Composition Scheme for Real-estate

Composition Scheme for Real-estate: War in London, Weapons to China

What will be the consequences if the patient is suffering from stomach ache and the physicist prescribes him paracetamol? What will happen if the war is taking place in London and the consignment of weapons reach China? In both of these cases, the problem will not be solved because the solutions proposed are completely out of the line.

In this article, we have made an attempt to summarize the intention of Government behind the introduction of composition scheme and the viability of such an option.

The intention of the Government behind the introduction of composition scheme

Honorable Finance Minister, Shri Arun Jaitley, in his press conference, stated that the builders have not passed on the benefits of input tax credit accrued to them due to the implementation of GST. Therefore, the GST Council intends to block the credit available to them with a reduced GST rate on Real-estate sector.

The GST press release for 33rd GST Council meeting stated that:-

“Real estate sector is one of the largest contributors to the national GDP and provides employment opportunity to large numbers of people. “Housing for All by 2022” envisions that every citizen would have a house and the urban areas would be free of slums. There are reports of a slowdown in the sector and low off-take of under-construction houses which needs to be addressed. To boost the residential segment of the real estate sector, the following recommendations were made by the GST Council in its 33rd meeting held today:”

After the implementation of GST, it was expected that all businesses will adhere to anti-profiteering provisions and will pass on a huge amount of credits availed by them to their consumers. However, some industries like restaurants and Real-estate sector failed to pass on the benefits extended to them. As a result, the industry witnessed inflationary trends and the buyers were reluctant to buy any Real-estate properties due to lack of confidence. Resultantly, in the last one and a half year, the quantity of unsold inventory also went up to a huge extent.

Due to all these issues, the Government thought to intervene and propose a solution. Now the next question that arises in our minds is:-

Whether the Government has succeeded in its intervention?

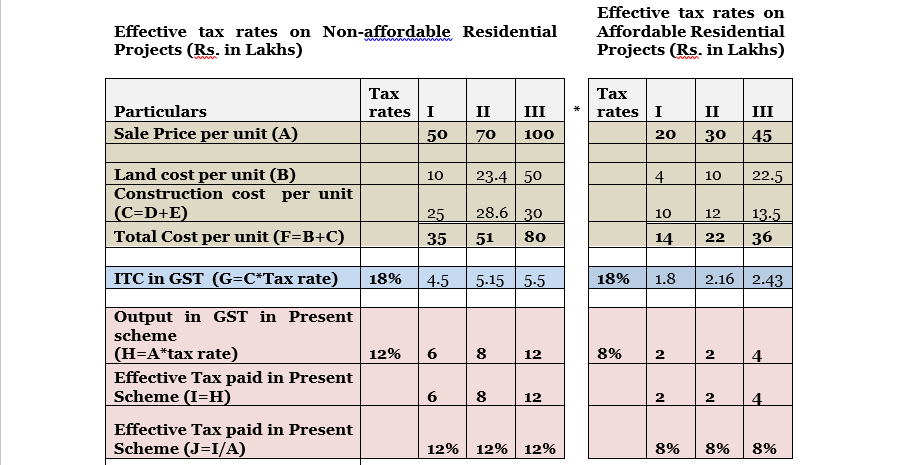

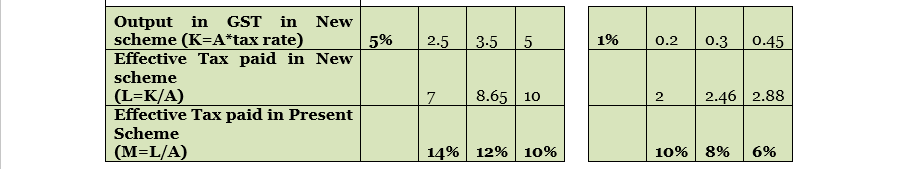

The viability of the proposed policy should be measured by the impact it has on total cost to the consumer. Let us take an example:-

Assumptions:

1. The figures of sales price, construction cost, material and labour proportion in the construction cost and deemed profit margin are assumed.

2. Some of the inputs is taxed at the rate of 28% and most of the inputs and input services are taxable at 18% under GST. Therefore, an average rate of 18% is assumed for inputs and input services. The rate of 18% is assumed after taking into consideration the requirement of credit reversal on 1/3rd value of land.

Notes:

1. ITC shall not be allowed in the new scheme and therefore, effective tax rate is the addition of GST ITC lost and output tax paid under GST.

2. In the new scheme, the tax rates are 5% and 1% for non-affordable and affordable housing projects respectively. Affordable projects are proposed to be defined as follows:-

“A residential house/flat of carpet area of upto 90 sqm in non-metropolitan cities / towns and 60 sqm in metropolitan cities having value upto Rs. 45 lacs (both for metropolitan and non-metropolitan cities).”

3. In the present scheme, applicable GST rate on output side is 18% with deduction of 1/3rd amount for the land value. So the effective tax rate on output is 12%.

Looking at the above example, one may conclude that GST is implemented with an intent to consolidate all the indirect taxes so that the effective tax rates borne by the consumer is reduced to some extent. Looking at this objective, the scheme proposed by the GST Council may not be summarized as an optimum scheme because it results in to increase in cost by 2% in less budget residential houses. The Government’s decision of reducing tax rate does not supplement the Housing for All by 2020 policy as low-cost houses are the one suffering in the proposed scheme.

Looking at the above outcome, one can contend that there is still a big gap between the anomaly that was sought to be rectified and the policy proposed. This takes us to our second question which is, what else could have been done to cure the anomaly.

Alternatives that were available with GST Council

Although it has been claimed that the rates prescribed are computed taking into account the present effective tax rate, we are not able to understand the math behind it. So at this stage, we believe that two of the best alternatives that GST Council had in front of them were:-

- Bring Real-estate under GST.

- Streamline anti-profiteering mechanism

The land is subjected to Stamp duty. Therefore, GST can be levied on the construction component only. This system has created a lot of issues including double taxation and an increase in prices of Real-estate properties. If the Government brings land under GST then, it is likely that the effective cost to the customer might get reduced.

This might be a little unreasonable to expect from the Government at this stage so another alternative might be streamlining the anti-profiteering mechanism. Government claims that builders lobby has failed to adhere to anti-profiteering mechanism but if we look into the same closely, we may find that Government has left a great number of loopholes and if Government steps forward to cure those loopholes then, the prices might get actually reduced and this solution will be an optimum alternative of composition scheme.

The issues that the Government should focus on are as follows:-

- To establish a formula for calculating anti-profiteering benefits:-

Mr. Adam Smith once said, “Little else is requisite to carry a state to the highest degree of opulence from the lowest barbarism but peace, easy taxes, and a tolerable administration of justice: all the rest being brought about by the natural course of things”. Past regime speaks volumes on the attitude of businesses at times of uncertain tax system. With that experience, Government should come with a clear formulae to calculate and the methodology to pass on the benefits under anti-profiteering provisions. Without which, the builder cannot reduce their prices.

- Education to builders: – The Government has issued various press releases in the benefits of customers. However, they have not given much thought to educate the builders. Most of the builders do not know about the anti-profiteering mechanism introduced under GST. This is also a major cause why the prices of Real-estate properties have not been reduced upon introduction of the new tax regime.

- Denial of benefits: – On one hand, entire builder lobby have been receiving notices questioning the amount of credits claimed by them and on the other hand, the Government is expecting the builders to pass on benefits. Hence, the builder’s community is in dilemma about the validity of credit claims made by them and when the credit claimed is itself not certain, how will they be able to pass on the benefits?

If the Government would have focused on solving problems arising in the present tax scheme, there might not be a need to revamp the entire tax structure. We vouch to the fact that the tax system cannot be perfected in one go however, there should be improvements and revamping should be avoided for all means and purposes as the transition to a new scheme is an onerous task.

To conclude with, to our mind, the composition scheme for Real-estate sector seems to be a punitive approach for forcing prices reduction in Real-estate. Had the GOM have brainstormed a bit before the introduction of composition scheme, they should have simplified the present system. We also acknowledge the efforts and intention of Government to boost this sector, however, their bow has went in the wrong direction. For future, we hope that the new scheme turns out to be the right medicine for the disease/problems Real-estate is facing today.

(This article is authored by CA Suman Mundra & CA Pooja Jajwani from Sandesh Mundra & Associates. The authors can be reached at suman.mundra@smaca.in)

Pooja Jajwani

Pooja Jajwani

Ahemdabad, India