Original copy of GST AAR of M/s. Inox Air Products Pvt. Ltd.

Original copy of GST AAR of M/s. Inox Air Products Pvt. Ltd.

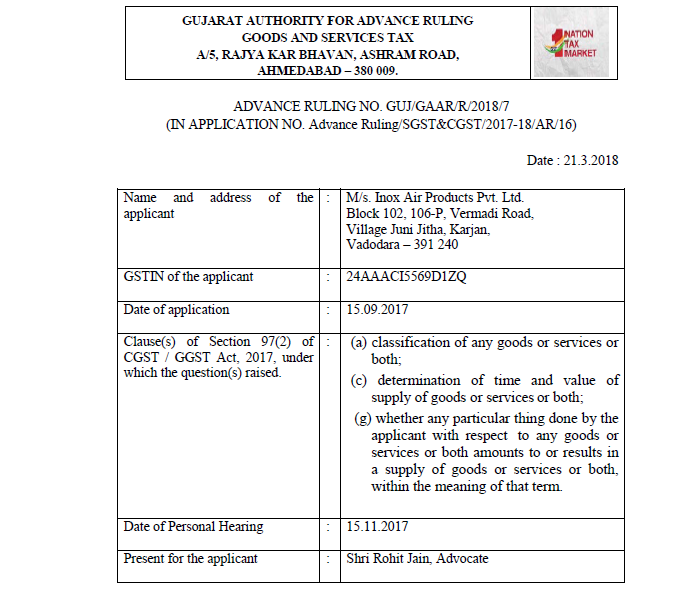

In the GST AAR of M/s. Inox Air Products Pvt. Ltd. the applicant has raised the query regarding the classification of supply. Whether it is “Job Work” or not. Following is the GST AAR of M/s. Inox Air Products Pvt. Ltd.:

Order:

The applicant M/s. INOX Air Products Private Limited (hereinafter also referred to as ‘INOXAP’) is engaged in the business of manufacture and supply of industrial gases, including Oxygen, Nitrogen, Argon etc. M/s. Essar Steel India Limited (hereinafter referred to as “M/s. Essar”) is in the business of manufacture and supply of steel and has one of its steel plants at Hazira, Gujarat. M/s. Essar requires certain quantities of Oxygen, Nitrogen, and Argon on a continuous and dedicated basis, to manufacture steel at their Steel Plant. Accordingly, the applicant has entered into a Job Work Agreement dated 07.02.2014 with M/s. Essar, in terms of which the applicant acts as a job worker for M/s. Essar.

2.1 M/s. Essar undertakes to provide the necessary goods such as Electricity, Industrial quality water to the applicant on a free-of-cost basis, using which the applicant manufactures industrial gases (Oxygen, Nitrogen and Argon) for Essar on Job Work basis. It is submitted that the arrangement is on a job work basis, accordingly, the title to the electricity and industrial water remains with M/s. Essar and M/s. Essar is also the owner of the gases manufactured by the applicant using the said electricity and water.

2.2 It is submitted that the gases so produced are further captively consumed by M/s. Essar in its steel manufacturing operations. In order to ensure continuous availability of the gases, the applicant’s gas plant is located at a designated land within the premises of the Steel Plant. The applicant has obtained a separate GST registration for this premises.

2.3 The mechanics of the transaction and consideration payable by M/s. Essar to the applicant for the manufacture and supply of gases is as follows :-

a. The applicant will raise a daily invoice for the fixed and variable job work charges for each product, based on the quantum cleared on that day;

b. At the end of each month, the applicant will raise a supplementary invoice for ‘additional consideration’ for the gases supplied in that month, equivalent to the difference between the monthly fixed and variable job work charges (as agreed by the parties) less the fixed and variable job work charges billed on a daily basis. A separate supplementary invoice will be raised for gas supply and for supply of vaporised liquid gas.

c. At the end of each month, a supplementary invoice will also be raised on account of WPI / CPI escalation on the variable job work charges, based on the WPI / CPI index for the previous quarter. Again, a separate supplementary invoice will be raised for gas supply and for supply of vaporised liquid gas.

d. One time job work charges charged for production within the first 30 days post commencement of production.

e. Job work charges to be charged for operation of plant in excess of 355 days a year (subject to a maximum of 5 days).

2.4 It is submitted that under the pre-GST regime, the applicant was duly discharging Excise duty on the gases supplied to M/s. Essar at the time of their removal from the applicant’s premises. Since the applicant was acting as a job worker for Essar, the valuation was carried out as per Rule 10A of the Central Excise (Determination of Price of Excisable Goods) Rules, 2000 (herein after referred to as the ‘Central Excise Valuation Rules, 2000’). Further, since the gases were captively consumed by M/s. Essar, Rule 8 of Valuation Rules was also pertinent, which mandated the payment of Central Excise Duty on the cost of manufacturing plus a ten per cent mark-up. In light of Rule 10A read with Rule 8 of the Valuation Rules, the applicant discharged the Central Excise Duty on an assessable value comprising of the following:

(a) Job Work Charges payable by Essar to applicant;

(b) The value of electricity and industrial water provided by Essar;

(c) Notional rent for the designated land;

(d) Escalation on account of WPI / CPI

Plus a ten per cent mark-up on the aforesaid.

2.5 In view of the above, the applicant raised following issues for determination before this authority :-

(i) Whether the activity undertaken by the applicant amounts to “Job Work” as defined under Section 2(68) of the Central Goods and Services Tax Act, 2017 (herein after referred to as the ‘CGST Act, 2017’) ?

(ii) What is the value on which the applicant is liable to pay GST ?

3. The applicant has referred to various provisions of CGST Act, 2017 with respect to job work, supply and valuation. The applicant has also referred to various clauses of agreement between them and M/s. Essar.

4.1 As regards the issues whether the activities undertaken by the applicant amounts to job work as defined under Section 2(68) of the CGST Act, 2017, it is submitted that traditionally, the concept of job work, which has evolved over the period, clearly signifies that job work involves undertaking certain processing activities in respect of the goods supplied by the principal, resulting in intermediate / finished product. A job work typically works solely on behalf of and for the principal. It is submitted that in the present case, the applicant uses its air separation plant to separate the Oxygen, Nitrogen and Argon by liquefying and separating the atmospheric air. Accordingly, it is pertinent to note that activity of manufacture of gases by Air Separation Unit (‘ASU’) requires three primary ingredients viz. air, electricity and water for separation of the atmospheric air. These raw materials and inputs are supplied to them by M/s. Essar and the said activity of separation of air to obtain gases is done on behalf of M/s. Essar only. Therefore, the transaction in the present case clearly classifies as a job work transaction. They submitted that as clarified by the Circular D.O.F. No. 334/4/2006-TRU dated 28.02.2006 issued by the Ministry of Finance, which has reiterated the settled law (UOI Vs. Playworld Electronics Private Ltd. – AIR 1990 SC 2002), that in order to determine the taxability of a transaction, it is essential to determine its true commercial nature. It is submitted that the perusal of various clauses of the Agreement between the applicant and M/s. Essar, the following emerge as key features of the contractual and commercial arrangement between the parties :

(a) Essar is to provide designated land and all other inputs including electricity, industrial water etc. uninterruptedly, on free-of-cost basis to INOXAP, and the ownership of the land and inputs will remain with Essar at all times.

(b) Essar shall be the sole and absolute owner of the gases which result from the processing by INOXAP.

(c) INOXAP cannot in any manner deal with the gases that result from the processing which is carried out by utilising the inputs provided by Essar, and the mere fact the INOXAP processes the inputs provided by Essar for manufacturing the gases does not give INOXAP any rights whatsoever over the gases so produced.

It is submitted that in light of the foregoing, in terms of the proposed arrangement between the parties, M/s. Essar is required to provide land and all other inputs for manufacture of gases by the applicant. The said inputs are processed by the applicant for manufacturing the industrial gases by employing its plant and personnel, and the applicant has no rights whatsoever to the resultant gases. It is submitted that in view of the commercial arrangement outlined above, the activity undertaken by the applicant on behalf of M/s. Essar is clearly a job work activity.

4.2 It is submitted that from the provisions of the CGST Act, 2017, there are three essential requirements to be fulfilled by the applicant in the present case to term the present transaction as job work, namely :

(a) The activity undertaken by the company should qualify as a ‘treatment or process’,

(b) The treatment or process undertaken should be on goods i.e. the raw materials/ inputs involved in the present cases should fall within the ambit of term ‘goods,

(c) The goods should belong to ‘Essar’.

4.3 The applicant submitted that as the terms ‘treatment’ or ‘process’ have not been defined under the GST laws, reliance is placed on various dictionary meanings and judicial precedents in this regard. They referred to decisions in the case of CST Vs. Samodar Padmanath Rao [1968 (22) STC 187 (Bom)] and Haldia Petrochemicals Ltd. Vs. Commissioner of Central Excise, Haldia [2006 (197) E.L.T. 97 (Tri.-Del.)]. They also referred to S.B. Sarkar’s Word & Phrases of Excise, Customs & Service Tax, 4th Edition, wherein it is mentioned that process means ‘prepared, handled, treated or produced by a special process’. They also referred to Websters Dictionary, wherein it is mentioned as ‘processing means to subject to some special process or treatment; to subject (esp. raw material) to a process of manufacture, development or preparation’. The applicant submitted that considering the above, it can be concluded that the activity of separation of air to obtain industrial gases, such as Oxygen undertaken by the applicant amounts to a ‘process’ and accordingly, the applicant is undertaking a process in the present case on the goods. Therefore, condition (a) mentioned above is fulfilled in the present case.

4.4 The applicant submitted that the raw materials / inputs on which the treatment / process undertaken by the applicant should qualify as ‘goods’. In this regard, they referred to definition of term ‘goods’ given in section 2(52) of the CGST Act, 2017. They also referred to the definitions of ‘goods’ given under some of the erstwhile Sales Tax and VAT legislations. It is submitted that in the context of the definition of ‘goods’ under the Sales Tax and VAT legislations, the Hon’ble Supreme Court has examined and ruled on the issue of whether electricity constitutes ‘goods’. They referred to the decision of Hon’ble Supreme Court in the case of Commissioner of Sales Tax, M.P., Indore Vs. M.P. Electricity Board, Jabalpur [1970 (25) STC 188] and State of Andhra Pradesh Vs. National Thermal Power Corporation Ltd. and Ors. [(2002) 3 SCR 278] and submitted that electricity is in the nature of moveable property which is capable of abstraction, transmission, consumption and use, consequently electricity would fall within the ambit of the term ‘goods’ as defined under the CGST Act, 2017. They referred to the meaning of the term ‘movable property’ given in Black’s Law Dictionary and submitted that ‘Air’ used as an input by the applicant clearly falls within the ambit of the definition of the term ‘movable property’ and therefore, the same would fall within the ambit of the definition of the term ‘goods’ as defined under the CGST Act. As regards the water, the same being tangible movable property, the same would also qualify as ‘goods’. Therefore, condition (b) mentioned above is fulfilled in the present case.

4.5 As regards the condition that the goods should belong to the principal and should be provided to the applicant for undertaking the processing activity, the applicant submitted that as far as electricity and water is concerned, there is no iota of doubt that the same belongs to M/s. Essar as the payment for procurement of the same to the Government authorities is also done by M/s. Essar only. Further, this is also evident on perusal of clause 4 of the Agreement. As regards the ‘Air’ used by the applicant for manufacture of the industrial gases, they submitted that the following aspects need to be examined to conclude on the issue of ownership of the air viz. (i) statutory position; and (ii) position under the commercial arrangement.

They submitted that it is a settled position in law that the owner of land is also the owner of the vertical column of air above the land. This position derives from the Latin maxim cuius est solum, eius est usque ad coelum et ad inferos, and has been legislatively recognized under the Indian Easements Act, 1882 at Section 7 thereof. It is submitted that the said provision clearly states that the ownership of land includes ownership of the air vertically above the land and this principle has also been judicially accepted in a plethora of decisions. In light of the settled principle of law, the ownership of land extends to the ownership of the air vertically above it, accordingly, the air (above the land which is owned by Essar), clearly belongs to M/s. Essar.

It is further submitted that in terms of the arrangement between the parties, M/s. Essar is required to provide land and all other inputs for the processing of gases by the applicant. Since the owner of the land would own the ambient air above its land, in effect, Essar has provided the same to the applicant in terms of the arrangement (along with electricity, industrial water etc.). In view of both the statutory position as well as the position under the commercial arrangement outlined above, it is clear that the air also belongs to Essar, which is provided to the applicant to undertake the processing activity. Therefore, all the goods used by the applicant for manufacture of industrial gases belong to Essar only, accordingly, condition (c) mentioned above is fulfilled in the present case.

4.6 The applicant submitted that as all the conditions required to be fulfilled by the applicant in order to fit into the definition of the term ‘job work’ are satisfied, the present transaction would be construed as a job work transaction and the applicant would be considered as a job worker of Essar.

5.1 As regards the valuation, it is submitted that the valuation of the present transaction would be transaction value as determined in accordance with Section 15(1) of the CGST Act, 2017 i.e. the price actually paid or payable when the following two conditions are satisfied :

- The supplier and the recipient of the supply should not be related, and

- Price should be the sole consideration for the supply

They referred to the decisions in the cases of Commissioner of Central Excise Rajkot Vs. Jai Bharat Steel Industries [2005 (192) ELT 792 (Tri.-Mumbai)], maintained in Supreme Court [2016 (340) ELT A138 (SC)] and Eicher Tractors Ltd. Vs. Commissioner of Customs, Mumbai [2000 (122) ELT 321 (SC)] and submitted that when transaction value can be determined in accordance with the provisions contained under Rule 4(1) of Customs Valuation Rules, 1988 / Customs Valuation (Determination of Price of Imported Goods) Rules, 1988, there is no question of determining value under subsequent rules. They submitted that even under the GST regime, if the transaction value can be determined in accordance with Section 15(1) of the CGST Act, then there is no question of determining the value under Chapter IV of the CGST Rules.

5.2 They submitted that the applicant and M/s. Essar do not fall within the ambit of the definition of the term ‘related person’, the valuation of the transaction in present case can be determined in accordance with Section 15(1) of the CGST Act, 2017 i.e. transaction value. Therefore, there is no need to determine the value in accordance with Chapter IV of the CGST Rules.

5.3 It is further submitted that the transaction value is the price actually payable or paid and in the present case, the price actually paid or payable is the job work charges, therefore, GST in the present transaction would be payable only on the job work charges paid by M/s. Essar to the applicant.

6. The applicant also submitted that they only process the goods supplied by M/s. Essar to manufacture those goods into industrial gases. The activity of processing applied to another person’s goods is a supply of service by virtue of Section 7(1)(d) read with Entry 3 of Schedule II of the CGST Act, 2017 which provides that ‘any treatment or process which is applied to another person’s goods is a supply of services’. Accordingly, the process is undertaken by the applicant in the present case on the goods belonging to M/s. Essar would be considered as a ‘Supply of Service’ and GST on the said transaction would be payable only on the processing charges collected by the applicant from M/s. Essar.

7.1 The applicant filed further submission vide letter dated 16.11.2017, wherein they referred to clause 4.3.1 and 6.1.4 of the agreement between M/s. Essar and the applicant and submitted that the land is an essential requirement under the agreement for the company to undertake the manufacturing activity and the same is being provided by M/s. Essar to the applicant. They cited various judgments in support of their submission that the owner of land is also the owner of the vertical column of air above the land, and submitted that the transaction between M/s. Essar and the applicant would be construed as a job work transaction and the applicant would be considered as a job worker of M/s. Essar. Further, the GST would be payable only on the job work charges paid by M/s. Essar to the applicant.

8.1 The Central Excise & GST, Vadodara – I Commissionerate informed that the applicant has entered into a job work agreement with M/s. Essar on 07.02.2014. M/s. Essar is providing necessary goods i.e. Electricity, Industrial quality water to the applicant free of cost. In fact, as per their agreement (Para 4.3.2 Page 25), earlier they were paying Central Excise duty. The gases produced are further captively consumed by M/s. Essar in its steel manufacturing operations. The applicant’s claim that they have obtained a separate GST registration for location at designated land of Essar is not correct as the applicant has mentioned it as their additional place of business and GST Registration’s copy has been submitted.

8.2 The definition of ‘job work’ under Section 2(68) under the CGST Act, 2017 has been referred and it is submitted that the job work means undertaking any treatment or process by a person on goods belonging to another registered taxable person; that the person who is treating or processing the goods belonging to other person is called ‘job worker’ and the person to whom the goods belong is called ‘principal’.

8.3 With respect to the submissions made by the applicant at Para 4.1.2 of the submissions wherein it has been stated that the activity of manufacture of gases by Air Separation Unit (ASU) requires three primary ingredients viz., air, electricity, and water for separation of the atmospheric air and that these raw materials and inputs are supplied to them by Essar and the said activity of separation of air to obtain gases is done on behalf of Essar only, it has been informed that as per Section 2(52) of the CGST Act, 2017, the ‘goods’ means every kind of movable property other than money and securities but includes actionable claim, growing crops, grass and things attached to or forming part of the land which are agreed to be severed before supply or under a contract of supply.

The industrial gases, in this case, are admittedly manufactured by separating the ‘Atmospheric air’ which is the main input and is not in possession of M/s. Essar and the ‘Atmospheric air’, therefore, is not a property of M/s. Essar that can be transferred or given to the applicant for manufacturing industrial gases from it. Even the electricity is not the goods, supplied by M/s. Essar, on which any treatment or process is undertaken by the applicant to manufacture industrial gases. Therefore, the activity of the applicant does not meet the definition of ‘job work’ given in the CGST Act, 2017 as it does not involve any treatment or process on goods belonging to another registered person. It is evident that the applicant is involved in an activity which is not job work but manufacture and supply of a completely new item i.e. industrial gases which are goods in terms of section 2(52) of the CGST Act, 2017.

8.4 Further, as the process undertaken amounts to manufacture, the applicant was registered with the Central Excise department as a manufacturer and discharging Central Excise liability towards clearances to M/s. Essar. Even the clause 2(c) of Schedule 2 of CGST Act, 2017, mandates that any transfer of title in goods under an agreement which stipulates that property in goods shall pass at a future date upon payment of full consideration as agreed, is a supply of goods.

8.5 It is also opined that the applicant is supplying industrial liquid gases to a related party who has given them the input raw materials free of cost and land/place to install plant which is nothing but additional considerations. Therefore, value may be assessed in terms of provisions of Section 15(4) of the CGST Act, 2017 as the value is not the transaction price but there are certain adjustments which are required to be done on account of supply of certain input raw materials free of cost by the buyer and land/place by the buyer.

9. We have considered the submissions made by the applicant in their application for the advance ruling as well as at the time of the personal hearing on 15.11.2017 and in the additional submissions dated 16.11.2017. We have also considered the information and views submitted by the Central Excise & GST, Vadodara – I Commissionerate.

10.1 The main issue involved in this case is whether the activity undertaken by the applicant amounts to “Job Work” as defined under Section 2(68) of the CGST Act, 2017 and the Gujarat Goods and Services Tax Act, 2017 (herein after referred to as the ‘GGST Act, 2017’ and the CGST Act, 2017 and the GGST Act, 2017 have been collectively referred to as the ‘said Acts’). The term ‘job work’ has been defined under Section 2(68) of the said Acts as follows :-

“job work” means any treatment or process undertaken by a person on goods belonging to another registered person and the expression “job worker” shall be construed accordingly;

10.2 The applicant has submitted that the essential requirements to be fulfilled by them to term the present transaction as ‘job work’ includes that the treatment or process undertaken should be on goods and that these goods should belong to Essar.

Download the GST AAR of M/s. Inox Air Products Pvt. Ltd. by clicking the below image:

11.1 The definition of the term ‘goods’ has been given under Section 2(52) of the said Acts as follows:-

“goods” means every kind of movable property other than money and securities but includes actionable claim, growing crops, grass, and things attached to or forming part of the land which are agreed to be severed before supply or under a contract of supply;

11.2 As submitted by the applicant, Atmospheric Air, Industrial Water and Electricity is required to manufacture industrial gases viz. Oxygen, Nitrogen and Argon. Atmospheric Air and Water being movable property, falls within the definition of goods. As regards electricity, the applicant has relied upon the decision of the Hon’ble Supreme Court of India in the case of Commissioner of Sales Tax, M.P., Indore Vs. M.P. Electricity Board, Jabalpur [1970 (25) STC 188], wherein it has been held as that –

“The definition in terms is very wide according to which “goods” means all kinds of movable property. Then certain items are specifically excluded or included and electric energy or electricity is not one of them. The term “movable property” when considered with reference to “goods” as defined for the purposes of sales tax cannot be taken in a narrow sense and merely because electric energy is not tangible or cannot be moved or touched like, for instance, a piece of wood or a book, it cannot cease to be movable property when it has all the attributes of such property. It is needless to repeat that it is capable of abstraction, consumption, and use which, if done dishonestly, would attract punishment under s. 39 of the Indian Electricity Act, 1910. It can be transmitted, transferred, delivered, stored, possessed etc. in the same way as any other movable property. Even in Benjamin on Sale, 8th Edn., reference has been made at page 171 to County of Durham Electrical, etc., Co. v Inland Revenue(1) in which electric energy was assumed to be “goods”. If there can be sale and purchase of electric energy like any other movable object we see no difficulty in holding that electric energy was intended to be covered by the definition of “goods” in the two Acts.”

The applicant has submitted that similar view has been adopted by the Hon’ble Supreme Court of India in the case of State of Andhra Pradesh Vs. National Thermal Power Corporation Ltd. and Ors. [(2002) 3 SCR 278].

Thus, in view of the aforesaid decisions, we find that it is a settled position of law that Electricity is goods.

11.3 Therefore, Atmospheric Air, Industrial Water and Electricity fall within the definition of goods.

12.1 Another requirement of ‘Job Work’ is that any treatment or process should have been undertaken on the goods.

12.2 The applicant has submitted that the terms ‘treatment’ or ‘process’ have not been defined under the GST laws and placed reliance on following judgements and dictionary meanings.

(a) CST Vs. Samodar Padmanath Rao [1968 (22) STC 187 (Bom)] : “One of the meanings that can be given to the word ‘process’ is to subject to a particular method or technique of preparation, handling, or other treatment, designed to affect a particular result”.

(b) Haldia Petrochemicals Ltd. Vs. Commissioner of C.Ex., Haldia [2006 (197) E.L.T. 97 (Tri.-Del.)] : In this case, it has been held that the term ‘processing’ is a much wider term.

“In our opinion, the expressions “further processing” and “any other purpose” mentioned in Rule 4(5)(a) are fairly wide and would take their colour from the processes mentioned in the definition of ‘input’. As such the generation of electricity or steam as intermediate products would fall within the scope of these expressions, and would amount to job work”

(c) S.B. Sarkar’s Word & Phrases of Excise, Customs & Service Tax, 4th Edition : Process means “Prepared, handled, treated or produced by a special process”

(d) Websters Dictionary : “Processing means to subject to some special process or treatment; to subject (esp. raw material) to a process of manufacture, development or preparation.”

12.3 The applicant carries out activity of manufacturing industrial gases viz. Oxygen, Nitrogen and Argon by undertaking treatment or process on the goods viz. Atmospheric Air and Industrial Water.

13.1 As per the definition of ‘Job Work’ such treatment or process should have been carried out on the goods belonging to another registered person.

13.2 M/s. Essar is a registered person under the said Acts. As per clause 4.1 of the agreement entered into between INOXAP and M/s. Essar, the main inputs required for the manufacturing activity viz. electricity and industrial water, are to be provided by M/s. Essar to INOXP, free of charge. The said clause 4.1 of the agreement reads as follows :-

“4.1 Provision of Inputs

4.1.1 The main inputs required for the Manufacturing Activity are electricity, and industrial water, to be provided by ESSAR to INOXAP, free of charge, as per technical specifications set forth in clause 12 of Schedule I (“Inputs”). The Parties agree that INOXAP shall not be able to perform its obligations in relation to the Manufacturing Activity or generation of the Guaranteed Quantity (which obligations are contingent upon supply of the Inputs) under this Agreement unless the INOXAP Facility receives uninterrupted availability / accessibility, as applicable, of/to each of the inputs.

4.1.2 ESSAR agrees to provide to INOXAP the Inputs (free of charge) at the INOXAP Facility to enable INOXAP to meet its obligations in relation to the Manufacturing Activity and to generate the Guaranteed Quantity (which obligations are contingent upon supply of the Inputs) under this Agreement. For the avoidance of doubt, the Parties agree that ESSAR shall at all times during the Term continue to provide the auxiliary power (free of charge) in accordance with Clause 12.1.3 of Schedule 1 at the INOXAP Facility.”

13.3 As regards Atmospheric Air, which required for manufacturing industrial gases viz. Oxygen, Nitrogen and Argon, there is no reference in the agreement. In this regard, the applicant has submitted that the owner of the land is also the owner of the vertical column of air above the land, which position derives from the Latin maxim cuius est solum, eius est usque ad coelum et ad inferos (Translated : For whoever owns the soil, it is theirs up to Heaven and down to Hell) and has been legislatively recognized under the Indian Easements Act, 1882, at Section 7 thereof, as follow :-

“7. Easement restrictive of certain rights. – Easement are restrictions of one or other of the following rights (namely) :

(a) Exclusive right to enjoy- The exclusive right of every owner of immovable property (subject to any law for the time being in force) to enjoy and dispose of the same and all products thereof and accessions thereto.

(b) Rights to advantages arising from situation.-The right of every owner of immovable property (subject to any law for the time being in force) to enjoy without disturbance by another the natural advantages arising from its situation.

Illustrations of the Rights above referred to

[ ]

(d) The right of every owner of land to so much light and air as pass vertically thereto.”

It is submitted by the applicant that the aforesaid provision clearly stated that the ownership of land includes ownership of the air vertically above the land. This principle has also been judicially accepted in a plethora of decisions. In light of the settled principle of law, the ownership of land extends to the ownership of the air vertically above it. Accordingly, the air (above the land which is owned by ESSAR), clearly belongs to ESSAR.

It is also submitted by the applicant that in terms of the arrangement between the parties, M/s. Essar is required to provide land and all other inputs for the processing of gases by INOXAP. Since the owner of the land would own the ambient air above its land, in effect, M/s. Essar has provided the same to INOXAP in terms of the arrangement (along with electricity, industrial water etc.)

13.4 In view of the aforesaid statutory position and commercial arrangement, it is clear that the Atmospheric Air used by the applicant belongs to M/s. Essar. Thus, all the inputs viz. Atmospheric Air, Industrial Water and Electricity belongs to M/s. Essar.

14.1 As all the necessary ingredients of the definition of ‘job work’ are fulfilled in this case, the activity of manufacturing of industrial gases viz. Oxygen, Nitrogen and Argon by the applicant amounts to ‘Job Work’ as defined under Section 2(68) of the said Acts.

14.2 Even at clause 3.1.1 of the agreement entered into between M/s. Essar and the applicant, it is mentioned that – “ESSAR hereby appoints INOXAP, on job work basis, to undertake manufacturing of the Products at the INOXAP Facility for the Steel Plant as per the terms of this Agreement (“Manufacturing Activity”).

14.3 The applicant has submitted that under the pre-GST regime, they were duly discharging excise duty on the gases supplied to M/s. Essar at the time of their removal from the Applicant’s premises. Since the applicant was acting as a job worker for M/s. Essar, the valuation was carried out as the Rule 10A read with Rule 8 of the Central Excise Valuation Rules, 2000. The said Rule 10A read as follows :-

RULE 10A. Where the excisable goods are produced or manufactured by a job-worker, on behalf of a person (hereinafter referred to as principal manufacturer), then, –

(i) ……..

(ii) ……..

(iii) ……..

Provided that ………..

Explanation. – For the purposes of this rule, job-worker means a person engaged in the manufacture or production of goods on behalf of a principal manufacturer, from any inputs or goods supplied by the said principal manufacturer or by any other person authorised by him.”

Thus, it is evident that under the Central Excise regime also, the applicant was discharging duty under Rule 10A of the Central Excise Valuation Rules, 2000, which Rule was applicable where the excisable goods were produced or manufactured by a job-worker, on behalf of a principal manufacturer, from any inputs or goods supplied by the said principal manufacturer or by any other person authorized by him.

14.4 Therefore, taking all these aspects into consideration, we hold that the activity of manufacturing industrial gases viz. Oxygen, Nitrogen, and Argon undertaken by the applicant amounts to ‘Job Work’ as defined under Section 2(68) of the said Acts.

15.1 The provisions relating to the determination of the value of taxable supply are contained in Section 15 of the said Acts, the relevant portion of which is reproduced below:-

“Section 15. Value of taxable supply. — (1) The value of a supply of goods or services or both shall be the transaction value, which is the price actually paid or payable for the said supply of goods or services or both where the supplier and the recipient of the supply are not related and the price is the sole consideration for the supply.

(2) ……

(3) ……

(4) Where the value of the supply of goods or services or both cannot be determined under sub-section (1), the same shall be determined in such manner as may be prescribed.

(5) ……

Explanation. — For the purposes of this Act, —

(a) persons shall be deemed to be “related persons” if —

(i) such persons are officers or directors of one another’s businesses;

(ii) such persons are legally recognised partners in business;

(iii) such persons are employer and employee;

(iv) any person directly or indirectly owns, controls or holds twenty-five per cent. or more of the outstanding voting stock or shares of both of them;

(v) one of them directly or indirectly controls the other;

(vi) both of them are directly or indirectly controlled by a third person;

(vii) together they directly or indirectly control a third person; or;

(viii) they are members of the same family;

(b) the term “person” also includes legal persons;

(c) persons who are associated in the business of one another in that one is the sole agent or sole distributor or sole concessionaire, howsoever described, of the other, shall be deemed to be related.”

15.2 The applicant and M/s. Essar are not related persons as defined under Explanation (a) and (c) of Section 15 of the said Acts.

15.3 Further, the computation of Job Work Charges has been described at clause 6 of the agreement entered into between the applicant and M/s. Essar. The Job Work charge agreed by the applicant and M/s. Essar is the sole consideration payable by M/s. Essar to the applicant for the agreed activity to be carried out by the applicant.

15.4 Therefore, the value of supply by the applicant shall be the transaction value, which is the price actually paid or payable for the said supply as Job Charges, in view of sub-section (1) of Section 15 of the said Acts.

Ruling:

16. In view of the foregoing, we rule as under –

(a) The activity undertaken by the applicant falls under the ‘Job Work’ as defined under Section 2(68) of the Central Goods and Services Tax Act, 2017 and the Gujarat Goods and Services Tax Act, 2017.

(b) The applicant is liable to pay Goods and Services Tax on the value of supply determined under Section 15(1) of the Central Goods and Services Tax Act, 2017 and the Gujarat Goods and Services Tax Act, 2017.

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.