Critical Analysis of GST Constitutional Journey

Table of Contents

- Critical Analysis of GST Constitutional Journey

- List – I (UNION LIST):

- List-II (STATE LIST):

- List – III (CONCURRENT LIST):

- Insertion of ARTICLE 246A – To Facilitate the Parliament & States to make laws in regard to Goods & Service Tax Imposed by Union or such State.

- Article 248: Residuary power of legislation.

- Article 254: Inconsistency between laws made by Parliament and laws made by the Legislatures of States.

- Article 249: Power of Parliament to legislate with respect to a matter in the State List in the national interest.

- Article 250: Power of Parliament to legislate with respect to any matter in the State List if a Proclamation of Emergency is in operation.

- Article 268: Duties levied by the Union but collected and appropriated by the States.

- Article 268A: Service tax levied by Union and collected and appropriated by the Union and the States.‐

- Article 269 and Insertion of Article 269A:

- Article 271: Surcharge on certain duties and taxes for purposes of the Union

- Article 286: Restriction as to the imposition of tax on the sale or purchase of goods

- Article 366 Definitions:‐

- Read the Copy:

Critical Analysis of GST Constitutional Journey

We all know that the Constitution amendment bill later on passed by parliament and become 101 st constitutional amendment law bring the GST into life. Here I have analyzed its complete journey and constitutional background.

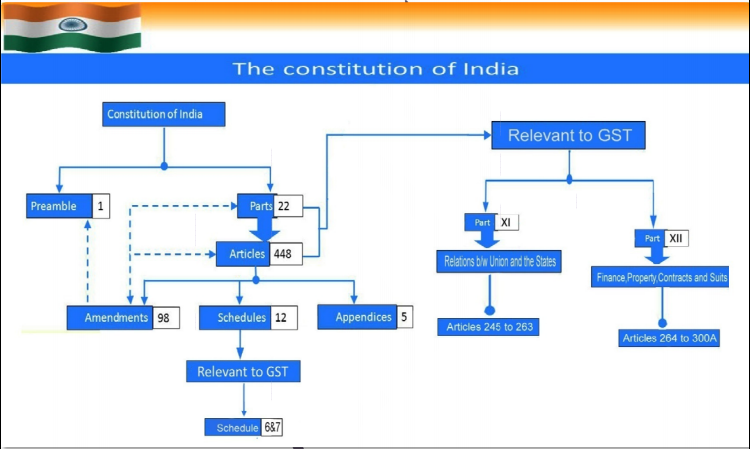

Constitution of India supreme law of land and source of powers to legislate all law in India by parliament and state legislatures. Following is the basic structure of the Constitution of India.

The authority to levy a tax is derived from the Constitution of India which allocates the power to levy various taxes between the Centre and the State. An important restriction on this power is Article 265 of the Constitution which states that “No tax shall be levied or collected except by the authority of law”.

Article 246 of the Indian Constitution, distributes legislative powers including taxation, between the Parliament of India and the State Legislature. Schedule VII enumerates these subject matters with the use of three lists:

List – I (UNION LIST):

entailing the areas on which only the parliament is competent to make laws,

Following amendments, has been done in the list I

1. Entry 84 has been substituted as follows:

Duties of excise on the following goods manufactured or produced in India, namely:

- Petroleum crude;

- High-speed diesel;

- Motor spirit (commonly known as petrol)

- Natural gas;

- Aviation turbine fuel;

- Tobacco and tobacco products

Related Topic:

101st Constitution Amendment Act, 2016

Earlier entry 84 was as follows:

Duties of Excise on tobacco and other goods manufactured or produced in India except, –

(a) alcoholic liquors for human consumption

(b) opium, Indian hemp, and other narcotic drugs and narcotics,

but including medicinal and toilet preparations containing alcohol or any substance included in sub‐para (b) of this entry.

2. The following entries have been omitted:

- Entry 92‐Taxes on sale or purchase of newspaper and advertisements published therein

- Entry 92C‐Taxes on services

Following entries have been omitted:

83‐ Duties of custom,

90‐ Stamp duties on transactions on stock exchanges,

92A‐Taxes on sale or purchase in the course of interstate trade or commerce.

92B‐Taxes on consignment of goods in the course of interstate trade or commerce.

List-II (STATE LIST):

entailing the areas on which only the state legislature can make laws,

Following amendments has been done in list II

Entry 52 for Octroi or Entry tax has been omitted.

1. Entry 54 has been substituted as follows‐ “Tax on sale of petroleum crude, high-speed diesel, motor spirit (commonly known as petrol), natural gas, aviation turbine fuel and alcoholic liquor for human consumption, but not including a sale in the course of inter‐state or commerce or sale in the course of international trade or commerce of such goods.

Earlier entry 84 was as follows:‐

Taxes on the sale or purchase of goods other than newspapers, subject to the provisions of entry 92A of List I.

2. Entry 55 for tax on the advertisement has been omitted.

3. Entry 62 shall be substituted as follows‐Tax on entertainment and amusements to the extent levied and collected by a Panchayat or a Municipality or a Regional Council or a District Council.

Simultaneously, para8(3)(e) is proposed to be inserted in Sixth Schedule to Constitution as follows ‘taxes on entertainment and amusements’.

The sixth schedule to Constitution of India contains provisions for the administration of Tribal Areas in the States of Assam, Meghalaya, Tripura, and Mizoram. Under the provisions of this schedule, District Councils are constituted for each autonomous district.

As per the proposed amendment, These district councils shall have the power to levy taxes on entertainment and amusements.

Previous Entry 62:

“62. Taxes on luxuries, including taxes on entertainments, amusements, betting and gambling”

Following Entry have not been changed:

49 – Taxes on lands & buildings

50 – Taxes on mineral rights

53 – Tax on sale/consumption of electricity

56 – Taxes on goods & passengers by road or inland waterways

57 – Taxes on vehicles

58 – Taxes on animals & boats

63 – Stamp duty

List – III (CONCURRENT LIST):

listing the areas on which both the Parliament and the State Legislature can make laws upon concurrently.

Insertion of ARTICLE 246A – To Facilitate the Parliament & States to make laws in regard to Goods & Service Tax Imposed by Union or such State.

Article 246A as a special article dealing exclusively with goods and service tax. The general principles of legislation under Articles 246 and 254 will not be applicable to this article. It grants power to Parliament and the legislature of every State, to make laws to levy GST with a condition that only the Parliament shall be competent to levy GST on the transfer of goods and/or services in the course of inter‐State trade or commerce.

Article 248: Residuary power of legislation.

The article 248 has been amended to avoid contradiction between this article and article 246A. The article 248 gives exclusive power to parliament to make laws on a matter not mentioned in the state and concurrent list. The amendment has added the word “subject to 246A” Parliament has exclusive power to make laws on matters not mentioned in state and concurrent list.

Article 254: Inconsistency between laws made by Parliament and laws made by the Legislatures of States.

(1) If any provision of a law made by the Legislature of a State is repugnant to any provision of a law made by Parliament which Parliament is competent to enact, or to any provision of existing law with respect to one of the matters enumerated in the Concurrent List, then, subject to the provisions of clause (2), the law made by Parliament, whether passed before or after the law made by the Legislature of such State or, as the case may be, the existing law, shall prevail and the law made by the Legislature of the State shall, to the extent of the repugnancy, be void.

(2) Where a law made by the Legislature of a State with respect to one of the matters enumerated in the concurrent List contains any provision repugnant to the provisions of an earlier law made by Parliament or any existing law with respect to that matter, then, the law so made by the Legislature of such State shall, if it has been reserved for the consideration of the President and has received his assent, prevail in that State: Provided that nothing in this clause shall prevent Parliament from enacting at any time any law with respect to the same matter including a law adding to, amending, varying or repealing the law so made by the Legislature of the State

EXPLANATION:

1. Where the provisions of a Central Act and a State Act in the Concurrent List are fully inconsistent and are absolutely irreconcilable, the Central Act will prevail and the State Act will become void in view of the repugnancy.

2. Where however a law passed by the State comes into collision with a law passed by Parliament on an Entry in the Concurrent List, the State Act shall prevail to the extent of the repugnancy and the provisions of the Central Act would become void provided the State Act has been passed in accordance with clause (2) of Article 254.

3. Where a law passed by the State Legislature while being substantially within the scope of the entries in the State List entrenches upon any of the Entries in the Central List, the constitutionality of the law may be upheld by invoking the doctrine of pith and substance if on an analysis of the provisions of the Act it appears that by and large, the law falls within the four corners of the State List and entrenchment, if any, is purely incidental or inconsequential.

4. Where, however, a law made by the State Legislature on a subject covered by the Concurrent List is inconsistent with and repugnant to a previous law made by Parliament, then such a law can be protected by obtaining the assent of the President under Article 254(2) of the Constitution. The result of obtaining the assent of the President would be that so far as the State Act is concerned, it will prevail in the State and overrule the provisions of the Central Act in their applicability to the State only. Such a state of affairs will exist only until Parliament may at any time make a law adding to, or amending, varying or repealing the law made by the State Legislature under the proviso to Article 254.

Article 249: Power of Parliament to legislate with respect to a matter in the State List in the national interest.

In case a two-third majority resolution has been passed by the Council of States, for the national interest, Parliament shall have the power to make necessary laws with respect to that matter enumerated in the State List, specified in the resolution, it shall be lawful for parliament to make laws for the whole or any part of the territory of India with respect to that matter while the resolution remains in force.

The article has been amended to included goods and service tax provided under article 246 A to make law by parliament.

Article 250: Power of Parliament to legislate with respect to any matter in the State List if a Proclamation of Emergency is in operation.

The Parliament shall have the power to make the necessary laws, relating to any of the matter enumerated in the State List, for whole or part of the territory of India, during the period when a proclamation of Emergency is in operation.

Article 268: Duties levied by the Union but collected and appropriated by the States.

Article 268 has been amended to exclude duties of excise on medicinal and toilet preparations and only stamp duties have been left to be levied by GOI and to be collected by

(a) in the case where such duties are leviable within any Union territory, by the Government of India, and

(b) in other cases, by the States within which such duties are respectively leviable.

Article 268A: Service tax levied by Union and collected and appropriated by the Union and the States.‐

Omitted

Article 269 and Insertion of Article 269A:

Article 269 facilitates levy and collection of interstate tax on the sale of goods (not services) or consignment of goods but the same to be assigned to states. Now, the interstate supply of goods and services has been made an exception to this pure assignment to states since service now covered. A separate article 269A has been inserted to apportion the taxes. The GST for supplies in the course of interest trade or commerce to be levied and collected by GOI and shared between the Union and States on the basis recommended by the Council.

For the purpose of the aforesaid, the supply of goods or services in the course of import shall be considered as deemed supplies in the course of inter‐state trade or commerce.

Further, the principle determining the place of supply and when a supply of goods or services, or both take place in the course of inter‐state trade or commerce shall be formulated by the Parliament. Article 270:Taxes levied and collected by the Union and distributed between the Union and the States. The article has been amended to include an article to 246A and 269A to collect taxes by union and distribution between union and states.

Article 271: Surcharge on certain duties and taxes for purposes of the Union

This article provides the power to the union to levy a surcharge on the duties and taxes referred in articles 269 and 270. The article has been amended that such surcharges can not be levied to goods and service tax under article 246A.

Article 286: Restriction as to the imposition of tax on the sale or purchase of goods

Article 286 has been amended to restrict the imposition of tax on supply of goods or services or both (earlier it was a tax on the sale or purchase of goods) by states where such supply takes place

1. Outside the state;

2. In the course of import/export out of India.

The amendment has dispensed with the concept of ‘declared goods of special importance’ under the Constitution.

The amendment also withdrew restrictions on conditions on the power of states for taxing the sale or purchase of goods falling under the following sub-clauses of Article 366(29A):

1. Works contract

2. Hire purchase

3. Right to use.

Article 366 Definitions:‐

Article 366 has been amended to include clause 12A, 26A, and 26B as follows:

12A‐ “Goods and services tax” means any tax on supply of goods, or services or both except taxes on supply of the alcoholic liquor for human consumption;

26A‐ “Services” means anything other than goods;

26B‐ “State” with reference to articles 246A, 268, 268, 269, 269A and article 279A includes a Union territory with Legislature;

Good under the constitution has already been define under clause 12 of article 366 as follows‐“Goods includes all materials, commodities and articles”. There is no change in the definition of goods in the constitution.

‘GST’ defined to align with the concept of one tax on the supply of goods and services. However, alcoholic liquor kept out of its purview and continues to be a State subject.

‘Service’ has been clarified to mean anything other than goods.

States and Union territories aligned with reference to certain articles.

Read the Copy:

Ashu Dalmia

Ashu Dalmia

New Delhi, India

Ashu Dalmia is Managing Partner of the firm AAP and Co., having office in Connaught Place Delhi. He is rank holder in CA Inter and also at graduation level from Lucknow university. He is has been working extensively in GST training, Consultancy and litigation in India and also handled VAT implementation projects for mid and large corporates in Saudi Arabia. He was special Invitee to Indirect Tax Committee of ICAI for year 2018-19. He is faculty in ICAI to train professionals for GST in India and VAT for UAE. He has authored books on GST: “GST A Practical Approach” published by Taxman, “Audit and Annual Return in GST” published by Wolters Kluwer-CCH GST Referencer and Manual published by LMP. He has taken more than 300 workshops and trainings on various forums: like ICAI, ASSOCHAM, CII, PHD Chamber of commerce, trade associations in India, UAE and KSA.