ITC in GSTR 9: treatment in all cases in one pdf

Know all the ITC tables in GSTR 9:

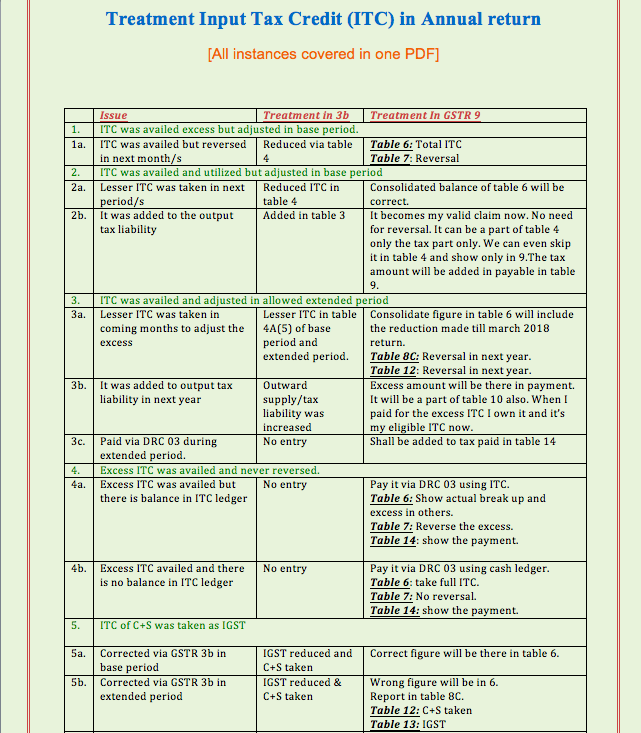

The annual return is a compilation of entire data of the base period. It covers two major parts: supply and ITC. In this article, we will cover all errors and mistakes done in monthly returns. Treatment of all of them will be discussed. Following three tables covers the ITC in GSTR 9.

- Table 6: break up of ITC availed. Its data will flow in table 8 and into 9C also.

- Table 7: Reversal done from availed ITC. Any reversal during the year will be a part of it.

- Table 8: It is a reconciliation of 2A auto populate data and availed data. This table is a failure in itself due to its defective drafting. It completely ignores table 7, reversal. Many taxpayers have this misconception that they need to pay tax for its mismatch. There is no such requirement.

- Table 12/13: Table 12 is for ITC reversed in next FY but it was pertaining to the base period. Table 13 is just the opposite of 12. It is for ITC availed for PY.

GSTR 9- Input tax credit availed 1.2

Treatment of various errors of ITC in GSTR 9:

we have summarised all the issues in 5 parts. You can download this summary PDF.

ITC was availed excess but adjusted in the base period.

|

1a. |

ITC was availed but reversed in next month/s |

Reduced via table 4 |

Table 6: Total ITC Table 7: Reversal |

ITC was availed and utilized but adjusted in the base period. |

|||

|

2a. |

Lesser ITC was taken in next period/s |

Reduced ITC in table 4 |

Consolidated balance of table 6 will be correct. |

|

2b. |

It was added to the output tax liability |

Added in table 3 |

It becomes my valid claim now. No need for reversal. It can be a part of table 4 only the tax part only. We can even skip it in table 4 and show only in 9.The tax amount will be added in payable in table 9. |

How to cover the ITC in GSTR 9 when ITC was availed and adjusted in an allowed extended period? |

|||

|

3a. |

Lesser ITC was taken in coming months to adjust the excess |

Lesser ITC in table 4A(5) of base period and extended period. |

Consolidate figure in table 6 will include the reduction made till march 2018 return. Table 8C: Reversal in next year. In Table 12: Reversal in next year. |

|

3b. |

It was added to output tax liability in next year |

Outward supply/tax liability was increased |

Excess amount will be there in payment. It will be a part of table 10 also. When I paid for the excess ITC I own it and it’s my eligible ITC now. |

|

3c. |

Paid via DRC 03 during extended period. |

No entry |

Shall be added to tax paid in table 14 |

How to show ITC in annual return when Excess ITC was availed and never reversed? |

|||

|

4a. |

Excess ITC was availed but there is balance in ITC ledger |

No entry |

Pay it via DRC 03 using ITC. In Table 6: Show actual break up and excess in others. Table 7: Reverse the excess. In Table 14: show the payment.

|

|

4b. |

Excess ITC availed and there is no balance in ITC ledger |

No entry |

Pay it via DRC 03 using cash ledger. Table 6: take full ITC. In Table 7: No reversal. Table 14: show the payment. |

How to show ITC in GSTR 9 when ITC of C+S was taken as IGST? |

|||

|

5a. |

Corrected via GSTR 3b in base period |

IGST reduced and C+S taken |

Correct figure will be there in table 6. |

|

5b. |

Corrected via GSTR 3b in extended period |

IGST reduced & C+S taken |

Wrong figure will be in 6. Report in table 8C. Table 12: C+S taken Table 13: IGST |

|

5c. |

Not corrected |

No entry |

Pay via DRC 3. Can’t claim correct ITC? |

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.