FEES ON ANNUAL FILING

FEES ON ANNUAL FILING AFTER 31st DEC 2018

The late fees on annual filing after 31st Dec 2018 is being discussed in the article. The late fees is applicable if the compliance under Companies Act.

Most of the professionals are of the view that they have to pay Rs. 100 per day w.e.f. 01st Jan 2019, but this view is not correct.

The penalty of Rs. 100 per day will be levied in the following manner:

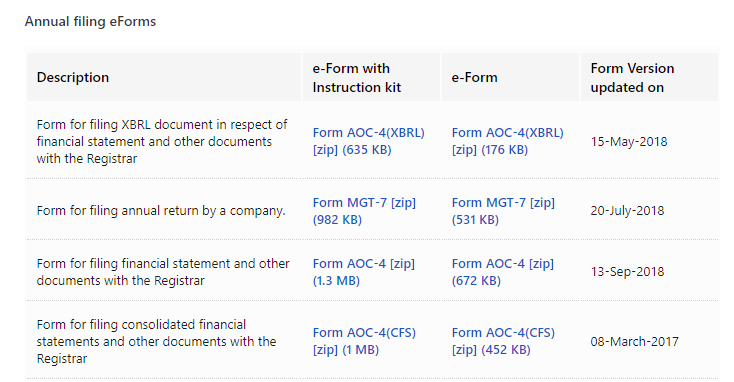

1. Form AOC-4, AOC-4 CFS, AOC-4 XBRL– Rs. 100 per day w.e.f. 30th October, 2018 If the AGM held on 30th September, 2018.

Illustration: If the AGM held on 30th September, 2018, the Company will have to pay the additional fees of Rs. 6200 if Company files on 01st January, 2019 and so on.

2. Form MGT-7 – Rs. 100 per day w.e.f. 29th November, 2018 If the AGM held on 30th September, 2018.

Illustration: If the AGM held on 30th September, 2018 the Company will have to pay the additional fees of Rs. 3400 if Company files on 01st January, 2019 and so on.

STAY COMPLIANT

With Regards

Varun Kapoor, PCS

CS Varun Kapoor

CS Varun Kapoor

New Delhi, India