on which tax is paid is calculated in table 7E.

Matching of turnover in 9 & 9C:

Mapping of turnover from GSTR 9 to GSTR 9C

The data of 7E of GSTR 9C is matched with 4N of Annual return

The data in table 5P of GSTR 9C is matched with 5N+10+11 of GSTR 9.

Let us have a look what they were.

7E= Supplies on which tax is paid (excluding RCM inward supplies)

4N= Supplies on which tax is paid (Including RCM inward supplies)

Eg.

Precision industries had following data in their GSTR 9 & GSTR 9C. Pls fill their table 8 of GSTR 9C.

in GSTR 9:

Table 4:

| A. |

Supplies made to un-registered persons (B2C) |

5,00,000 |

| B. |

Supplies made to registered persons (B2B) |

2,00,000 |

| C. |

Zero rated supply (Export) on payment of tax (except supplies to SEZs) |

– |

| D. |

Supply to SEZs on payment of tax |

– |

| E. |

Deemed Exports |

– |

| F. |

Advances on which tax has been paid but invoice has not been issued (not covered under (A) to (E) above) |

25000 |

| G. |

Inward supplies on which tax is to be paid on reverse charge basis |

100000 |

| H. |

Sub-total (A to G above) |

825000 |

| I. |

Credit Notes issued in respect of transactions specified in (B) to (E) above (-) |

25000 |

| J. |

Debit notes issued in respect of transactions specified in (B) to (E) above (+) |

– |

| K. |

Supplies / tax declared through Amendments (+) |

– |

| L. |

Supplies / tax reduced through Amendments (-) |

– |

| M. |

Sub-total (I to L above) |

– |

| N. |

Supplies and advances on which tax is to be paid (H + M) above |

8,00,000 |

Table 7 of GSTR 9C:

Table 7A=5P =Rs. 7,00,000 (Assuming it was matching with annual return data)

Comparison:

7G=7F-7E

7G=4N of GSTR 9-7E

Rs. 8,00,000-7,00,000= Rs. 1,00,000

This is figure of reverse charge inward supplies. This mismatch will always be there. Table 4N includes the inward supplies covered in RCM but 7E is not covering it. This difference will always be there in 7G.

Reporting of discrepancy:

This difference and any other difference is required to be disclosed in table 8 of GSTR 9C.

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.