AAAR of global reach education #intermediary 1

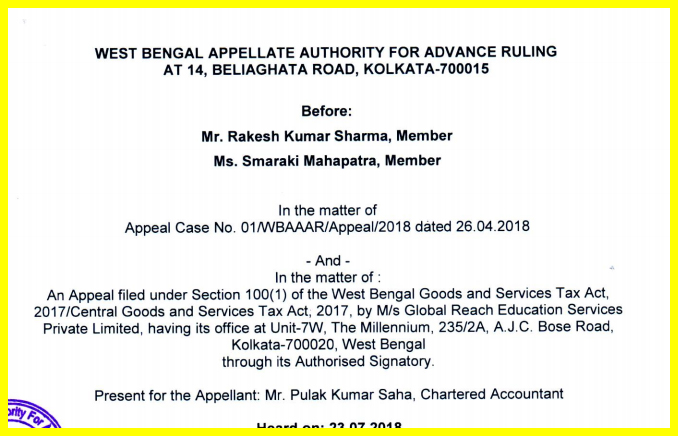

AAAR of global reach education

Facts of the case

Argument by the applicant

Observation of authority

AAAR of global reach education:

The appellant already tried the AAR of west Bengal. Where the observation was against the applicant.The west Bengal authority after hearing the applicants side decided that there activities are intermediary. Applicant went to the AAAR against the order of AAR dated 21.03.2018. AAAR of global reach education will be helpful for other intermediary cases.

Facts of the case:

The applicant is a private limited company engaged in promoting the courses of foreign universities. They already had an adverse order from West Bengal authority. In this case the applicant is providing some set of services for the foreign universities. They also submitted the copy of their agreement with ACU. Clause 3.1 of that agreement call them as education agent. Their activities were listed as:

- Promote the course of university

- Find suitable prospective student to undertake the course.

- In accordance with the university procedures and requirements , recruit and assist in the recruitment of the suitable students.

- Assist people to become students and for that purpose provide all necessary information about the course and assist in completion of forms and applications and submitting them to university.

- Comply with the requirements of ESOS Act and obligation under the national code.

- Meet any enrolment or other performance targets as mutually agreed between ACU and education agent.

- Perform other services and provide reports or other informations requested by the university or required by this agreement.

These were the main conditions in the agreement with one of the university.

The applicant also relied upon the ruling of Godaddy India web services. He said that the fact of both of the rulings are almost same.

Argument by the applicant:

The appellant submitted that the advance ruling authority wrongly considered them as a recruitment agency facilitating the recruitment or enrolment for the foreign universities. They further added that they are providing the ” business auxiliary services” by promoting their courses. This is a service of business promotion and marketing. Applicant referred two rulings from earstwhile service tax era. Godaddy India web services and sunrise immigration consultants private ltd Vs CCE. The argument of the applicant was that their case is similar to these two cases. In both of these case the activities by the Indian entity was not held as intermediary.In case of Go daddy also they were doing the activities of marketing and promotion. The applicants said that their activities are also like that.

He put emphasis on one important part of intermediary definition. If a supplier making services on his own account then it will not be an intermediary service.

Observation of authority:

The authority held in this case that.

- The applicant’s plea that AAR wrongly considered them as recruitment agent is not wrong. Agreements should be looked upon in its entirety and they cant pick and choose some part of agreement to decide the nature of activities.

- The facts of Go daddy and the applicant’s case are not similar. In case of Go daddy India the consideration was cost plus mark up of 13. Go daddy had only one client , that was Go daddy US. They were charging for promotion activity irrespective of conversion. Go daddy India was not eligible to make any contract or agreement on behalf of Go daddy US. Their activities were independent and they were not facilitating any supply from Go daddy US. In the case of applicant they are free to refer student to ACU or to any other university. Also they wont get any consideration irrespective of cost if they cant get any students enrolled.

- The facts of sunrise immigration consultants private limited Vs CCE (Chandigarh) and the applicants case are also completely different. Definitions of intermediary in service tax and in GST were compared. The issue of main services decided by the CESTAT Chandigarh cant be imported into the definition of intermediary in GST.

The authority held that in the light of above discussion it will not be an export. The same was held by AAR West Bengal.

Download the copy of original order of AAAR of Global reach education

References:

🔗 Goods and Services Tax Council AAAR global reach education.

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.