35TH GST COUNCIL MEETING RECOMMENDATIONS

35TH GST COUNCIL MEETING RECOMMENDATIONS by CA Shubham Khaitan:

The 35th GST Council Meeting was the first meeting of the Council after the swearing in of the new Government. The following are the major decisions taken in the 35th GST Council meeting:

➢Extension of the due dates for GSTR 9 and 9C

|

The due date for furnishing the annual returns in Form GSTR 9 and 9A and the |

|

reconciliation statements in Form GSTR 9C have been extended till 31.08.2019 |

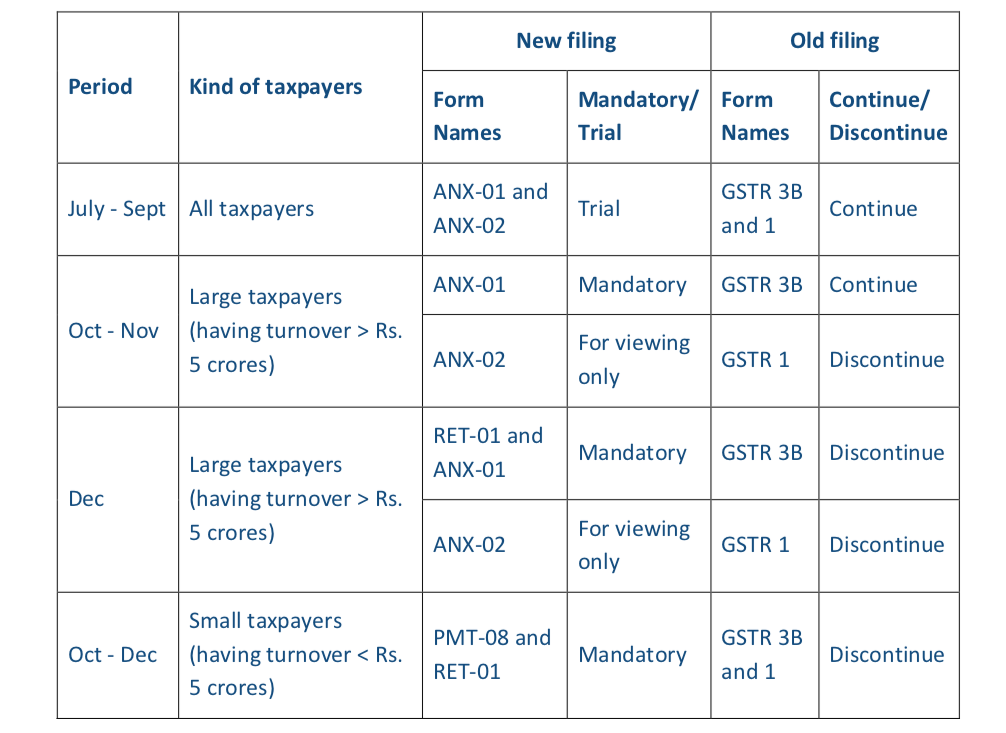

➢New return filing mechanism

The new return filing mechanism is proposed to be introduced in the following manner:

New Electronic invoicing system:

➢ The Council also decided to introduce electronic invoicing system in a phase-wise manner for B2B transactions. The Phase 1 is proposed to be voluntary and it shall be rolled out from Jan 2020.

➢ Further, this will help in combating tax evasion.

➢ This will help in automation of the tax procedures and in backward integration for the taxpayers

Extension of due dates for ITC-04:

The due date for furnishing the Form GST ITC-04 for the period July 2017 to June 2019 has been extended till 31.08.2019.

Other extensions:

Last date for filing of intimation, in FORM GST CMP-02, for availing the option of payment of tax under notification No. 2/2019-Central Tax (Rate) dated 07.03.2019, to be extended from 30.04.2019 to 31.07.2019. This is in respect of the new composition scheme introduced for service providers and other taxpayers who were not eligible for the composition scheme earlier. Rule 138E of the CGST rules, pertaining to blocking of e-way bills on non-filing of returns for two consecutive tax periods, to be brought into effect from 21.08.2019, instead of the earlier notified date of 21.06.2019.

Decision on the benches of GSTAT:

The Council took a decision regarding location of the State and the Area Benches for the Goods and Services Tax Appellate Tribunal (GSTAT) for various States and Union Territories with legislature. It has been decided to have a common State Bench for then States of Sikkim, Nagaland, Manipur and Arunachal Pradesh.

Tenure of the National Anti Profiteering Authority

The tenure of National Anti-Profiteering Authority has been extended by 2 years.

Rate changes:

Electric vehicles – On issues relating to GST concessions on electric vehicle, charger and hiring of electric vehicle, the Council recommended that the issue be examined in detail by the Fitment Committee and brought before the Council in the next meeting.

Solar power generating systems and wind turbines – The issue related to valuation of goods and services in a solar power generating system and wind turbine be placed before next Fitment Committee and brought before the Council in the next meeting.

Lottery – Group of Ministers (GoM) on Lottery submitted report to the Council. After deliberations on the various issues on rate of lottery, the Council recommended that certain issues relating to taxation (rates and destination principle) would require legal opinion of Learned Attorney General

Shubham Khaitan

Shubham Khaitan

Kolkata, India