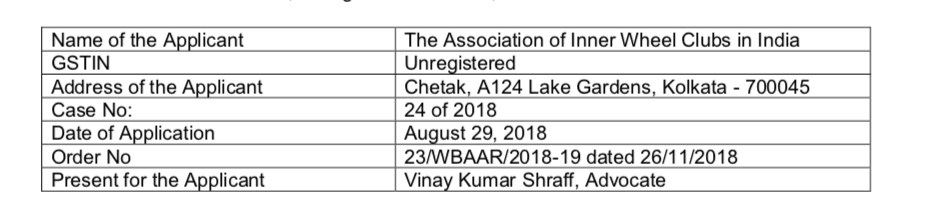

GST Case – 19 Association of Inner Wheel Clubs in India

GST Case – 19 Association of Inner Wheel Clubs in India

In the GST case of Association of Inner Wheel Clubs in India. The Taxability of funds received through Annual Subscription, Sponsorship Fees and Sale Of Souvenirs by Trust is raised.

1. Query:

The Applicant is affiliated to International Inner Wheel and accumulates funds through subscriptions, sponsorship fees, sale of souvenirs and organize events amongst other purposes to serve local community and provide financial and other practical support to the financially disadvantaged classes.

Whether the activities undertaken by the applicant maybe termed as “business” and “supply of services” as defined under the WBGST/CGST Act, 2017

2. Contention of the Applicant:

The Applicant relying upon the decision of Apex Court in Commissioner of Sales Tax v. Sai Publication Fund [(2002) 126 STC 288 (SC) submitted that activities of the applicant do not fall within the ambit of “business” as they are undertaken to facilitate and are ancillary to “charitable service” which is not covered under the definition of business under section 2(17) of CGST Act, 2017.

3. Observation by AAR:

Issue 1:

Fees Received from Members: Bye Laws of the Applicant mention that annual subscription fees is payable by each member and Voting rights would be withdrawn from Clubs in arrears with dues. Some of the facilities/benefits being granted exclusively to a member against subscriptions or fees are as follows:

a) Enabling members to attend conventions/meetings for the furtherance of the objectives of the Organisation,

b) Members would be associated with other similar organisations at national and global level. including those in the UN.

c) Inner Wheel Club award members for outstanding services.

Financial Statements of Financial Year 2017-18 show that fund collected is mainly spent on organising meetings and conventions like Triennial etc. and such meetings provide facilities to members in the form of a platform for social mixing, networking, promotion of friendship etc.

In the above backdrop, activity of appellant was held to be falling under “business” as defined under section 2(17)(e) which includes in its ambit provision by a club, association, society, or any other body (for a subscription or any other consideration) of facilities or benefits to its members.

Issue 2:

Charitable Activities and activity involving providing space for advertisements, raising sponsorship: Activity of the applicant does not fall within the ambit of “Charitable Activity” as defined under clause 2(r) of Notification No 12/2017-CT (Rate) dated 28.06.2017 and can be broadly defined as social welfare activities. The activity by the entity is an “adventure” and maybe be treated as a business under Section 2(17)(a) of the GST Act. It would be a taxable supply of service if consideration is charged from the recipient.

In the backdrop of social welfare activities of applicant being held as “Adventure” under 2(17)(a) of CGST Act, 2017; activity involving providing space for advertisements, raising sponsorship etc, was held to be business transactions within the meaning of section 2(17)(b) of CGST Act, 2017, being transactions undertaken in connection with or incidental or ancillary to the social welfare activities of the Applicant and therefore supplies in terms of Section 7(1) of the GST Act.

Issue 3:

Sale of Souvenirs: Sale of souvenirs is to be treated as a supply of goods.

4. Held:

Subscription and membership fee is classifiable under SAC Heading 99959 under the category ‘Services furnished by other membership organization’. Activity involving providing space for advertisements, raising sponsorship etc. was held to be classifiable under SAC Heading 99836 under the category ‘Advertising services’. Sale of souvenirs was held to be supply of goods.

Membership fees can be consideration in GST

5. Comments:

The judgement touches the cornerstone of controversial scenarios of supply of service but does not goes down the root cause of the issue. The judgement involved two of the most controversial scenarios i.e. supply of service by the club to its members and whether the club is involved in the carrying out of business or not.

Comment 1: Non-Consideration of Decision of Apex Court and High Court

It was surprising to note that A/R of the applicant referred to the decision of Hon’ble Apex Court in the matter of Commissioner of Sales Tax v. Sai Publication Fund [(2002) 126 STC 288 (SC) but AAR delivered its judgement as follows:

“The decision of the apex court in Sai Publication Fund (supra) is clearly not applicable in the present context, as the main activity is to be treated as a business.”

AAR did not refer and detailed out why decision of Hon’ble Apex Court is not applicable in the said matter. Similarly AAR Maharashtra as well in the matter of Shrimad Rajchandra Adhyatmik Satsang Sadhana Kendra also held similar activities as Business even though decision of Hon’ble Apex Court of Sai Publication and CIT Vs. Gujarat Maritime Board (2007) 14 SCC 704 (SC) and Bombay High Court in case of Lalbaugcha Raja Sarawajanik Geneshotsav Mandal (MVXA Tax Appeal No.10 of 2015 dt. 28.6.2015) and Commissioner of Sales Tax vs. Cutchi Dasha Oswal Mahajan Udyog Committee (36 STC 1) (Bom) were referred but AAR rejected all such cases by referring as follows:

Applicant has submitted different case laws mention of which is already made herein above. Since we have come to the conclusion that the activities carried on by the applicant is in the nature of business as defined u/s 2(17) of the GST Act and further considering the GST Regulations that all services provided by the religious trusts and charitable institutions are not exempt from tax and the various case laws referred by the applicant are in different context and therefore cannot be considered and relied upon in the facts of the present case.

Surprisingly, AAR referred that since they have arrived at conclusion, therefore decisions of Hon’ble Apex Court and High Court are not applicable. Both the decisions are clearly against the doctrine of judicial precedents wherein deviations are being made from the judgments of Apex Court and High Court without deliberating why these decisions are not applicable on the given case in hand.

Comment-2 (Issue 1): Fees Received from Members:

There are many decisions of Hon’ble Apex Court and High Courts on the matter i.e. CIT v. Darjeeling Club [1985 (153) ITR 676], CIT v. Bankipur Club [1997 (226) ITR 97] and Chelmsford Club v. CIT [2000 (243) ITR 89], Saturday Club Ltd. v. Assistant Commissioner of Service Tax [2005 (180) ELT 437].

However, stand of the revenue is pretty clear from service tax regime and there have been litigations arising out of the same. Under the GST Regime, Entry No. 77A inserted in Notification No. 11/2017 dated 28th June 2017 with effect from 26th July 2018 provides as under:

Services provided by an unincorporated body or a non-profit entity registered under any law for the time being in force, engaged in,-

(i) activities relating to the welfare of industrial or agricultural labour or farmers; or

(ii) promotion of trade, commerce, industry, agriculture, art, science, literature, culture, sports, education, social welfare, charitable activities and protection of environment,

to its own members against consideration in the form of membership fee upto an amount of one thousand rupees (Rs 1000/-) per member per year.

The above entry clarifies the intent of the government that services provided by an unincorporated body or non-profit entity to its own members for consideration in the form of membership fees upto Rs one thousand would be exempted and any fees in excess of the above would be taxable. Further, one of the conditions for the tax being levied is that service should have been provided to the members. AAR has in its judgment observed that against fees being collected, applicant is providing exclusive benefits to members and also spending fees on organizing meetings and conventions like Triennial etc. and such meetings provide facilities to members in the form of a platform for social mixing, networking, promotion of friendship etc. Therefore, it was held that tax was leviable on the membership fees collected by the applicant.

Comment -3-(Issue 2 and 3): Whether club is involved in the carrying out of business or not

This again was a bone of contention and the case referred to by the applicant was rejected without providing any reason by the AAR. Here again the stand of the revenue is pretty clear that the activities are in the nature of business and therefore liable to be considered as supply. In the press release dated 11th July 2017, It was clarified that No GST is applicable on food supplied free as prasadam by religious places like temples, mosques, churches, gurudwaras, dargahs, etc. The press release at one hand clarified that there is no tax leviable on the food supplied free but in the hindsight also sought to direct that if any consideration is charged for the supply of food, tax would be leviable.

AAR Maharashtra in the matter of Shrimad Rajchandra Adhyatmik Satsang Sadhana Kendra held that the activities of applicant trust i.e. sale of books, CDs and statues as well as provision of accommodation for participants for Shibir/Satsang are covered under the definition of ‘business’ as given under Section 2(17) of the CGST Act and in view of this, their activities are very well covered within the scope of ‘supply’ as given in Section 7 of the CGST Act, 2017. Thus, in absence of specific exemptions, activities of applicant trust being a charitable organisation registered under section 12AA of the Income Tax Act would qualify as taxable and would be liable to GST.

The decision runs contrary to the decision of Apex Court in Commissioner of Sales Tax v. Sai Publication Fund [(2002) 126 STC 288 (SC) whether Trust – Sai Publication Fund, which was set up by some devotees of Saibaba of Shridi for spreading his message, can be held to be a “dealer” in respect of sale of books, booklets, pamphlets, photos, stickers and other publications containing message of Saibaba and the turnover of such publication can be assessed to sales tax under the Bombay Sales Tax Act, 1959.

The definition of business as provided under the Bombay Sales Tax Act was similar to the one provided under the CGST Act, 2017 and for reference purposes, same is being reproduced hereunder:

“S.2(5A)- “Business” includes any trade, commerce or manufacture or any adventure or concern in the nature of trade, commerce or manufacture whether or not such trade, commerce, manufacture, adventure or concern is carried on with a motive to make gain or profit and whether or not any gain or profit accrues from such trade, commerce, manufacture, adventure or concern and any transaction in connection with, or incidental or ancillary to, the commencement or closure of such trade, commerce, manufacture, adventure or concern;…………..

It was observed by the Apex Court that object of Trust is to spread message of Saibaba of Shridi and in furtherance of and to accomplish the said object, trust publishes books, pamphlets and other literature containing message of Saibaba under the aegis of “Sai Publications” which are available to the devotees of Saibaba on nominal charge to meet the cost. Therefore, the Trust is not carrying on trade, commerce etc., in the sense of occupation to be a “dealer” as its main object is to spread message of Saibaba of Shridi as already noticed above and turnover of such publication cannot be assessed to sales tax under the Bombay Sales Tax Act, 1959.

Therefore, the issues would only be going to getting more tricky and seems that with divergent views, there needs to be a clarification on the issue to prevent huge litigation.