Impact of new scheme on Joint Development Agreements

Impact of new scheme on Joint Development Agreements

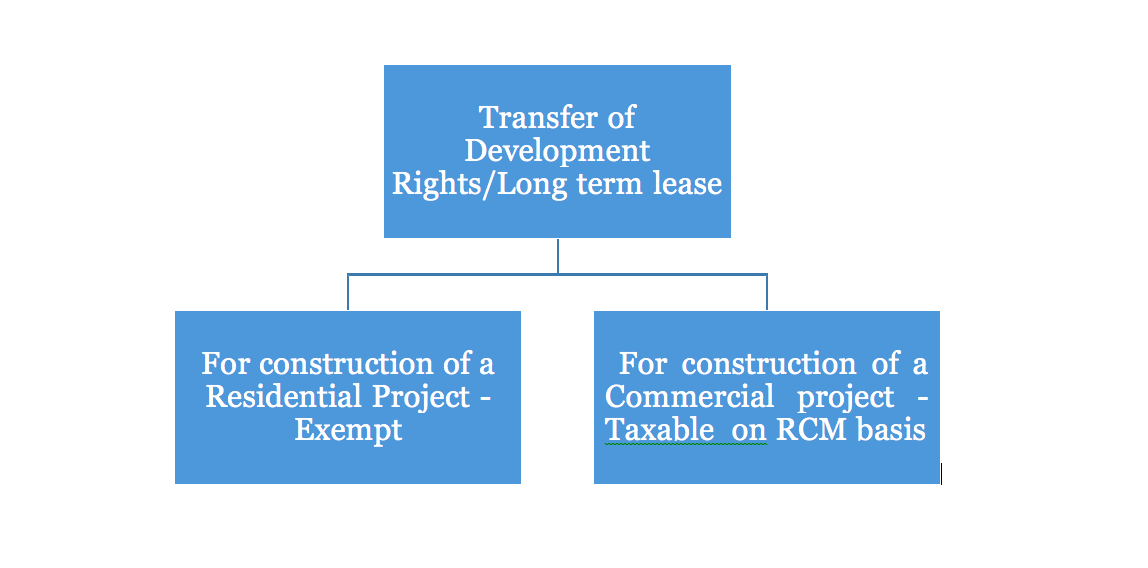

Taxability of transfer of development rights or long term lease

new scheme on Joint Development Agreements

Calculation of amount eligible for exemption

| Particulars | Amount (Rs. In Lakhs) |

| Value of development rights/long term lease (A) | 200 |

| GST payable on development rights (B=A*18%) | 36 |

| Carpet area of residential units (C) | 8000 sq. meter |

| Carpet area of commercial units (D) | 2000 sq. meter |

| Total Carpet area (E=C+D) | 10,000 sq. meter |

| Exemption of GST on TDR/lease as attributable to residential units (F=B*C/E) | 28.8 |

| GST on TDR/Lease as attributable to commercial units payable by developer on RCM basis (G=B*D/E) | 7.2 |

Some relevant points for exemption:-

- Long term lease means lease for a period of 30 years or

- Developer shall be liable to pay tax, on RCM, as is attributable to the residential units, which remain un booked on the date of issuance of completion certificate, or first occupation of the project, as the case may

The tax payable shall be calculated as:

| Particulars | Amount (Rs. In Lakhs) |

| Exemption of GST on TDR/lease as attributable to residential units (A) | 28.8 |

| Carpet area of residential units booked before receipt of CC (B) | 6000 sq. meter |

| Carpet area of residential units booked after receipt of CC

(C) |

2000 sq. meter |

| Total Carpet area of residential units (D=C+A) | 8,000 sq. meter |

| GST to be paid by developer on RCM basis for units booked after receipt of CC (E=A*C/D) | 7.2 |

- Tax paid as per above working should not exceed –

- 1% of value of affordable housing unit;

- 5% of value of non-affordable housing

- For example:-

| Particulars | Amount (Rs. In Lakhs) |

| Tax payable as per above working (A) | 7.2 |

| Total value of non-affordable un booked units (B) | 20 |

| 5% of B above (C) | 1 |

| Tax to be paid (D=lower of A and C) | 1 |

-

- Landowner will pay 1%/5% GST on flats sold by him to third parties before issuance of completion certificate or first occupation, whichever is

- Landowner will be eligible to take credit of 50%/7.50% tax charged by developer to him subject to the condition that –

- Tax liability of landowner is more than the tax charged to him by the developer and

- Landowner should sell the units to third parties independently.

Valuation for payment of tax by developer on units allotted to landowner :-

Particulars Amount Value of similar units sold nearest to the date of transfer of development rights 100 Less:- 1/3rd amount representing land value -33 Value of construction on which the developer has to pay tax 67 Value of development rights received against provision of construction services by the developer :-

Value as arrived in above example.

Time of supply for payment of tax on following transactions:-

| Particular | Person liable to pay tax | Time at which liability to pay tax will arise |

| Supply of development rights by landowner | Developer (unless exempted) under RCM | On the date of issuance of completion certificate or first occupation, whichever is earlier |

| Supply of construction services by developer in exchange of development rights | Developer | On the date of issuance of completion certificate or first occupation, whichever is earlier |

Related Topic:

Taxability of Joint Development Agreement

(Note:- This note summarizes the notifications issued for real-estate sector. This note is not intended to throw any light on the taxability of development rights.)

Pooja Jajwani

Pooja Jajwani

Ahemdabad, India