GST annual return case studies: Supply part

Table of Contents

- Introduction: GST annual return case studies

- 1. When Actual GSTR 3b and GSTR 1 data is same and reported in same year Issue:

- 2. When Actual GSTR 3b and GSTR 1 data is same but reported in next year.

- 3A. When actual and GSTR 3b is same but GSTR 1 invoices for B2B and B2C large is amended in same year

- 3B. When actual and 3b is same GSTR 1 b2c is amended in same year

- 4. When 3b and 1 are matching and tax is paid in next year

- 5. When all three are not matching

- 6. When NIL GSTR 3b and 1 filed

- 7. When GSTR 1 and actual are same but 3b is understated

- 8. When GSTR 1 and actual match in 3b tax was paid in next year

- 9. When supply understated in GSTR 1

- 10. When supply is overstated in GSTR 1

- 11. When supply is same but tax is shown extra in GSTR 1

- 12. When amount of supply is same but tax figure is over stated

- 13. When excess tax was paid and then corrected in later period

- 14. When tax is paid in wrong head

Introduction: GST annual return case studies

This article is compiled to discuss the GST annual return case studies. These case studies will help you in understanding supply part of GST annual return. It is advisable to be slow on annual return as you will not be able to revise it once it is filed.

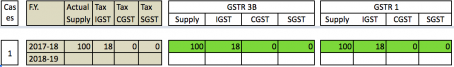

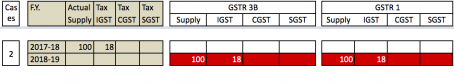

1. When Actual GSTR 3b and GSTR 1 data is same and reported in same year Issue:

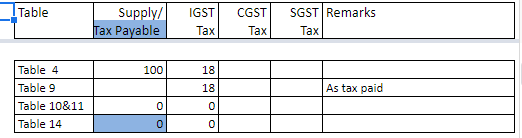

In this case actual figures will match with the data filed in returns. GST returns also matches with each other. In this case data will be entered in table no 4 and 9 of GSTR 9.

GST annual return case studies -1

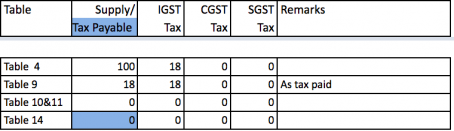

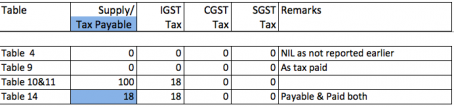

2. When Actual GSTR 3b and GSTR 1 data is same but reported in next year.

In this case data is matching but it is reported in next year. So table 10& 11 will also come into the picture. Data disclosd in next year will be covered via table 10 & 11.

GST annual return case studies-2

3A. When actual and GSTR 3b is same but GSTR 1 invoices for B2B and B2C large is amended in same year

In this case GST invoices are amended in same year. In this case table 4(K to L ) will be used

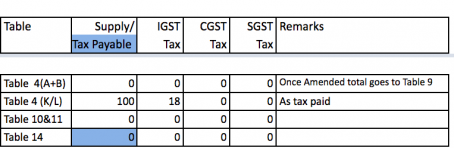

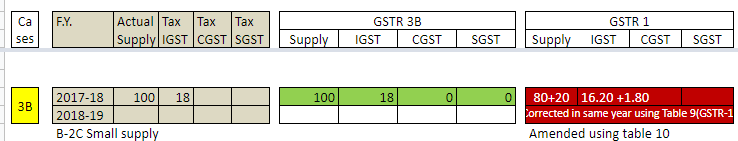

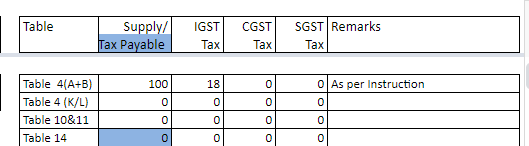

3B. When actual and 3b is same GSTR 1 b2c is amended in same year

Where the data is amended in b2c Table 4(A+B) will be considered.

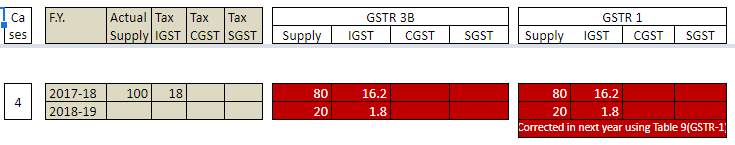

4. When 3b and 1 are matching and tax is paid in next year

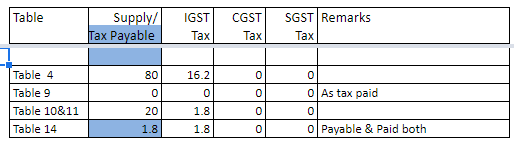

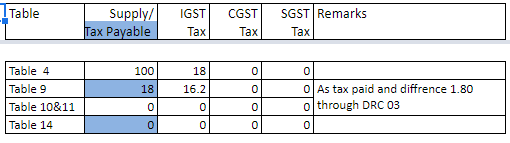

5. When all three are not matching

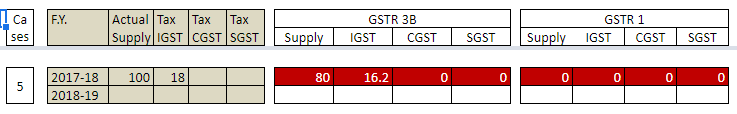

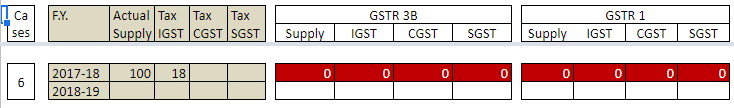

6. When NIL GSTR 3b and 1 filed

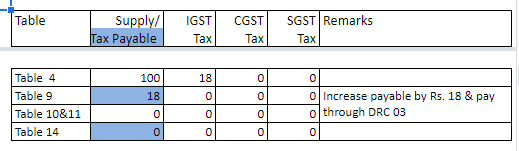

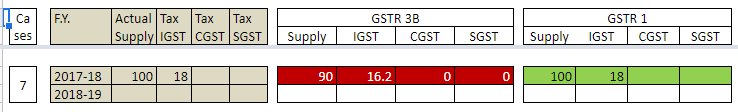

7. When GSTR 1 and actual are same but 3b is understated

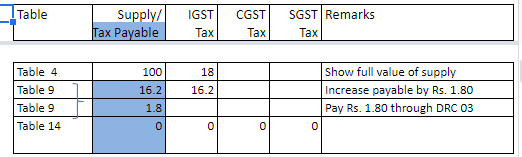

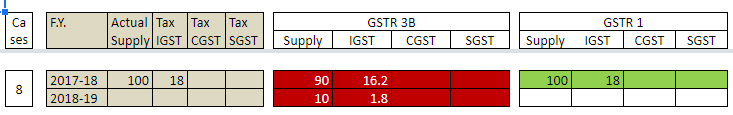

8. When GSTR 1 and actual match in 3b tax was paid in next year

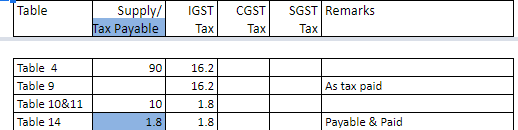

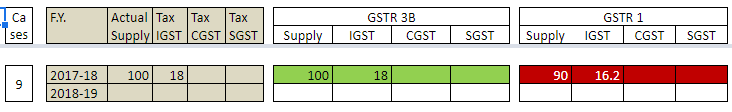

9. When supply understated in GSTR 1

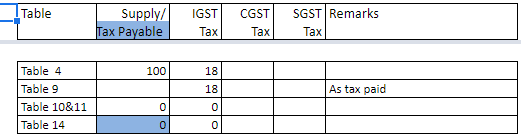

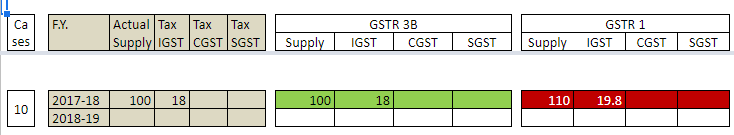

10. When supply is overstated in GSTR 1

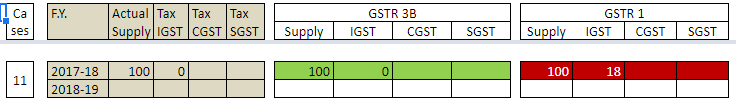

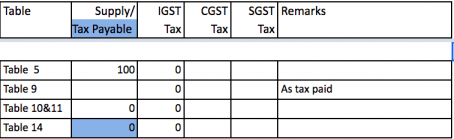

11. When supply is same but tax is shown extra in GSTR 1

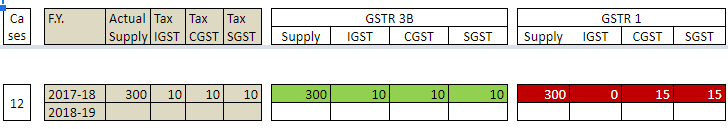

12. When amount of supply is same but tax figure is over stated

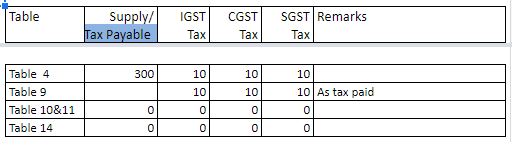

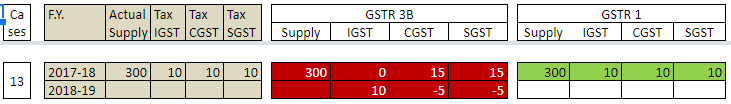

13. When excess tax was paid and then corrected in later period

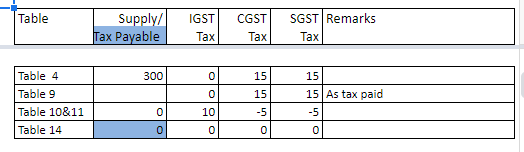

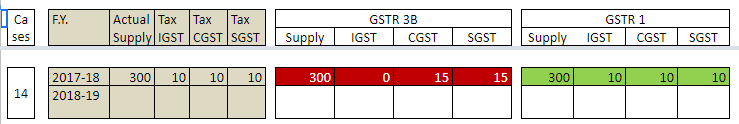

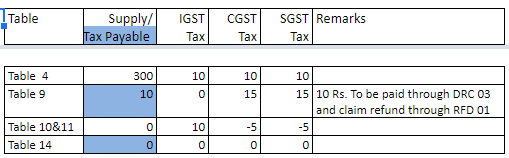

14. When tax is paid in wrong head

CA Jatan Jain

CA Jatan Jain

Delhi, India

CA Jatan Jain is a partner of a firm M/s J P R M S & Co. and practicing in the field of direct and indirect taxes since 25 years. He is well versed with handling of assessment and litigation. He is known for his practical approach towards implementation of law harmoniously. He made various utilities to ease the working of professionals.