Analysis of ITC of/in respect of Motor vehicles

Analysis of ITC of/in respect of Motor vehicles

ABSTRACT OF SECTION 17(5) BLOCKED CREDIT (APPLICABILITY AFTER 01-02-2019 ) FOR MOTOR VEHICLE

17(5)(a) motor vehicles for transportation of persons having approved seating capacity of not more than thirteen persons (including the driver), except when they are used for making the following taxable supplies, namely:—

(A) a further supply of such motor vehicles; or

(B) transportation of passengers; or

(C) imparting training on driving such motor vehicles;

1. MOTOR VEHICLES FOR TRANSPORTATION OF PERSONS – ITC ALLOWED IF CAPCAITY> 13

Amended 17(5) only talks about Motor vehicles used for Transportation of persons. Let’s analyze it.

ITC is anyways allowed if Motor vehicles are having seating capacity more than 13 persons ( incl driver).

No ITC allowed for Motor Vehicles for transportation of persons if seating capacity is up to 13 persons.

However, In following 3 cases , you don’t have to check seating capacity .

- ITC is allowed even if seating capacity up to 13 persons and used for further taxable supply of such

vehicles - ITC is allowed even if seating capacity up to 13 persons and used for transportation of passengers

which are taxable - ITC is allowed even if seating capacity up to 13 persons and used for imparting taxable training

Mind well, The Motor vehicle should be purchased for use in connection with business and not personal usage. Any ITC used in connection with the purpose other than business.

Moreover, No ITC allowed on general insurance, servicing, repair and maintenance services used in relation to the motor vehicles on which ITC is blocked.

Related Topic:

When ITC of Motor vehicle is allowed in GST

2. MOTOR VEHICLES FOR GOODS TRANSPORTATION – ITC ALLOWED (read point 4 below for GTA case)

ITC of Motor vehicles used in Goods Transportation is always allowed. Also, ITC of general insurance,

servicing, repair, and maintenance is also allowed in this case. – ITC AVAILABLE

Some instances when Motor vehicles used in Goods Transportation ( except when you are GTA. Read point 4 for GTA case )

1. You are selling Goods and also transporting in your trucks. so, in this case, You might be charging Freight in your invoice & levying GST on Forwarding charges basis in your invoice. Or You are not charging any Freight i.e inclusive price and using vehicle just for Goods transportation for your business purpose only. – ITC AVAILABLE

2. You are using the vehicle for pick up of raw material from the supplier or using vehicle inside premises or using vehicle between branches/factories for own goods transportation. – ITC AVAILABLE

3. You purchased truck & given it on rent to other for his business . You charge GST at 18% on such rental income. – ITC AVAILABLE

Moreover, ITC will be available in respect of motor vehicles if they are used for transportation of money for

or by a banking company or a financial institution. – ITC AVAILABLE

3. ITC OF MOTOR VEHICLES WHEN FURTHER SUPPLY OF SUCH VEHICLES OR CONVEYANCES i.e CAR DEALERS – ITC ALLOWED

ITC is allowed when Assessee in the business of making Taxable Supply of FURTHER SUPPLY OF SUCH VEHICLES OR CONVEYANCES (Any kind of Motor vehicle whether in Goods transportation or Passenger transportation or any ) i.e CAR Manufactures & Dealers – ITC ALLOWED.

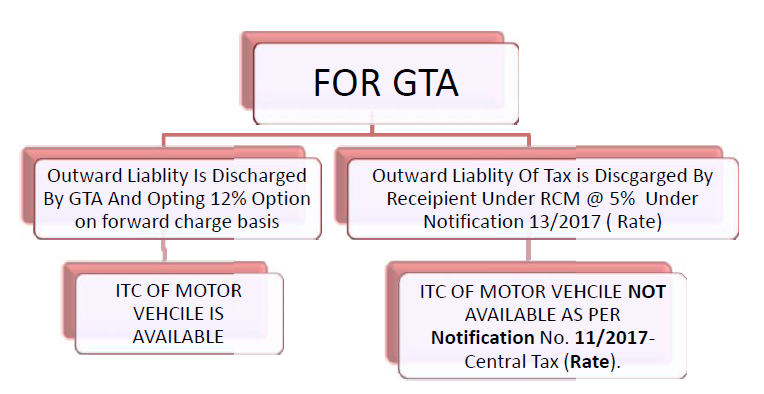

4. ITC OF MOTOR VEHICLE IN CASE OF “GTA” – GOODS TRANSPORTATION AGENCY”

FULL TEXT OF SECTION 17(5) BLOCKED CREDIT (APPLICABILITY AFTER 01-02-2019 )…FROM BARE ACT

clause (a) motor vehicles for transportation of persons having approved seating capacity of not more than thirteen persons (including the driver), except when they are used for making the following taxable supplies, namely:—

(A) further supply of such motor vehicles; or

(B) transportation of passengers; or

(C) imparting training on driving such motor vehicles;

Clause (aa) vessels and aircraft except when they are used––

(i) for making the following taxable supplies, namely:—

(A) further supply of such vessels or aircraft; or

(B) transportation of passengers; or

(C) imparting training on navigating such vessels; or

(D) imparting training on flying such aircraft;

(ii) for transportation of goods;

Clause (ab) services of general insurance, servicing, repair and maintenance in so far as they relate to motor vehicles, vessels or aircraft referred to in clause (a) or clause (aa):

Provided that the input tax credit in respect of such services shall be available—

(i) where the motor vehicles, vessels or aircraft referred to in clause (a) or clause (aa) are used for the purposes specified therein;

(ii) where received by a taxable person engaged—

(I) In the manufacture of such motor vehicles, vessels or aircraft; or

(II) In the supply of general insurance services in respect of such motor vehicles, vessels or aircraft insured by him;

Clause (b) the following supply of goods or services or both—

(i) food and beverages, outdoor catering, beauty treatment, health services, cosmetic and plastic surgery, leasing, renting or hiring of motor vehicles, vessels or aircraft referred to in clause (a) or clause (aa) except when used for the purposes specified therein, life insurance and health insurance:

Provided that the input tax credit in respect of such goods or services or both shall be available where an

inward supply of such goods or services or both is used by a registered person for making an outward taxable supply of the same category of goods or services or both or as an element of a taxable composite or mixed supply;

(ii) membership of a club, health and fitness centre; and

(iii) travel benefits extended to employees on vacation such as leave or home travel concession:

Provided that the input tax credit in respect of such goods or services or both shall be available, where it is obligatory for an employer to provide the same to its employees under any law for the time being in force.”.

clause (C). Works contract services when supplied for construction of an immovable property (other than plant and machinery) except where it is an input service for further supply of works contract service;

clause (D) Goods or services or both received by a taxable person for construction of an immovable property (other than plant or machinery) on his own account including when such goods or services or both are used in the course or furtherance of business.

Explanation – For the purposes of clauses (c) and (d), the expression “construction” includes re-construction, renovation, additions or alterations or repairs, to the extent of capitalisation, to the said immovable property;

Clause (E). Goods or services or both on which tax has been paid under section 10 or;

Clause (F). Goods or services or both received by a non-resident taxable person except on goods imported by him;

Clause (G). Goods or services or both used for personal consumption;

Clause (H). goods lost, stolen, destroyed, written off or disposed of by way of gift or free samples; and

Clause (I). any tax paid in accordance with the provisions of sections 74, 129 and 130.