How to do Export to Nepal & Bhutan in GST

Introduction:

There are lot of Confusion regarding Export to Nepal / Bhutan. In this Article an attempt has been made to clarify those Critical Questions.

Let’s first understand basics and then move to clarifications.

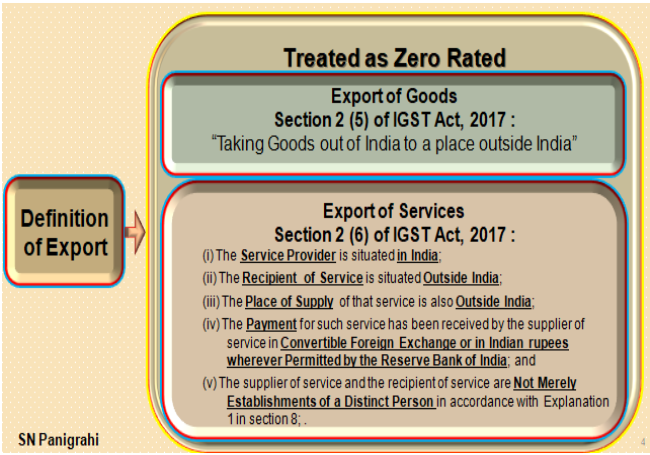

Definition of Exports :

Definitions of Export of Goods & Export of Services are shown below:

In case of Export of Goods the Goods must be Physically moved from India to a Place outside India. Where as in case Export of Services below mentioned all the Five Conditions should be fulfilled.

Note : as per IGST (Amendment) Act, 2018, Following added to Sub-Clause (iv) of Sec 2(6)

………………. “or in Indian rupees wherever Permitted by the Reserve Bank of India”

Now the Clause reads as

“The Payment for such service has been received by the supplier of service in Convertible Foreign Exchange or in Indian rupees wherever Permitted by the Reserve Bank of India”

This provides great relief to the Service Exporters relaxing Stringent Condition of Receiving only in Convertible Foreign Exchange. Now Service Exporters are allowed to Receive Payment in Indian rupees wherever Permitted by the Reserve Bank of India.

Now Let’s Answer the Queries :

Goods Exported to Nepal & Bhutan Payment Received in Indian Currency Whether Treated as Exports?

As per Section 2 (5) of IGST Act, 2017, Export of Goods means

“Taking out of India to a place outside India”.

No Condition attached for Receiving Payment either in Indian Currency or in any other Currency.

Therefore once the Goods are Taken Out of India from India, it is Treated as Exports.

Export Order Received from Nepal / Bhutan Goods Sourced from China & Delivered Directly to Nepal / Bhutan Order Fulfilled & Payment Received Whether Treated as Export?

As per Section 2 (5) of IGST Act, 2017, Export of Goods means

“Taking Goods out of India to a place outside India”.

Since Goods are Not taken Out of India Physically, but Moved from China, it is not Fulfilling Condition in the definition, therefore it is Not Treated as Exports.

Whether Export to Nepal / Bhutan Can be Made Through LUT?

The acceptance of LUT for supplies of Goods or Services to Nepal or Bhutan will be permissible irrespective of whether the payments are made in Indian currency or convertible foreign exchange as long as they are in accordance with the applicable RBI guidelines.

Refer following Notifications

Notification No. 37 /2017 – Central Tax, 4th October, 2017

Circular No. 8/8/2017-GST; Dated the 4th October, 2017 amended vide

Circular No. 88/07/2019-GST; Dated the 1 st February, 2019

Condition of Receipt of Export Proceeds in case of Service Exports in Foreign Exchange had been Removed vide Notification No. 42/2017- Integrated Tax(Rate) dated 27th October, 2017

Whether Exemption on Supply of Services Associated with Transit Cargo to Nepal and Bhutan?

Notification No. 30 / 2017, Central Tax (Rate), 29th September, 2017 was released to amend the Notification No. 12/2017- Central Tax (Rate), dated the 28th June, 2017 by exempting tax on Supply of services associated with transit cargo to Nepal and Bhutan

A client based out of Nepal / Bhutan, send his products to a Registered Person in India for Testing / Repair. Testing / Repair is done in India. Kindly clarify if GST is payable / applicable on the same?

Goods Temporarily Imported into India for Testing / Repairs and are Exported After Testing / Repairs, the Place of Supply shall be Outside India. Subject to other Conditions of Definition as per Section 2 (6) of IGST Act, 2017 is Satisfied, it is Treated as Export of Service (Even though Consideration is Received in India Currency).

By Plain reading of Sec 13(3)(a) of IGST Act, may Confuse by treating the Place of Supply in India, but read with Second Provo to the Section clear the Confusion, there by treating the Place of Supply Outside India.

Sec 13(3)(a) of IGST Act, services supplied in respect of goods which are required to be made physically available by the recipient of services to the supplier of services, or to a person acting on behalf of the supplier of services in order to provide the services:

Provided …………….

Provided further that nothing contained in this clause shall apply in the case of services supplied in respect of goods which are temporarily imported into India for repairs and are exported after repairs without being put to any other use in India, than that which is required for such repairs;

Commentary – Place of supply in case of any treatment or process (which may not come within the four corners of the definition of job work) done on goods temporarily imported into India and then exported without putting them to any other use in India, to be outside India.

Shipperfrom Nepal / Bhutan, Export to outside India. In that case some operation process done in Kolkata, India.

Whether the Services Provided by Service Provider (C&F Agent / Forwarder) in India to Shipper in Nepal / Bhutan is Treated as Export of Service?

As per Sec 13(2) of IGST Act, the Place of Supply of Services shall be the Location of the Recipient of Services

Since the Services are Provided from India to the Recipient in Nepal / Bhutan, the Place of Supply is Location of the Recipient of Services, ie Outside India. Subject to other Conditions of Definition as per Section 2 (6) of IGST Act, 2017 is Satisfied, it is Treated as Export of Service (Even though Consideration is Received in India Currency).

We are Providing Services of Transportation of Goods from India to Nepal / Bhutan. Whether these Services are Treated as Export of Services?

As per Sec 13(9) of IGST Act, the Place of Supply of Services of Transportation of Goods, other than by way of mail or courier, shall be the Place of Destination of Such Goods.

Since the Services of Transportation of Good provided from India to the Recipient in Nepal / Bhutan, the Place of Supply is Outside India. Subject to other Conditions of Definition as per Section 2 (6) of IGST Act, 2017 is Satisfied, it is Treated as Export of Service (Even though Consideration is Received in India Currency).

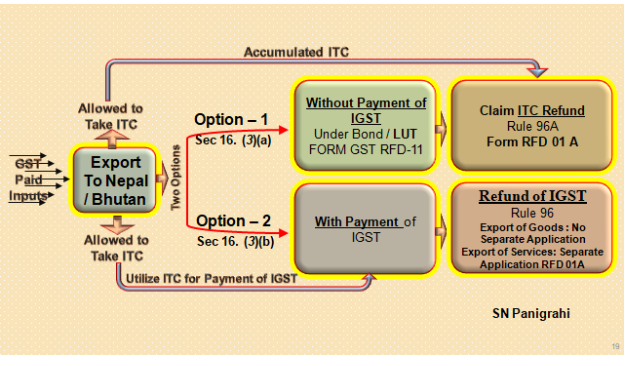

For Export to Nepal / Bhutan how to make the Invoice? Do we need to charge IGST or we need to make under L.U.T without Paying GST? Whether we can get Export Refunds?

As per Sec 16. (3) of IGST Act : A registered person making zero rated supply shall be eligible to claim refund under either of the following options, namely:––

he may supply goods or services or both under bond or Letter of Undertaking, subject to such conditions, safeguards and procedure as may be prescribed, without payment of integrated tax and claim refund of unutilised input tax credit; or

he may supply goods or services or both, subject to such conditions, safeguards and procedure as may be prescribed, on payment of integrated tax and claim refund of such tax paid on goods or services or both supplied,

in accordance with the provisions of section 54 of the Central Goods and Services Tax Act or the rules made thereunder.

Export to Nepal & Bhutan

That means the Exporter has Two Option

Export Under LUT / Bond without Payment of GST & Claim Refund of Accumulated ITC

Export on Payment of IGST and Claim Refund of IGST

Disclaimer : The views and opinions; thoughts and assumptions; analysis and conclusions expressed in this article are those of the authors and do not necessarily reflect any legal standing.

Author : SN Panigrahi, GST & Foreign Trade Consultant, Practitioner, Corporate Trainer & Author.

Available for Corporate Trainings & Consultancy

Can be reached @ snpanigrahi1963@gmail.com