Tax Slabs and Deductions

Tax Slabs and Deductions

In this article we have discussed the various Tax Slabs and Deductions under Income Tax Act while calculating the taxable income for the assessment.

| Tax slabs for Individuals for FY 18-19 (AY19-20) | |||

| Particulars | Tax rate for Individuals below the age of 60 years | Tax Rate for Individuals (Age above 60 years but less than 80 years) | Tax Rate for Individuals (Age above 80 years) |

| Up to INR 2,50,000 | NIL | NIL | NIL |

| INR 2,50,001-INR 3,00,000 | 5% | NIL | NIL |

| INR 3,00,001 to INR 5,00,000 | 5% | 5% | NIL |

| INR 5,00,001 to INR 10,00,000 | 20% | 20% | 20% |

| Over INR10,00,001 | 30% | 30% | 30% |

1. Surcharge:

(i) In case income is more than INR 50 lakhs and less than INR 1 crore, the surcharge is applicable at a rate of 10% of the income tax.

(ii) For income more than INR 1 crore, a surcharge of 15% is applicable on income tax on the amount exceeding INR 1 crore

2. Health and Education Cess:

Levy of Health and Education Cess” at the rate of 4%, on the amount of tax computed , inclusive of surcharge.

3.Rebate u/s 87A:

Tax rebate maximum upto Rs. 2500 for Total income upto Rs. 3,50,000 is allowed.

| Deductions allowable to an Individual under Income Tax | |||

| Section | Payments | Comments | Deduction Amount |

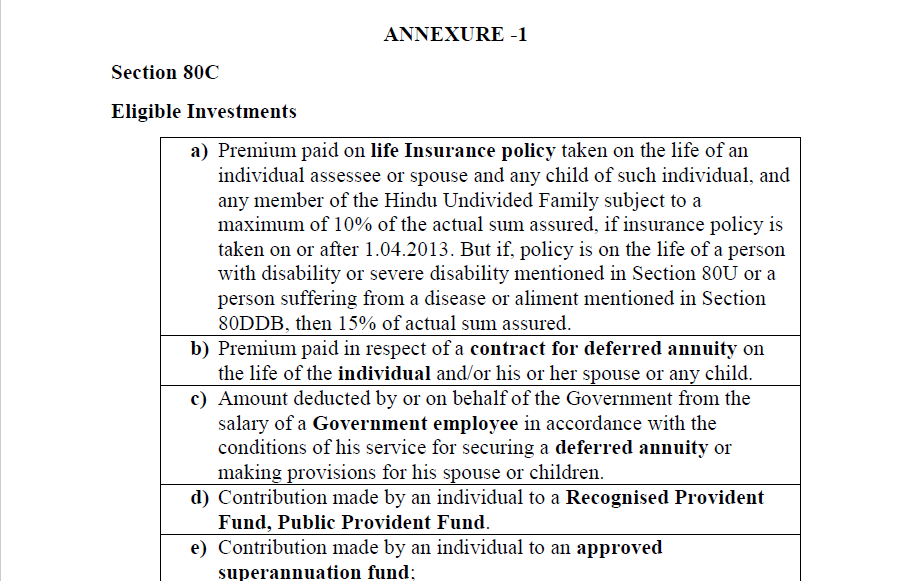

| 1. 80C | Deductions allowable to an Individual under Income Tax | Refer Annexure 1 given below. | INR 1,50,000 |

| 2. 80CCC | Payment made to LIC or other insurer under approved | Total deduction u/s 80C,80CCC and 80CCD(1) cannot exceed INR 1,50,000 by virtue of section 80CCE. | INR 1,50,000 |

| 3.80CCD | Contribution to the pension scheme of Government |

1. Employees and self-employed persons are eligible for deduction. 2.No rebate u/s 88 or No deduction u/s 80C will be allowed in respect of amount allowed as deduction under this section. 3. Amount received at closure of scheme/withdrawal from scheme will be taxable in year of receipt. Amount received as pension from an annuity plan purchased or taken on such withdrawal or closure will also be taxable. 4. Withdrawal from NPS (Tier-1): Amount withdrawn up to 25 per cent of subscriber contribution is exempt from tax.before the age of 60 .After Subscriber attain the age of |

1.Employee(Government or private) contribution: Not exceeding 10% of salary in the previous year 2. Employer’s contribution : Amount contributed by employer not exceeding 10% of salary in previous year 3. Self employed persons: Not exceeding 20% (w.e.f 1.4.18 )of gross total income of previous year . 4.Additional deduction for investment up to Rs. 50,000 in NPS (Tier I account) is available exclusively to NPS subscribers under subsection 80CCD (1B). This is over and above the deduction of Rs. 1.5 lakh available under section 80C . |

| 4.80D | Medical Insurance Premium |

1. Payment can be made by any mode other than cash.However, for preventive check up, cash mode can be used. 2.In case payment is made in lump sum in the previous year for more than a year, then, a deduction equal to the appropriate fraction of the amountshall be allowed for each of the relevant previous year |

1. For self and family : INR 25,000(INR 30,000 (50,000 from 1.4.19) for senior citizen) 2. For parents:INR 25,000 (INR 30,000 (50,000 from 1.4.19) for senior citizen) 3. For preventive health check up : INR 5,000. This is inclusive in above limit of INR 25,000/30,000. |

| 5.80DD | Maintenance including medical treatment of a dependent disabled |

1.The amount deposited in scheme framed by LIC or other insurer or administrator or specified company for maintenance of dependent disabled is also eligible for deduction. 2.Disability” means-(I) Blindness; (ii) Low vision; (iii) Leprosy-cured; (iv) Hearing impairment; (v) Locomotor disability; (vi) Mental retardation; (vii) Mental illness; (viii) autism(ix) cerebral palsy (x) multiple disability. 3. A person with a severe disability means, A person with eighty percent or more of one or more /multiple disabilities. |

INR 75,000. In case of severe disability, INR 1,25,000 |

| 6.80DDB | Amount paid for medical treatment of specified diseases or ailments |

1.Any amount received from insurer or reimbursed by an employer for treatment shall be reduced from deduction amount. 2. Very senior citizen means a person who is of age 80 years more |

Amount actually paid or INR 40,000 whichever is less. -Where assessee or dependant is senior citizen, INR 60,000(INR 1,00,000 from 1.4.19) or amount paid , whichever is less. -Where assessee or dependant is very senior citizen, INR 80,000 or amount paid , whichever is less. From 1.4.19, this higher deduction for very senior citizen shall not be available |

| 7. 80E | Interest on loan is taken for higher education | Loan should have been taken for higher education for self or relative. | Deduction available for initiial 8 assessment years or until the interest is paid in full, whichever is earlier. |

| 8. 80EE | Additional deduction for interest on loan |

1.The loan has been sanctioned by the financial institution during the period beginning on the 1st day of April, 2016 and ending on the 31st day of March, 2017; 2. The amount of loan sanctioned for acquisition of the residential house property does not exceed thirty-five lakh rupees; 3.Value of residential house property does not exceed INR 50 Lac. 4. Assessee does not own any residential house property on date of sanction of loan. |

Amount not exceeding INR 50,000. |

| 9. 80G | Donation to approved funds, charitable institutions, etc. For detailed approved funds, refer Annexure 2 given below. |

1. Donations should not be in kind. 2.No deduction shall be allowed under this section in respect of donation of any sum exceeding [two] thousand rupees unless such sum is paid by any mode other than cash. |

100%/50% of donation amount or 10% of adjusted Gross total income whichever is less. For more details, refer Annexure 2 given below. |

| 10. 80GG | Individuals not receiving House rent allowance(HRA) are entitled to claim benefit of any sum paid as rent exceeding 10% of total income | Assessee, spouse, minor child or HUF of which he is member should not own any residential accomodation at a place where assessee resides. If accomodation is at any other place, no concession in respect of such property should be claimed u/s 23(2)(a) or 23(4). |

Least is available for deduction – -25% of total income before deduction under this section ; -INR 5,000 P.M; -Excess of rent paid over 10% of total income before deduction under this section |

| 11. 80GGA | Donation for scientific research or rural development |

Sums should be paid to:-Research association , college, university , institution for scientific research,research in social science or statistical research; -An association or institution for carrying out programme of rural development or training of persons for implementing programmes for rural development; – A public sector company or a local authority or to an association or institution approved by the National Committee, for carrying out any eligible project or scheme; -Rural development fund u/s35CCA. -National Urban Poverty Eradication Fund |

Amount paid as donation. |

| 13. 80QQA | Professional income of authors of text books in Indian languages. |

1.The book should be either in the nature of a dictionary, thesaurus or encyclopaedia or should have been prescribed or recommended as a text book, or included in the curriculum, by any University, for a degree or post-graduate course of that University; and 2. The book should have been written in any language specified in the Eighth Schedule to the Constitution or in any notified language |

25% of professional income of author |

| 14. 80QQB | Royalty income, etc., of authors of certain books other than textbooks. |

1. Individual must have authored or co-authored a book that falls under the category of literary, artistic or scientific work. 2. If an Individual has not received a lump sum amount , 15% of the value of the books sold during the year (before allowing any expenses) should be ignored. 3. Individual must obtain FORM 10CCD from the person responsible for making the payment |

INR 3 Lac or amount of royalty received, whichever is less |

| 15. 80R | Remuneration received outside India from University or other educational institution established outside India or any other association or body established outside India in the case of professors, teachers, research worker. | Form 10H for inward remittance is required | 15% of such remuneration brought to India in convertible foreign exchange within a period of six months from the end of the previous year or within such further period allowed by competent authority |

| 16. 80RR | Professional income of an author, playwright, artist, musician, actor or sportsman (including an athlete) from foreign sources, | Form 10H for inward remittance is required | 15% of such income brought to India in convertible foreign exchange within a period of six months from the end of the previous year or within such further period allowed by competent authority |

| 17. 80RRA | Remuneration received in foreign currency from any employer (being a foreign employer or an Indian concern) for any service rendered outside India |

1. This deduction is allowed to an individual who was Government employee before deputed outside India or a technician whose terms and conditions of foreign services are approved by Government. 2.Form 10H for inward remittance is required. |

15% of such income brought to India in convertible foreign exchange within a period of six months from the end of the previous year or within such further period allowed by competent authority |

| 18. 80RRB | Royalty income from patent |

Form 10H for inward remittance is required . |

Royalty income or INR 3 Lac , whichever is less |

| 19. 80TTA | Interest earned on savings account with bank, co-operative society,post office | NIL | Lower of :Interest income or INR 10,000 |

| 20. 80TTB | Interest on deposits | This deduction is for senior citizens earning income from interest on bank deposits (savings or fixed), interest on deposits with co-operative society engaged in banking business, interest from deposits with post office | Lower of :Interest income or INR 50,000 |

| 21. 80U | Person with disability | Certificate by medical authority is required | INR 75,000. In case of severe disability, INR 1,25,000 |

No deduction u/s 80CCG is allowed from AY 18-19 in respect of any investment made under an equity savings scheme.

Download the Annexures to the Article on Tax Slabs and Deductions by clicking the below image: