Original copy of GST AAR of M/s. Sandvik Asia Pvt. Ltd.

Original copy of GST AAR of M/s. Sandvik Asia Pvt. Ltd.

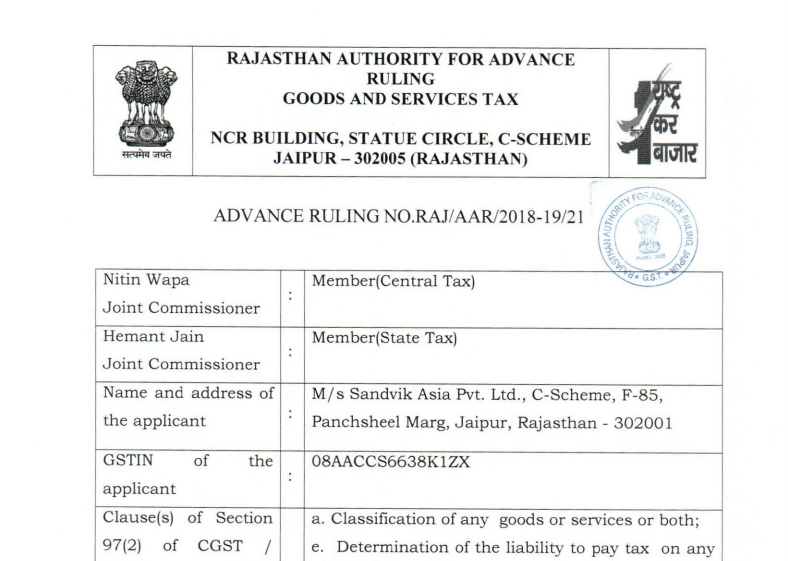

In the GST AAR of M/s. Sandvik Asia Pvt. Ltd. the applicant has raised the query regarding the applicability of the GST on the goods and services provided. Following is the GST AAR of M/s. Sandvik Asia Pvt. Ltd.:

Order:

Under Section 100 of the CGST/RGST Act 2017, an appeal against this ruling lies before the Appellate Authority for Advance Ruling constituted under section 99 of CGST/RGST Act 2017, within a period of 30 days from the date of service of this order.

The Issue raised by M/s Sandvik Asia Pvt. Ltd. {hereinafter the applicant} is fit to pronounce advance ruling as it falls under the ambit of Section 97(2)(a)(e) and it is given as under:-

a. Classification of any goods or services or both;

e. Determination of the liability to pay tax on any goods or services or both;

Further, the applicant being a registered person, GSTIN is 08AACCS6638K1ZX, as per the declaration was given by him in Form ARA-01, the issue raised by the applicant is neither pending for proceedings nor proceedings were passed by any authority. Based on the above observations, the application is admitted to pronounce advance ruling.

1. SUBMISSION OF THE APPLICANT:

The Applicant is a private limited company incorporated under the provisions of Companies Act, 1956 having registered head office located at Pune and holding GST registration Number (GSTIN) 08AACCS6638K1ZX for the State of Maharashtra.

1.1. The Applicant is a multi-product, multi-division entity, engaged in manufacturing, distribution and sales agency activities of various industrial products which include metal cutting tools, mining/construction equipment, spares for mining equipment, seamless stainless steel tubes and pipes and wires and heating systems. Further, the Applicant is also engaged in the business of after-sales support for the mining equipment manufactured by its overseas group entities which are imported by the customers into India.

1.2. With respect to after-sales support, the Applicant provides maintenance services for the imported equipment which includes repair and replacement of parts and tools. The maintenance services are provided for the equipment post issuance of commissioning certificate. The maintenance services are rendered on the equipment for a specific period as agreed with the customer from the commencement of mining operations depending upon the number of hours the equipment are operational or the quantum of output ton produced by the equipment during the equipment life cycle.

1.3 In respect of the supply of part under the proposed agreements, the Applicant would supply parts falling under multiple GST rates such as 12%, 18%, 28%, etc.

1.4. The Applicant intends to execute an agreement for providing maintenance services to prospective customers for equipment located at various sites in the state of Rajasthan.

2. QUESTIONS ON WHICH THE ADVANCE RULING IS SOUGHT

Applicant has sought ruling to be pronounced under section 97(2) (a) (e) of the CGST Act 2017, on the following questions:

1. Whether on facts and circumstances of the case, the maintenance services rendered on customers’ equipment under the two agreements i.e. comprehensive maintenance services agreement and supply of parts and services agreement which also includes supply and replacement of spare parts should be classified as ‘composite supply’ under Section 2(30) of Central Goods and Service tax Act, 2017 (CGST Act) and Rajasthan State Goods and Service Tax Act, 2017 (RJ SGST Act) [collectively referred to as the ‘GST Act’] or as mixed supply under Section 2(74) of GST Act?

2. In case the said agreements are considered as composite supply, what is the principal supply between goods and services?

3. In case services are considered as the principal supply, what tax rate should be applicable?

4. In respect of the said agreements, what shall be the relevant place of supply and type of tax which needs to be discharged? (i.e. CGST & SGST or IGST).

3. THE APPLICANTS INTREPRETATION:-

a. As per Section 2 (30) of GST Act, “composite supply” means a supply made by a taxable person to a recipient consisting of two or more taxable supplies of goods or services or both, or any combination thereof, which are naturally bundled and supplied in conjunction with each other in the ordinary course of business, one of which is a principal supply.

b. As per Section 2 (74) of GST Act, “mixed supply” means two or more individual supplies of goods or services, or any combination thereof, made in conjunction with each other by a taxable person for a single price where such supply does not constitute a composite supply.

c. As per Section 2 (90) of GST Act, “principal supply” means the supply of goods or services winch constitutes the predominant element of a composite supply and to which any other supply forming part of that composite supply is ancillary.

d. In the present case, the Applicant is entering into agreements with prospective customers with the sole intention to provide maintenance services to a customer. The main object of such maintenance services is to ensure the uninterrupted operation of the equipment, which could be achieved by ensuring the guaranteed availability of the equipment as defined under the agreement. Further, it is important to note that in case such guaranteed availability is not achieved by the Applicant, then the Applicant may be liable to penal consequences.

e. In order to achieve the above guaranteed availability, the Applicant may or may not necessarily require to use or supply spare parts or goods on a regular basis, however the Applicant would be required to supply maintenance services which would be rendered through skilled engineering, labourers etc. stationed at the site.

f. Further, it is important to note that in order to ensure the uninterrupted operation of the equipment the maintenance services are required to be performed, accordingly, depending on the requirements for performing the services, the Applicant would be supplying goods or services which could vary on each equipment.

g. Thus, it is clear that the main activity performed by the Applicant would be in respect of providing maintenance services ensuring uninterrupted operation of equipment irrespective of the quantum of goods required for the said purpose.

h. Therefore, it could be said that the supply of spares or other goods for providing maintenance services would be incidental or ancillary to the repair or maintenance services to be provided under the agreement.

i. In order to classify any activity as a composite supply, it could be said that the following conditions are required to be fulfilled referring the definition under Section 2(30) of GST Act:-

a) There should be two or more taxable supplies of goods or services or both;

b) The taxable supplies should be naturally bundled in the ordinary course of business;

c) The taxable supplies should be supplied in conjunction with each other in the ordinary course of business; and

d) One taxable supply should be a principal supply. In such case the principal supply would be treated as the main supply and the entire transaction should be liable to GST as per the rate applicable to the principal supply.

j. We believe that the maintenance services to be provided by the applicant fall under the definition of composite supply as it satisfies above conditions as explained below:

a) Two or more taxable supply of goods or services or both:

In the present case, more than one type of taxable goods could be used as spare parts for providing maintenance services. Further, taxable services of repair and maintenance are also being

provided under the same agreement along with supply of goods. Hence, the conditions of two or more taxable supply of goods or services are being satisfied under the subject agreement.

b) Taxable supplies should be naturally bundled in the ordinary course of business.

In order to understand whether any service is naturally bundled or not, it is important to refer to the Education Guide issued by the Central Board of Excise and Customs (‘CBEC’) now renamed as Central Board of Indirect Tax and Customs (‘CBIC’). Para 9.2.4 of the Education Guide mentioned the following:-

“Whether services are bundled in the ordinary course of business would depend upon the normal or frequent practices followed in the area of business to which services relate.”

Download the Original copy of GST AAR of M/s. Sandvik Asia Pvt. Ltd. by clicking the below image:

The nature of the various services in a bundle of services will also help in determining whether the services are naturally bundled in the ordinary course of business. If the nature of services is such that one of the services is the main service and the other services combined with such service are in the nature of incidental or ancillary services which help in better enjoyment of a main service. Referring to the scope of work to be executed under the above agreement, we have analysed few of the above indicative factors below:-

i. Perception of the service recipient: The intention of both the supplier and the service recipient under the execution of the agreement is to ensure the uninterrupted operation of the equipment. Thus, the perception of the recipient is intended towards the receipt of maintenance services irrespective of the quantum of goods being consumed for provision of such maintenance services.

ii. Advertised as a single package: The Applicant is engaged in providing its services to multiple customers in the mining industry and the applicant’s equipment, its spare parts and skilled engineers are proprietary in nature and difficult to replace in the local or domestic market. Hence the Applicant markets its maintenance services as a single package where the Applicant’s sole obligation is to ensure guaranteed availability of the equipment to the customer. The guaranteed availability is mutually defined in the agreement. Hence the quantum of goods used is not possible since it varies every time depending on the requirement of the equipment to ensure its guaranteed availability. Therefore the Applicant offers the maintenance services as a whole to its clients charging therein a fixed amount, on the basis of the time the equipment has been in operation or the output the equipment has produced.

iii. Single Price: As mentioned above, the Applicant provides these maintenance services as a single package which includes supply of goods and services. The pricing of these services is also fixed on the basis of the time the equipment is in operation or the quantum of output produced by the equipment. Hence, the quantum of goods consumed in providing these services would be irrelevant in respect of the price to be charged to the customers by the Applicant. Further, as discussed earlier, the Applicant may not be able to predict the type of goods that may be required for the maintenance of the equipment prior to providing maintenance services. Hence, it is not practically possible for the Applicant to separate the goods and services being supplied for ensuring continuous operation of the equipment. Accordingly, the Applicant intends to charge a fixed amount of consideration as per pre-determined hourly rates/ per ton rates on the basis of hours the equipment has been in operation or the quantum of output produced by the equipment.

iv. Nature of various services: the nature of services provided under this agreement is such that the main services could be categorized as the maintenance services provided to the customer and further the supply of goods is incidental to the supply of maintenance services.

Therefore, as per above discussion, it is clear that the supply of goods and services executed under the above agreement are naturally bundled in the ordinary course of business.

c) Taxable supply should be supplied in conjunction with each other.

The term ‘conjunction’ under Oxford dictionary has been “Conjunction: The action or an instance of two or more events or things occurring at the same point in time or space”

In the instant case, the supply of goods or services or both shall be occurring together or at the same point of time as the sole intention of the agreements is to ensure that the equipment is operating without any interruptions. Hence, it could be said that the supply of goods or services would be done by the Applicant in conjunction with each other.

d) One taxable supply should be a principal supply

The definition of principal supply states that the supply which constitutes the predominant element of a composite supply and to which the other supply is ancillary shall be the principal supply.

As the provision of maintenance services under the said agreements is with the objective to ensure smooth and uninterrupted operation of the equipment. Thus, the activity of providing maintenance and repair service would constitute the predominant element of the composite supply whereas supply of other goods or service that may be required to be supplied under the agreements shall be ancillary to the main service.

Further, it is also important to distinguish the concept of composite supply and mixed supply to have clarity on the subject matter. Under both the concepts i.e. composite supply and mixed supply there are supplies of two or more goods or services or both or any combination thereof and which are supplied in conjunction with each other. However, the distinguishing factor between composite supply and mixed supply is that a composite supply involves supplies of goods or services or both or any combination thereof which is naturally bundled in ordinary course of business and one of the supplies is the principal supply. Further, where the supply has been constituted as composite supply then the said supplies shall not be considered as mixed supply in terms of the definition.

k. The Uttar Pradesh Authority for Advance Ruling in case of M/s GE Diesel Locomotive Private Limited vide order dated 16.05.2018 held that comprehensive maintenance services in relation to railway locomotives are a composite supply of maintenance services.

4. PERSONAL HEARING (PH)

4.1 In the matter personal hearing was given to the applicant on 08/10/2018 wherein Sh. Nitin Vijayvargiya, Authorised representative (AR) appeared on behalf of the Applicant. During the PH the AR reiterated the submissions already made in the application for advance ruling and requested that the case may be decided at the earliest.

4.2 The jurisdictional officer in his comments has submitted that “the said supply is a mixed supply. As per Section 2 (74) of GST Act, “mixed supply” means two or more individual supplies of goods or services, or any combination thereof, made in conjunction with each other by a taxable person for a single price where such supply does not constitute a composite supply. Under Section 2 (74) of GST Act, the applicable GST for the supply will be 28%. Tax in relation to CGST and RGST for Rajasthan will be leviable only when place of supply is Rajasthan”.

5. FINDINGS. ANALYSIS & CONCLUSION:

5.1 We have gone through the contents of the application, submissions given by applicant at the time of hearing, comments of the concerned jurisdictional officers and accordingly find that the Applicant is a multiproduct, multi-division entity, engaged in manufacturing, distribution and sales agency activities of various industrial products which include metal cutting tools, mining/construction equipment, spares for mining equipment, seamless stainless steel tubes and pipes and wires and heating systems. Further, the Applicant is also engaged in the business of after sales support services for the mining equipment manufactured by its overseas group entities which are imported by the customers into India.

Question no.1

The applicant is mainly providing support services in respect of maintenance of machinery supplied by them. The machinery supplied in 2017 also requires maintenance and further supply of its parts by the applicant. We also find that the applicant also makes an integrated contract for the operation and maintenance service and they are not in a position to ascertain which parts are to be supplied in the course of its operation and maintenance. In these two situations the question raised by the applicant is that Whether on facts and circumstances of the case, the maintenance services rendered on customers’ equipment under the two agreements i.e. comprehensive maintenance services agreement and supply of parts and services agreement which also includes supply and replacement of spare parts should be classified as ‘composite supply ‘ under Section 2(30) of Central Goods and Service tax Act, 2017 (CGST Act) and Rajasthan State Goods and Service Tax Act, 2017 (RJ SGST Act) [collectively referred to as the ‘GST Act’] or as mixed supply under Section 2(74) of GST Act?

5.2 We find that Integrated contract made by the applicant is classifiable under Composite supply in terms of Section 2 (30) of GST Act, which means ‘a supply made by a taxable person to a recipient consisting of two or more taxable supplies of goods or services or both, or any combination thereof which are naturally bundled and supplied in conjunction with each other in the ordinary course of business, one of which is a principal supply’. The Contract made for parts and services is classifiable under mixed services under Section 2(74) of CGST/RGST Act, 2017.

5.3 The applicant’s contention is that in both the situations the service is classifiable under Composite Service which is not tenable. Regarding the Contract made for maintenance services in respect of machinery supplied in 2017, the applicant is well aware about the parts which would suffer wear and tear and need to be replaced by the applicant. Further, the applicant in their contract named ‘Equipment parts Supply and Service Agreement’ in Schedule-D, also shows that in their daily/monthly log-sheet the applicant has to mention the parts being replaced by them. It is evident that the applicant can supply these parts individually and along with the package of the services. Supply of parts and services are known and can be supplied individually to the customers, hence, these supplies fall under the services specified under Section 2(74) of the CGST/RGST Act, 2017 and they are chargeable to GST at applicable rates such as 12%, 18%, 28%, etc. whichever is higher.

5.4 As per Section 2 (74) of GST Act, “mixed supply” means two or more individual supplies of goods or services, or any combination thereof, made in conjunction with each other by a taxable person for a single price where such supply does not constitute a composite supply.

5.5 In the present case the applicant can supply the parts or services individually or any combination thereof on a single price which is appropriately covered under mixed supply.

5.6 However, the contention of the applicant regarding “Comprehensive Maintenance Contract”, that the services would be classifiable under the Composite Services, we are of the view that Services supplied under the said contract are to be treated as composite services and the tax rate applicable on the principle supply would also be applicable on the other services.

Question no. 2

5.7 The Second question arises on the basis of first question. The concept of principle supply is applicable only in supply of composite service. As already discussed, the applicant is supplying both type of services i.e. mixed supply and composite supply. There is no concept of principle supply in mixed supply.

5.8 The concept of principle supply is under Composite supply. On going through the contents of the Integrated Contract, we are of the view that in composite supply, the applicant is mainly providing operation and maintenance services of the machines supplied by them and hence, the principle supply would be the same i.e. operation and maintenance services. In the present case, main issue is to ensure the uninterrupted operation of the equipment through supply of maintenance services. For the provision of such services, the Applicant has to supply certain goods such as spare parts and consumables, and would also supply maintenance services through skilled engineers, labourers etc.

5.9 The consumption of goods vary substantially depending on the wear and tear of the equipment, however the consumption of services which would be critical may not vary substantially as these engineers would be stationed at the mine site and accordingly perform maintenance activities on the equipment at regular intervals. Therefore, the predominant element in the composite supply would be provision of maintenance services and the supply of goods would be ancillary to such services.

5.10 Accordingly, the supply of maintenance services should be considered as the principal supply and the supply of other goods or services shall be ancillary to such principal supply.

Question no.3

5.11 The maintenance services provided in the above agreements should be classified as a composite supply of maintenance services and hence the tax rate applicable for the supply of maintenance services should be under the ‘Chapter Heading of 9987- Maintenance, repair and installation (except construction) services’.-

Service Accounting Code (‘SAC’) 998717: Maintenance and repair services of commercial and industrial machinery refers that:-

This service code includes maintenance and repair services of engines and turbines (except aircraft, vehicle and cycle engines), pumps and compressors, taps and valves, furnaces and furnace burners, lifting and handling equipment, nondomestic cooling and ventilation equipment, agricultural and forestry machinery, machine tools, machinery for metallurgy, machinery for mining, quarrying and construction, machinery for food, beverage and tobacco processing, machinery for textile, apparel and leather production, machinery for paper and paperboard production, weapons and weapons systems, agricultural, forestry and garden tractors and lawnmowers, other general-purpose machinery and special- purpose machinery.

This service code does not include:

– maintenance and repair services of domestic boilers and burners, cf 995463 and

– elevators, goods lifts, escalators and moving pavements, cf 998718

5.12 Thus, the service code for Maintenance and repair services of commercial and industrial machinery is 9987171 and the prescribed rate of GST is 18% (CGST @ 9% of the taxable value, SGST @ 9% of the taxable value) or IGST @ 18% of the taxable value.

5.13 For the supply of mixed services, the applicant is liable to pay the highest rate of tax as per Section 8(b) of the CGST Act, 2017. Section8(b) of the CGST act is as below:-

“a mixed supply comprising two or more supplies shall be treated as a supply of that particular supply which attracts the highest rate of tax.”

Question 4

5.13 The applicant has also made a query about the place of supply, whether in the facts and circumstances of the case, what shall be the relevant place of supply and type of tax which needs to be discharged? (i.e. CGST & SGST or IGST).

5.14 The place of supply can be determined as per Chapter V of IGST Act, 2017. Section 10 of IGST Act relates to place of supply of goods and Section 12 of IGST relates to place of supply of services. As the applicant is supplying the parts of the machinery and also providing the services of operation and maintenance, accordingly the place of supply will be determined as per Section 10 or Section 12 of the IGST Act. We find that the determination of place of supply as requested by the applicant cannot be decided by the authorities for Advance Ruling constituted under Section 96 of SGST Act, 2017. The Authority constituted under the said section can determine or pronounce Advance ruling only on the issues specified under Section 97(2) of CGST/SGST Act, 2017 and determination of place of supply has not been specified under Section 97(2). In view of above we are not giving any finding in respect of place of supply. Hence the query raised by the applicant is accordingly disposed off.

Ruling:

6. In view of the above stated facts we pronounce the ruling as under:-

1. The activities performed under the ‘Comprehensive Maintenance Contract’ are to be treated as a composite supply of services and the activities performed under ‘Equipment Parts Supply and Services Agreement’ are to be treated as Mixed Supply.

2. In respect of the activities performed under ‘Comprehensive Maintenance Contract’, the supply of Operation & Maintenance services is the principal supply and the supply of other services are ancillary to such principal supply.

3. The service code for Maintenance and repair services of commercial and industrial machinery is 9987171 and the prescribed rate of GST is 18% (CGST @ 9% of the taxable value, SGST @ 9% of the taxable value) or IGST @ 18% of the taxable value. For the supply of mixed services, the applicant is liable to pay the highest rate of tax as per Section 8(b) of the CGST Act, 2017.

4. As the query raised by the applicant does not fall in the categories mentioned under Section 97(2) of CGST/SGST Act, 2017, hence the same is accordingly disposed off.

Source: http://gstcouncil.gov.in/sites/default/files/ruling-new/Raj.21.2018-19%20-Sandvik.pdf

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.